Vornado Tornado

#52: Is Commercial Real Estate the Next Shoe to Drop?

Of all the economic realignment from the COVID pandemic, the future of the office stands out as one of the largest. Even as most industries have rebounded, our cities’ shining towers sit dormant, with foot traffic down substantially compared to 2019. As a former New York City office worker, I can attest that Midtown remains a shadow of it’s past bustling self.

A tectonic shift in utilization and demand for office space colliding with the highest interest rates in 16 years has led some to point to commercial real estate (CRE) as the next shoe to drop (perhaps a “CRE-sis”). Given the current state of the banking system and the fact that CRE loans make up a meaningful portion of certain U.S. bank assets, any credit losses should be taken seriously.

But do the rumors of the collapse match the reality?

To move past headlines, this week we examine Vornado Realty Trust (NYSE:VNO). By revenue, it the one of the largest office Real Estate Investment Trusts (REITs) in the world. By share price, it is the worst performing office REIT over the past 10 years.

Since the vast majority of the REIT’s portfolio is prime New York City office space, it seems like a decent place to start.

At a Glance

Vornado owns and operates 62 Manhattan properties consisting of 9.9 million square feet of office space, 2.6 million square feet of street retail space, plus 1,664 units in six residential properties. The trust also owns a net interest in 5.0 million square feet of office space in Chicago and San Francisco, as well as other development and joint-venture assets.

At a glance, Vornado is down.

Vornado’s stock trades at just $13.58 per share - the lowest level since 1996. The company’s reported asset base and revenue have been flat or shrinking for the past several years, while leverage ratios have grown. Today, the company’s $9 billion of net debt represents 13x LTM EBITDA and a large majority of its total capitalization.

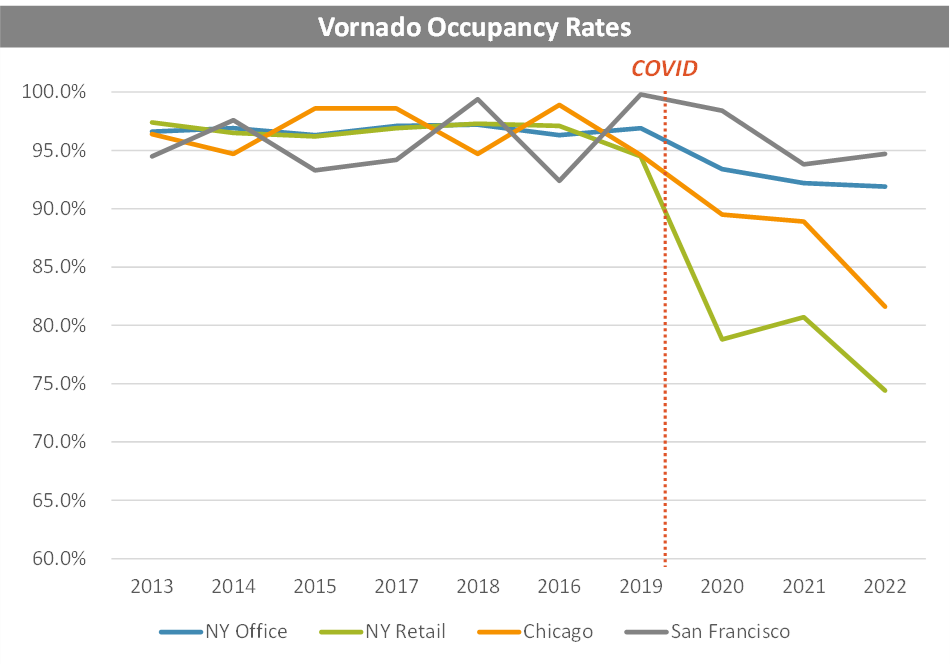

Utilization of office properties remains well below pre-pandemic levels, with only 52% of NYC workers in the office on a given weekday, according to the Partnership for New York1. Even despite long-term leases, tenant occupancy at Vornado’s properties have fallen across all categories since the pandemic.

In April, Vornado suspended cash payments of its 2023 dividends, a move usually seen as a last resort for a yield vehicle like a REIT, and a tacit acknowledgement of its stretched financials and the challenging market.

The common equity market capitalization has fallen from a peak of over $20 billion in 2017 to just $2.5 billion today - an 87% decline. The company’s current valuation reflects both its challenges during the pandemic as well as the treacherous road ahead.

Rising interest costs on the company’s $2.7 billion of floating rate debt have added roughly $136 million of annualized incremental expense in 1Q23 vs. the prior year (or about a 20% hit to funds from operations (FFO) on an annualized basis). VNO’s fixed rate debts will eventually roll off as well, posing a serious refinancing risk assuming rates remain at today’s levels.

