The Story of 2023

#83: Looking backward before we look forward.

Before we look ahead to 2024, let’s first recap the major stories in U.S. markets in 2023. How exactly did we get here? And as it pertains to The Last Bear Standing, what did I get right, and what did I get wrong?

A Timeline

There was a distinct shift in the air in January 2023.

First it was upbeat housing data that defied the downward trend of 2022 despite stretched affordability and common wisdom. Homebuilding stocks were back on the rise and housing prices were stabilizing. At the same time, we saw a return of aggressive call-buying in many pandemic stock market favorites that had languished over the past year (The Return of the Calls).

The release of January economic data helped illuminate the newfound optimism. After over a year of declining or stagnant real income, real disposable personal income (DPI) had jumped a remarkable 2.1%, driven by wage gains, cost of living adjustments, and a huge reduction in taxes owed. This upside surprise in economic data was the first of many positive economic data points that pointed to ongoing resiliency or outright improvement that we have continued to see through much of the year.

(It was also around this point that I began to take a more measured tone on the Federal Reserve’s pandemic policy — a topic that I had been fiercely critical of previously (Grading the Trade).

But despite positive economic data, in February, there was still a large divergence between the narrative of stocks and bonds (Best Wishes). The former was pricing nominal growth and an earnings rebound while bonds still seemed to predict a near-term hard landing.

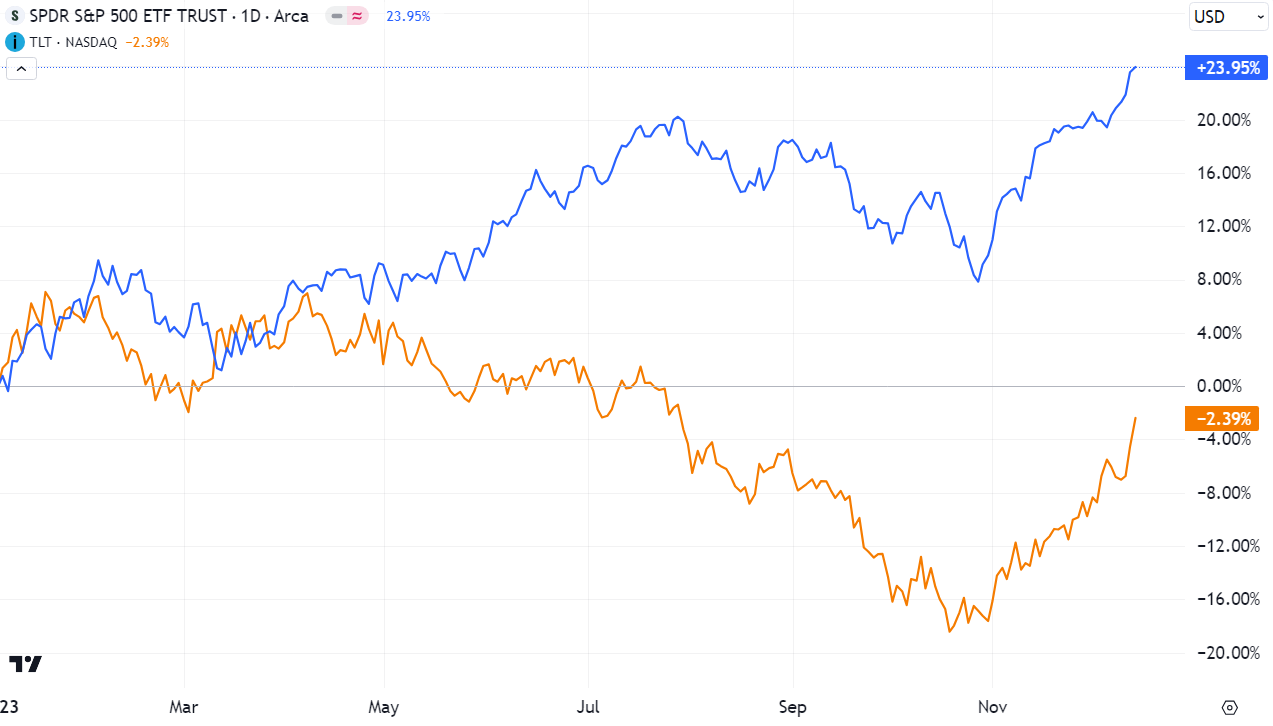

In the end, stocks proved correct. Growth in real and nominal GDP exceeded most expectations, corporate earnings shook off their slump and the S&P has risen 24% YTD. Meanwhile, bonds continued to trade off through most of the year.

