Capital One and Consumer Credit

#93: What the Capital One / Discover mega-merger means for subprime lenders.

This week’s big news (other than some chip company smashing its haters) was the announcement that Capital One Financial Corporation (NYSE: COF) has agreed to acquire Discover Financial Services (NYSE: DFS) in a $35 billion all-stock merger of (near) equals. Under the terms of the tie-up, Capital One would absorb the fourth largest payment network and fifth largest credit card provider in the country. Each share of DFS would be exchanged for precisely 1.0192x shares of COF as consideration. If consummated, the merger would create the largest vertically integrated card provider by loans (surpassing American Express) and the sixth largest U.S. bank by deposits1.

Mega-mergers are always intriguing to former M&A model monkeys like yours truly, and this one has some obvious wrinkles. First, there are strategic implications — a major shakeup to the credit card industry. Then there are the regulatory considerations. Can this deal survive the heightened scrutiny of mega-mergers in general (see: Spirit / JetBlue), and consolidation of the banking sector in particular?

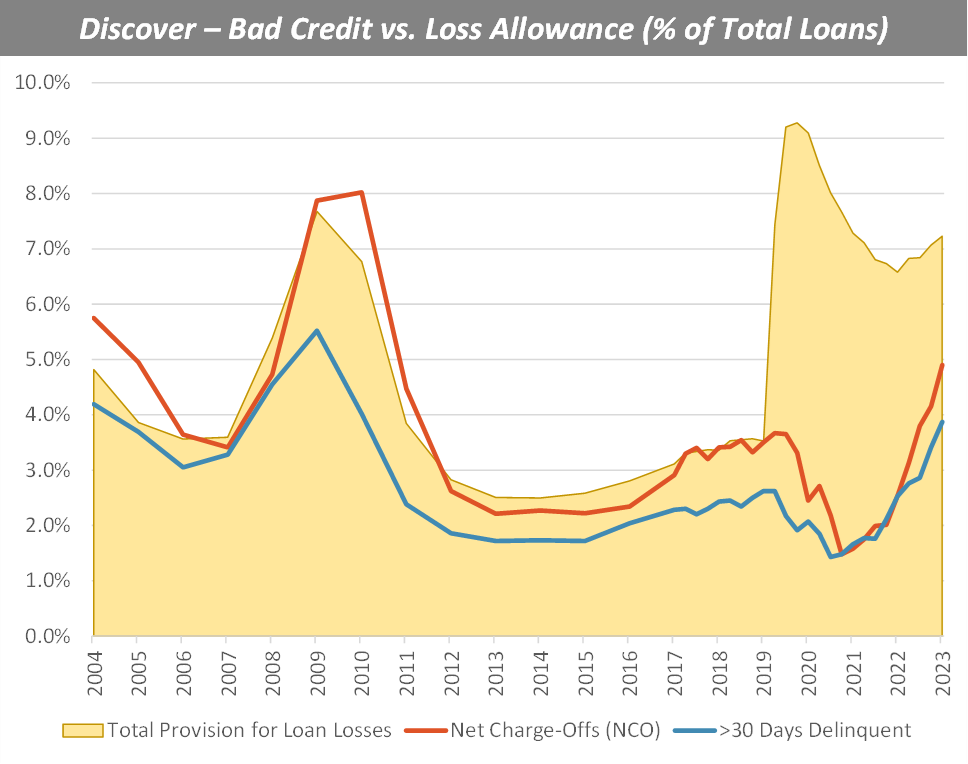

But truthfully, my interest is piqued for a different reason. Both Capital One and Discover skew towards subprime borrowers and both firms have experienced a significant increase in bad credit over the past two years, now surpassing pre-COVID levels. Prior to this merger announcement, Discover made headlines as disappointing 4Q 2023 results triggered a 10% dive in its share price. Indeed, rising bad debt has squeezed reported earnings for both companies over the past two years.

As readers know, consumer credit quality — credit cards, auto loans, and personal loans — has been deteriorating sharply as pandemic savings and stimulus fade and higher interest rates bite balance-carrying borrowers. While this dynamic hasn’t dampened the consumer spending overall, it has remained on my macroeconomic watch-list.

Given these two institutions hold the highest exposure to subprime credit of all the large U.S. banks2, it’s natural to wonder whether the motivations for the merger were strategic or defensive — true love or a shotgun marriage? And beyond the two firms in question, what can we glean about the state of consumer finances?

Margin of Safety

First, let’s level-set our understanding of normal, beginning with Discover.

Below, I’ve charted 30+ day delinquencies (DQs), net charge-off rates (NCOs), and total credit provision as a percentage of loans outstanding dating back to 20043.