Meanwhile, each expiring lease could put pressure on the company’s falling occupancy metrics. Retaining tenants may require price reductions or meaningful concessions in a market with massive supply overhang. Finally, while the company benefitted from attractive asset sales prior to the pandemic, Vornado hasn’t booked a meaningful gain on an asset sale since 2019 - giving it less alternatives to de-lever in a pinch.

Yet for equity holders, these losses have already been realized via the share price. If our concern is around credit losses related to office properties, we need to dig a little deeper.

Under the Hood

Under the hood, Vornado is perhaps not as poorly positioned as its share price indicates. The company has a runway of contracted lease revenue, ample liquidity, and a back-weighted debt maturity profile. In other words, it has time2.

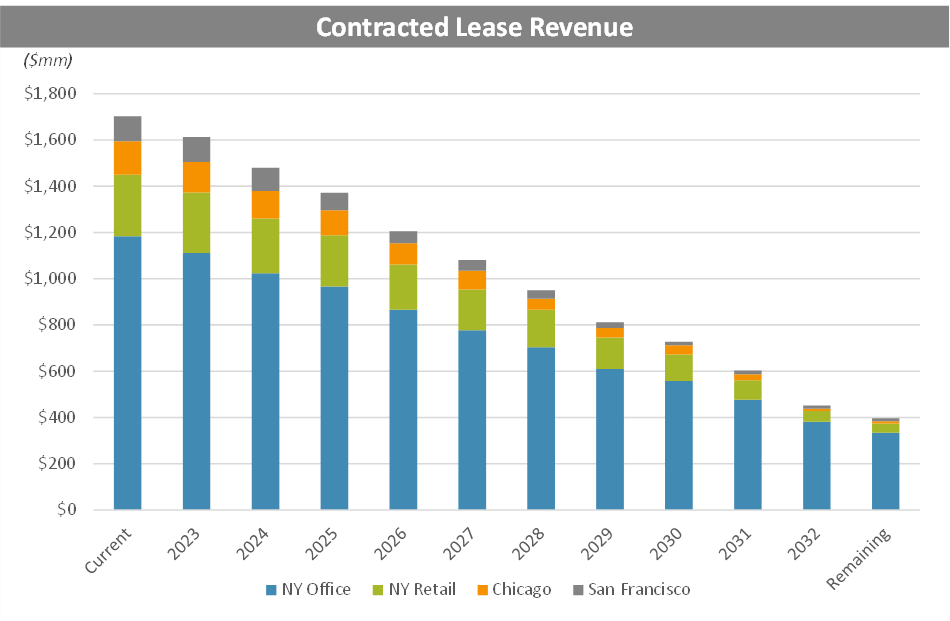

The long-term nature of commercial office leases provide substantial visibility into future revenues, even in the most dire market assumptions. If no tenant ever renews its lease, it would still take over a decade for the current ice-cube to gradually melt.

With diffuse and creditworthy tenants like Meta, Apple, NYU, Google, Bloomberg, or Citadel, it is unlikely that companies default on their existing leases. Further, actual lease renewals signed in 1Q23 show a marginal increase in rent prices vs. the prior lease terms. Net operating income (NOI) on the company’s current portfolio (i.e. adjusted for divestitures) had nearly recovered to pre-COVID levels by the end of 2022.

Vornado also maintains a strong liquidity position between cash on hand and revolver capacity, with relatively few near-term maturities.

Given positive free cash flow (with a slashed cash dividend), highly contracted revenue, and $2.8 billion of available liquidity after backing out future development capex on the PENN project, Vornado itself is not a real credit risk on its corporate-level borrowings at least for the next several years, and likely longer.

The bond market mostly agrees.

Yields on the company’s traded bonds (BBB- rated) gradually widened vs. the benchmarks3, until spreads blew out during the March bank run. While the acute panic subsided, yields today still stand around 8%, well above even the BB benchmark index. Yet, these trading levels imply more of a “premium yield” than distressed debt priced off of an estimated recovery.

But this doesn’t stop the company from defaulting on non-recourse asset level mortgages. These mortgages may be held on bank balance sheets or securitized and sold to investors through commercial mortgage-backed securities (CMBS), mortgage REITs (mREITs), collateralized loan obligations (CLOs) and other unique securitization structures. In fact, defaulting on such loans is actually a lever that VNO and other sponsors have at their disposal to rid themselves of non-profitable or deeply underwater assets.