NVIDIA and the Return to Normal

#55: NVIDIA smashed earnings. What does it mean for the market?

Earnings, NVIDIA, and AI

One thing that gets under my skin is the earnings beat.

Every quarter, a significant majority of publicly traded companies will beat their estimates - the average expectation of equity research reports published by sell-side analysts. Near-term estimates are often based on a company’s own public guidance or private nudges that set the bar high enough to maintain investor confidence but low enough to clear on a consistent basis.

By setting their own measuring stick, companies can generate upbeat headlines regardless of the actual trajectory of the business. XYZ Co. might beat with 50% year-over-year earnings decline so long as analysts estimated a 52% drop. Plus, there is usually enough wiggle room for an adept CFO to conjure up a satisfactory Earnings Per Share (EPS) figure.

But earnings matter and can prove pivotal for individual stocks and the market overall. This week, all eyes were on the 1Q 2024 release of NVIDIA Corporation (NASDAQ: NVDA).

(Note: NVIDIA’s fiscal year ends at the end of January. NVIDIA’s 1Q 2024 fiscal quarter ended on April 30, 2023, which is most directly comparable to 1Q 2023 on a calendar year basis. For this article, we will refer to the nearest calendar period, rather than the company’s fiscal period.)

NVIDIA is a technology company that specializes in designing and manufacturing advanced graphics processing units (GPUs) and related products. Originally known for its GPUs used in computer graphics and gaming, NVIDIA has expanded its scope and expertise to become a prominent player in artificial intelligence (AI), data centers, autonomous vehicles, and professional visualization.

Leading into this week’s highly anticipated earnings, NVDA had experienced one of the most volatile round-trips in the market over the past several years.

The company screamed higher throughout the pandemic on the back of rapidly growing demand for personal and professional chips - nearly reaching a $1 trillion market cap in November of 2021. But as the COVID bump faded, the high-flying stock lost two-thirds of its value over the following year.

Coinciding with the peak in long-term interest rates, NVDA bottomed in October 2022. Then, the public launch of ChatGPT and other large language models (LLMs) turbocharged enthusiasm for AI in general and NVIDIA in particular. The shares regained all of the losses of the prior year as investors called a trough in earnings and sentiment in the space swung positive.

Leading into earnings, reported revenues and earnings were falling - and yet the stock had returned to its 2021 peak. On a trailing basis, the company’s price-to-earnings (PE) ratio went vertical. Never had investors priced so much growth into the share price.

To many, NVIDIA’s ascent seemed divorced from fundamentals and driven by a potent combination of enthusiasm and call-buying, reminiscent of the mid-2021 market excess. NVDA’s earnings needed to show a dramatic turnaround to justify the recent price action. The release would also serve as a referendum on the AI theme which has captivated markets in 2023.

On Wednesday night, NVDA didn’t just beat earnings - it smashed them.

