Macro, Meta, Multiples and Margins

#102: Labor acceleration. Yellen's trillion. Meta whacked. And a stock pitch.

Happy Friday, folks. This week, we will cover ground in macroeconomics, fiscal policy, and earnings. Then, I will leave you with a quick healthcare pitch.

Macro Inflection

For much of the past year, the macroeconomic landscape in the United States has provided little fodder for this column. Putting it bluntly, in January’s The Great Moderation, I proclaimed that macro had gotten boring. Insofar as we want strong employment, business activity, and stock prices, boring is good.

But not to be caught with my pants down, I have also been transparent about two nagging concerns. First, is the multi-year slowdown in labor circulation. Second, is the multi-year deterioration in consumer credit quality.

Depending on whether these negative trends stabilized or accelerated, they might represent a simple “normalization” from a unique post-pandemic period, or more ominously, a late-cycle warning sign of structural economic weakness.

Cutting to the chase, there is good news on both fronts.

In the labor market, we may finally be seeing an inflection in hiring, quits, and job openings as tabulated in the monthly Job Openings and Labor Turnover Survey (JOLTS), which despite its lags and noise does a good job of capturing the labor cycle on a sufficiently broad scale.

As of the most recent report (released early April for the February period), hiring activity is once again on the rise, rebounding over 4% from a low point recorded in November 2023. The series is now flat going all the way back to July 2023, a notable change in trajectory from the prior eighteen months of worsening data. Likewise, total job openings, which plummeted throughout 2022 and 2023, has remained relatively stable for the past nine months. Data on “quits” seems to confirm a stabilization, and layoffs and discharges remain below the pre-pandemic average.

Other labor data tells a similar story. Temporary help workers — indicative of strong labor demand — had been in decline for 21 straight months, but ticked up for the first time in January 2024, and have held relatively stable since.

