Yields Nuke Utes

#73: Plus squished spreads, puny payouts, and sated shoppers.

This week’s edition covers several market topics of interest. Next week, I will publish a deep dive on a certain public cryptocurrency firm. Stay tuned.

Crack Spreads

Just as rising oil prices throughout the summer have agitated inflation concerns, prices at the pump have remained in check and are likely to fall. Wholesale gasoline (RBOB) futures have fallen by 25% or $0.77 per gallon1 since mid-August, even as crude oil prices remain roughly unchanged. In other words, the spread between crude oil and refined products (known as a “crack spread”) has collapsed. This is good news for consumers and inflation watchers and bad news for refineries.

The top chart below shows gasoline (blue), diesel (yellow), and crude oil (green) futures, priced in dollars per gallon2. In the bottom chart in red, is a “3-2-1” crack spread, which approximates refining margins assuming typical refining yields3. The recent decline in gasoline and diesel prices have driven cracks down to the lowest levels in nearly two years.

Elevated cracks greatly exacerbated fuel costs over the past two years as refining capacity fell well below pre-COVID and demand remained largely insensitive to price. At the peak, excess refining margin above historical norms accounted for ~$1 per gallon of realized prices.

Today, U.S. refining capacity remains ~4% below March 2020 levels, but has been increasing. Meanwhile, the EIA reports that implied gasoline demand has fallen significantly in recent weeks, dropping below last year’s levels for the first time in months.

Crack spreads are notoriously volatile. But in this circumstance, it seems likely that the rebound in supply combined with more price-sensitive demand are at play.

U.S. pure-play refining stocks seem to have woken up to this reality, falling 7% - 16% over the past week.

Yet, the same stocks are still up substantially since the last time cracks were at today’s levels back at the end of 2021. After two years of bumper harvests, the refining sector may need to reset expectations if the “new normal” means the “old normal”.

Refiners aren’t the only energy stocks under pressure.

Yields Nuke Utes

Utilities are considered boring and safe - a classic defensive play. As regulated monopolies, governed by state public utility commissions (PUCs), the companies are permitted to charge their ratepayers whatever price they need to earn a ~10% return on their asset base (or “rate base”), providing reliable earnings and dividends.

But in recent weeks, utility investors are learning the same painful lesson as sovereign debt holders. Surety of cash flow doesn’t protect from overvaluation. In a rising interest rate environment, overpaying for instruments with reliable but meager yield can be far more dangerous than buying business risk on the cheap.

While investors initially ignored rising rates, the sector has now been in decline for over a year - trading back towards COVID lows, punctuated by a 14% drop since mid-September.

The drawdown over the past year has been driven by moves in long-term interest rates, as demonstrated by the correlation to TLT below.

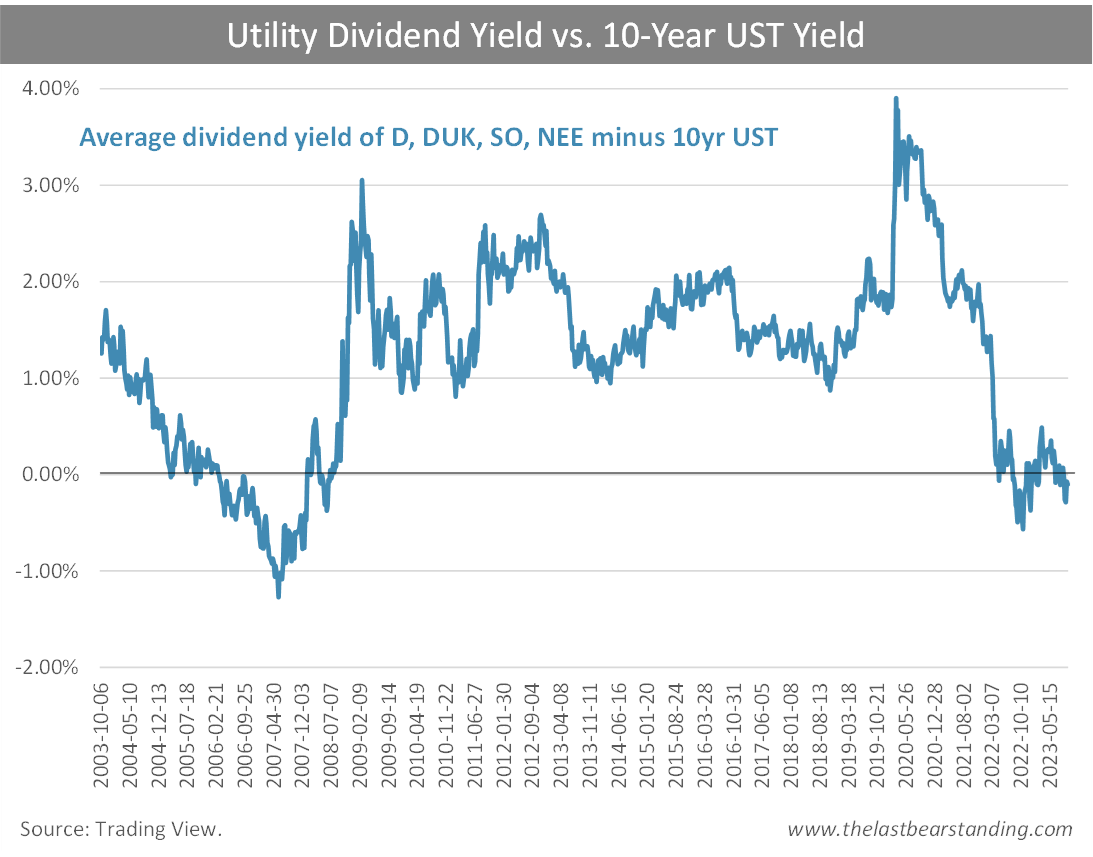

Yet, even after this decline, investors still aren’t receiving a premium to the risk-free rate. The spread between the dividend yield of some of the largest publicly traded utilities and the 10-year U.S. Treasury yield (black) is still negative, as compared to a 1% - 2% range for the last decade.

The last time that utilities traded below U.S. treasuries on a dividend yield basis was during the mid-aughts hiking cycle. The spread “normalized” throughout 2008 as the 10-year yield fell and the utilities sector traded off by ~40%.

If this relationship is to normalize again, either long-term rates or utility stocks must fall. Investors should hope for the former.

Speaking of stocks and yields…