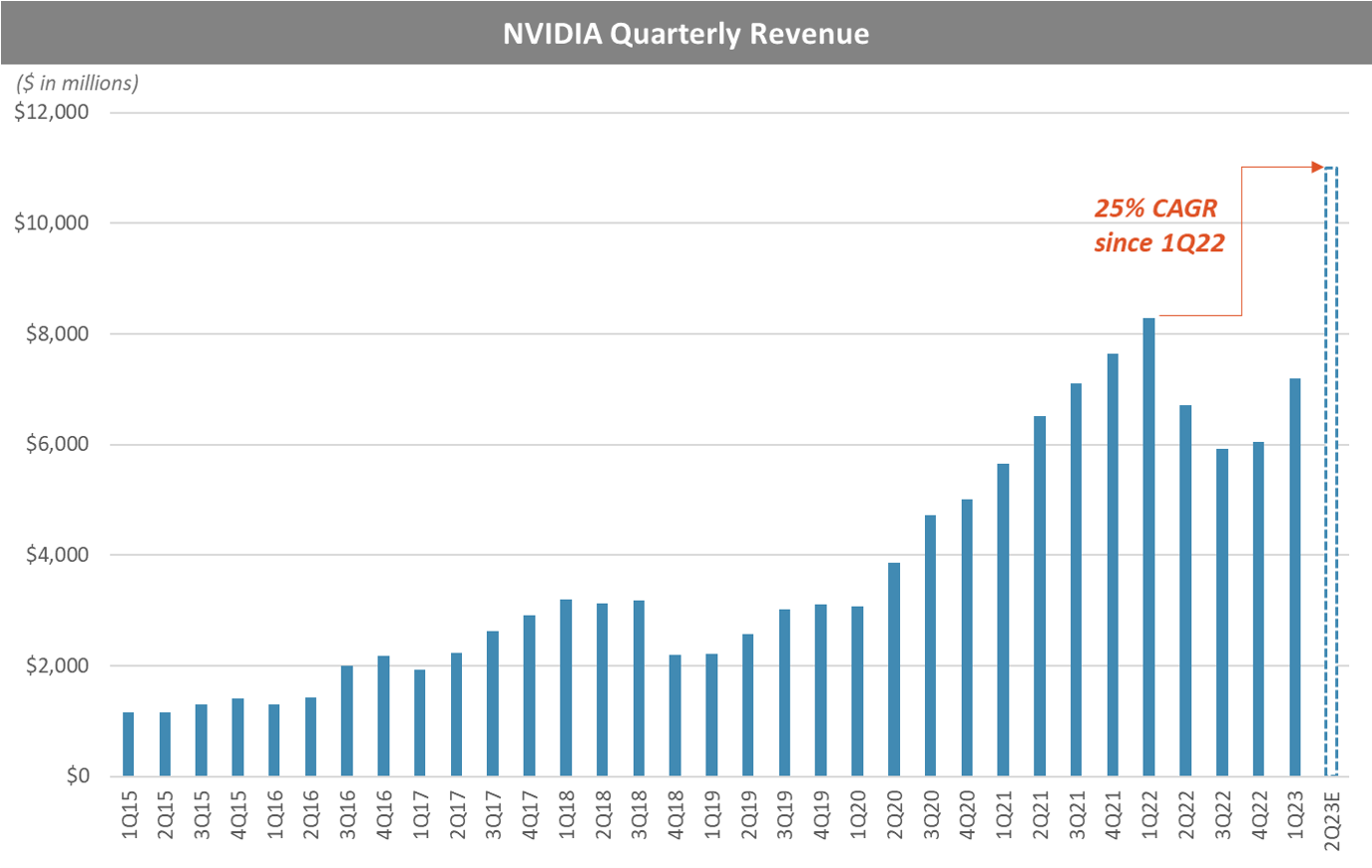

While reported results for the quarter easily beat expectations, the jaw-dropping guidance for 2Q23 was the big story. Barring some catastrophe, NVIDIA will post record quarterly revenue of $11 billion, record gross margins of 69%, record non-GAAP operating profit of $5.7bn, and record net income of around $4.5 billion for the current quarter.

This guidance implies not merely a return to sequential growth, but a continuation of the rapid growth as measured by the previous high point of the business - a 25% compounded annual growth rate (CAGR) from peak revenue in 1Q 2022.

With a relatively sticky cost base, the surge in revenue will translate into even faster growing profits - a 33% CAGR from peak net income recorded in 4Q21.

These results far exceeded the high bar investors had priced into the stock - NVDA soared 24% higher on Thursday to a new all-time high of $379.80 per share, adding some $175 billion to the company’s market capitalization. Further, the results affirm “AI” is more than just buzzword - the AI arms race is underway, with major investment accelerating at a rapid pace.

Perhaps the company’s decline in 2022 was the true anomaly. At least for the time being, the sorry skeptics have miscalculated.

Rate of Change

To be clear, even NVIDIA’s blockbuster guidance does not justify its valuation on its own. Annualizing 2Q23 guidance to $18 billion of annual net income implies just a 1.9% earnings yield based on the current market cap of $943 billion, or an annualized forward P/E ratio over 50x. To provide an attractive return relative to the overnight risk-free rate of 5.25%, the company must continue to grow at a rapid pace or risk substantial market losses.

Skeptics will be quick to point out the challenges. The semiconductor industry is cyclical, hinging on changes in end-user demand, capital expenditure cycles, foundry capacity, and global economic conditions. Crypto and gaming led to accelerated growth during the pandemic but rolled over as preferences changed1. It’s possible that the investment in new data center capacity to host generative AI processing may not sustain long enough for earnings to grow into the company’s current valuation.

Even assuming NVIDIA grows to $50 billion in earnings, it likely won’t be a straight line. The natural cyclicality will lead to earnings variability as witnessed in 2019 or 2022. The stock price will likely compress during such periods as investors re-think the trajectory of the company. But in the near term, what matters is the rate of change.

Think back to Tesla during its meteoric ascent from a bankruptcy risk in 2019 to a peak valuation of $1.2 trillion in 2021 - when Elon Musk held the largest paper fortune in the world. There was no shortage of reasons to doubt the company’s potential. Autos are cyclical and capital intensive, often trading on single-digit earning multiples. Meanwhile, Tesla had a larger market cap than all other global automakers combined, despite representing a tiny fraction of the actual car market.