By March, optimism was derailed by the sudden collapse of Silicon Valley Bank. Monetary policy had claimed its first major victim and raised doubts about the stability of the banking sector at a large. When First Republic revealed its balance sheet damage in April, it was clear that it would be the next to fail (The Last of First Republic). But here the bank carnage would end. With clear support from the Fed (Bank Term Funding Program), FDIC and Treasury, even troubled banks like PacWest and Western Alliance were able to avoid the same fate.

At the same time, a growing chorus suggested that commercial real estate was the next shoe to drop — downtown office buildings still struggling in the post-COVID world were of chief concern. In May, I reviewed Vornado Realty Trust (NYSE: VNO), writing that much of the equity value of such assets had already been slashed by the market, and that predictions of an imminent collapse seemed misplaced and mistimed (Vornado Tornado). Since publishing, Vornado has rallied 131%, from $13.54 to $31.34.

The other major macro concern as spring turned to summer was the debt-ceiling standoff and the question of whether the rebuilding of the U.S. Treasury General Account (TGA) would drain liquidity from commercial banks or the Reverse Repo Facility (Re-Funding the Treasury). Here, it was my concerns that proved to be misplaced.

Since June, usage of the RRP has fallen dramatically, providing an enormous $1.5 trillion of liquidity back into the market - allowing bank liquidity to actually improve even despite the TGA rebuild and ongoing Quantitative Tightening. Indeed, this dynamic has provided a highly supportive backdrop for risk assets throughout the second half of the year (Repo to the Rescue).

By mid-summer, macroeconomic concerns had largely faded, financial conditions continued to ease, and the U.S. economy remained on firm footing (Behind the Curve?). Sentiment shifted away from downside risks and towards upside opportunities.

In July, I made the case for a rebound in regional banks which still were trading at crisis levels despite an improving backdrop (Regional Bank Rebound). I’m happy to note that the four regional bank “winners” (WTFC, EWBC, SNV, CATY) are now up between 34% - 39%. Each name has topped the broader KRE Regional Bank ETF (+33%), and strongly outperformed the S&P 500 (+7%).

But the two biggest equity themes of the summer were the Artificial Intelligence arms race (NVIDIA and the Return to Normal) and the growing impact of GLP-1 drugs on the pharmaceutical sector and beyond (Ozempic and the Rise of GLP-1s). With respect to AI, I stopped short of pitching NVDA long but cautioned Bears against trying to fade the “hype” at the risk of being steamrolled. Since then, AI beneficiaries have continued to post strong results, and a wide range of industries have been forced to recognize the potential disruptive impact of GLP-1s.

As economic growth continued to surprise to the upside in August, there was growing recognition of fiscal stimulus as a counterbalance to tighter monetary policy (Big Fiscal, Big Funding, and Buybacks). Deficit spending was fueling investment in infrastructure and semiconductor manufacturing, and had contributed roughly 25% of GDP growth over the prior four quarters.

But the flipside of this resilience was that the Fed seemed to have less room to pivot on monetary policy. With a little coaxing from the hawkish September dot plots, yields on the long end finally began to accelerate higher towards the Federal Funds rate (Higher for (a little bit) Longer). By the mid-October, 10-year yields approached 5% for the first time since 2007. The surge in yields dragged down both bonds and rate-sensitive stocks, taking much of the air out of the summer rally (Yields Nuke Utes).

But 5.00% ticked the top and pessimism proved to be short lived. Since the start of November, we have experienced a face-ripping “everything rally”. Yields have collapsed and stocks have soared (Playing the Pivot). Since October 27th, the S&P 500 is up 14.6%, the Nasdaq 100 is up 16.6%, the Russell 2000 is up 22.0%, the Dow Jones is up 17.4% and long term government bonds are up 17.4%. With the exception of the Nasdaq, this latest rally has accounted for a majority if not all of the price appreciation in indices this year.