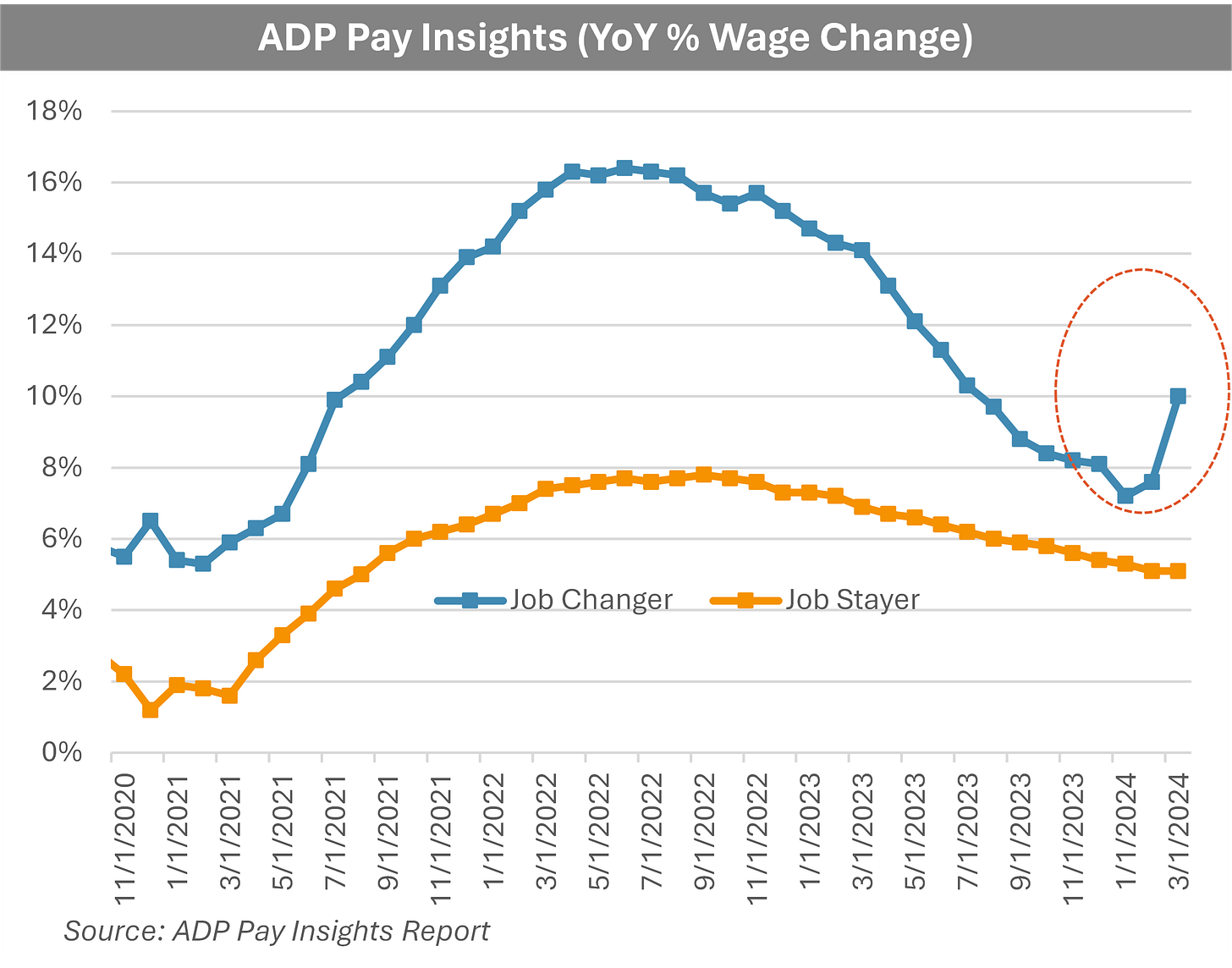

But perhaps the most dramatic indication of shift in labor dynamics comes from data compiled by payroll processor, ADP. Its Pay Insight report shows a dramatic inflection in wage-gains by job-changers, which began at the start of the year and accelerated in March. This means that employers are once again raising wages in order to hire new talent, a stark reversal from the trend over the past two years.

Meanwhile, job gains (calculated by both public and private sources) remain solid while new and existing unemployment claims remain subdued.

Similarly, consumer finances seem to be improving. I previewed these positive trends in Capital One and Consumer Credit, noting that sub-prime card providers were hinting at credit improvement ahead of schedule, and that perhaps the peak of consumer delinquencies would come much sooner than many assumed.

Indeed, in its 1Q24 earnings released last week, Discover Financial Services (NYSE: DFS) reported an outright decline in quarterly credit card delinquencies for the first time in two years.

Rather than more pain on the way, we argued that the company had likely over-provisioned for its credit losses, and that a reversal in loss-allowances could lead to a material increase in earnings (and share price) over the coming year. Sure enough, Discover’s total credit allowance declined marginally in the first quarter for the first time in two years1, and the stock has modestly outperformed the S&P 500 and financial sector since publication. Capital One reports earnings next week.

Taken together, my two macroeconomic concerns may not have just been misplaced, but directionally wrong. Rather than just a normalization, we may be seeing the early stage of a “re-tightening” in labor conditions. An improvement in labor markets and consumer finances come hand in hand, and contain significant implications for policy.

Any economically-dampening effect of rate hikes is fully in the rearview mirror. Credit access has improved. Capital markets activity continues to accelerate. While consumer spending and job gains never dipped in aggregate, the internals of both markets seem to be inflecting positively as well.

There is scant evidence that any “long-and-variable” lags of stricter policy are left on the horizon. On the contrary, the U.S. economy is stronger today than it was six or twelve months ago, and may be on the verge of reacceleration. For policymakers dealing with recalcitrant inflation north of 3%, incremental wage pressure is a most unwelcome development.

The key question is not whether inflation will remain above target, but rather how much excess inflation will the Fed tolerate before changing course. So far, the answer seems to be plenty.

A Trillion in the Treasury

Next week, the Treasury will throw some red meat to market-watchers as it releases its 2Q2024 Quarterly Refunding Announcement (QRA). The report will provide updated projections of the federal government’s funding needs and debt issuance plans. In recent quarters, this release has become a market moving event, given the heightened focus on government borrowing and Treasury yields.