But during those years, the company began earning GAAP profits for the first time, increased its vehicle production and revenue at 60% annually, and opened a company-transforming factory in Shanghai. So long as Tesla’s actual growth followed the trajectory demanded by its stock price (and the pipeline was filled with theoretical new products) the nosebleed valuation made little difference. If you stood in front of the cybertruck, you got run over.

Eventually, reality caught up with the company in 2022 as its growth rate faltered, “unlimited” demand found a limit, and earnings flattened - the stock remains down 55% off its peak. Skeptics may have been validated eventually, but most lost their shirt screaming about valuations back in 2020.

Tesla’s valuation was far more divorced from reality than NVIDIA today. Yet there are parallels. Merely looking at NVDA’s stock chart or earnings multiple suggests that the company’s epic run over the last nine months may be overdue for correction. But if the company can simply maintain its guidance figures going forward, it will be posting 85% YoY revenue growth and over 500% YoY earnings growth in the coming quarters.

Given its position in the supply chain, NVIDIA does not even require successful commercialization of AI products - it merely requires large tech companies with virtually no capital constraints to continue investing in capacity. Unless you think we have already reached “peak” AI, which is doubtful, NVIDIA has room to grow.

For a long-term buy-and-hold investor, the valuation of the company matters - including the long-term trajectory, the cyclicality, the threat of competitors. But expecting a short-term reversal based on a 50x forward P/E ratio alone is a recipe for disappointment, so long at the company’s growth continues at the current pace.

Beyond the story of a single stock, NVIDIA’s results may also shed some light on the broader market.

Return to Normal

Back in 2021, it was easy to claim that there was a bubble in equities. Unprofitable companies were worth tens of billions. IPOs doubled on their debut. Crypto was a path to prosperity, not a punchline. Your kid’s lemonade stand could have SPAC’d with the right sponsors. The more speculative the investment, the higher the price would go.

But even as these pockets of speculation grabbed headlines, they distracted from the immense real earnings growth of the mega-cap tech names that dominate the major indices. Apple’s earnings grew from a stagnant $60 billion in 2019 to over $100 billion by 2021. Amazon’s earnings nearly tripled from $11 billion to $30 billion, Google and Meta’s earnings doubled.

Last August, we argued that the market had more room to fall, in part because tech earnings had plateaued and appeared to be rolling over. This prediction held true - earnings across mega-cap tech are all down from their peaks, and all the big tech names saw meaningful share price declines (at least temporarily).

But many of these stocks are back up. Apple and Microsoft are approaching new highs and there has been a substantial rebound in the price of most other tech names. The Nasdaq 100 is up over 30% year-to-date.

Which has me thinking a lot about return to normal.

“Return to normal” is a loaded phrase. Rather than being used sincerely, it is most often used to describe the delusional double-top of an asset bubble.

While such diagrams seem too stylized and generic to be useful, the basic shape of a bubble has been repeated with remarkable consistency over the centuries - a product of the positive feedback loop and human nature.

Like this one - Cathie Wood’s ARK Innovation ETF - the posterchild of the COVID bubble.

Unlike, NVDA, MSFT, or AAPL, there has been no renewed enthusiasm for ARKK, even as the Nasdaq rises. The crypto bluechips, Bitcoin and Ethereum, saw a bit of life earlier in the year but remain down 60% from their highs and seem to have lost momentum. Lifeless SPACs circle the drain, and there is no IPO window for speculative companies. The irrational exuberance ain’t what it used to be.

So have we drained the bathwater but kept the baby?

Market bears should pay close attention to the path of earnings. If earnings (particularly in growth tech) stop their slide and begin to rebound, it could spur continued appreciation in the Nasdaq and S&P 500.

Sticky inflation continues to benefit nominal revenue, unemployment remains incredibly low, and real incomes are growing. Large parts of the economy are not impacted by higher interest rates. On the flip side, valuations remain well above historical averages, the money supply is shrinking, and financial markets continue to price significant rate cuts going forward.

There is still a large degree of macro uncertainty. But NVIDIA, while just one company, demonstrates the risk of holding onto yesterday’s narratives while ignoring what comes next.

If you enjoy The Last Bear Standing, please subscribe, hit “like”, and tell a friend! Let me know your thoughts in the comments - I respond to all of them.

As always, thank you for reading.

-TLBS

To be clear, I’m not equating AI to crypto, though both generate demand for chips.

Brilliant article. Something I am realized this week as well. I was holding onto 2021 thesis for too long and paid for it dearly. Need to reset the thinking going forward. The ground underneath has shifted.

Great article as usual …I have been holding NVDA for a few years and look forward to see how the stock does in coming years …. enjoy the holiday weekend