This week, the Fed stamped its approval of the rally, as it made clear its intention to cut rates in 2024 and refused to talk down markets. Effectively, the Fed has ended its fight against inflation while adopting a goldilocks “soft landing” in its outlook. Only time will tell whether the pivot is premature, but the message is loud and clear. The Fed is easing, and the market is listening.

A Summary

The story of 2023 has been one of constructive moderation.

The moderation of inflation has allowed for real income gains and a rebound in corporate margins.

The moderation in the labor market has brought supply and demand into balance without yet spurring significant unemployment.

The moderation of monetary policy has led to easing financial conditions throughout the year, even as interest rates have risen.

These dynamics have provided a supportive backdrop for equities, where gains have been most pronounced in technology (the biggest loser of 2022). Meanwhile bonds, commodities, small caps, and rate-sensitive sectors have generally underperformed.

While some portion of this appreciation has been driven by multiple expansion, particularly among mega-cap tech, nominal GDP continues to grow at well over 5%, and earnings appear to be back on the rise. Even as we approach all-time highs, market-wide valuations generally remain more realistic than during the 2021 exuberance (After the Memes).

Now, for a bit of self-reflection.

Revisionist History

Writing this weekly column over the past two years has created a public record of my opinions on the economy, policy and market at any moment in time. As such, there is little room for revisionist history. This is a good thing. Accountability is essential.

So while writing this article, I went back to last year’s preview (The Year of the Bear), which I will quote at length:

Now, as we approach 2023, the Bears have multiplied as sentiment has followed the market downwards — and so too have the predictions of imminent recession and doom. Today, Bulls are an endangered species. Increasingly though, I find myself taking a more measured and optimistic tone than other prognosticators, which is a bit ironic.

As I wrote two weeks ago, I don’t think the bottom is in yet. We don’t know what effect the Fed’s hikes will have on the real economy or financial markets. Liquidity, derivatives, and global instability all pose significant tail risks. A recession in 2023 seems like a reasonable prediction (though we haven’t yet seen it show up in the data). Further, we haven’t seen the panic or capitulation that comes with the last leg down.

But, despite all that, I feel more confident in the long-term resilience and strength of the economy than I did a year ago (even if the Fed forces a recession) and have always believed in the long-term power of the market to compound wealth (even while I think your entry prices are critical).

Call it a hunch, but I think the market will find a floor at some point in the coming year. When that time comes, I’ll be The First Bull Running.

This passage is frustrating. Despite recognizing the strength in the economy and overly negative sentiment, I held out for more downside in order to say actually, I was right and timed it to perfection. With hindsight we know the bottom was already in, and 2023 would prove to be a strong year for most stocks.

To be clear, this year’s column has been far more bullish than 2022. I pitched office REITs, regional banks, and growth stocks. I highlighted the powerful resurgence in call-options and warned against betting against an “AI bubble”. Leading into the face-ripping rally over the past six weeks, I wrote about the positive backdrop for risk assets given improving liquidity and the ongoing easing of financial conditions.

But I should have been earlier and more direct. Some combination of stubbornness, fear, and ego held me back. Over the next several weeks I will be writing about the outlook for 2024, and while the setup is very different from a year ago, I will seek to avoid these same mistakes.

Finally, I want to thank everyone who has read, engaged, and subscribed to The Last Bear Standing over the past year. I hope that you have found it valuable, and I hope that you stick around.

Thank you for subscribing to The Last Bear Standing. If you like what you’ve read, hit the like button and share it with a friend. Let me know your thoughts in the comments - I respond to all of them.

As always, thank you for reading.

TLBS

The return on investment on this substack has been substantial. And for that, I thank you.

I think you provide a lot of well-reasoned insight and deep reporting, which isn’t easy for readers to come by. You’re an informed, rational voice. Economic predictions are never all spot on. Looking forward to your 2024 outlook.