Year of the Dragon

#105: With Chinese markets breaking out, is it time to buy property?

First, an update on an eventful couple weeks in U.S. markets. Then we turn east.

We Are So Back (?)

In April, I cautioned readers about a changing of the winds. The momentum trade that has turbocharged U.S. equity markets since November 1, 2023 finally hit an air-pocket. And with the market pushing past 2021 levels from a valuation perspective, perhaps it was time for a healthy breather. Mae culpa — my barometer malfunctioned.

I was envisioning something akin to the third quarter slump that we saw last year — not the start of some bear market but a rolling consolidation, partially driven by higher interest rates and partially by a natural oscillation of sentiment. Instead, pretty much every major component of financial conditions has fallen in line, creating a springboard back into the green.

Oil has played ball. West Texas Intermediate crude has dropped 10% off the April peaks, back below $80 per barrel — much more comfortable from a forward inflation perspective while brining relief to the pump.

The U.S. dollar has also retreated — a critical metric for global financial conditions. The Euro, Pound and Yuan have rallied vs. greenbacks, even the Yen has held most of its ground.

Meanwhile, a number of “soft” economic prints in the U.S. have helped ease concerns around the path of policy. April’s official BLS employment report showed 175,000 of payroll growth, consistent with the average over the pre-COVID decade but nevertheless below expectations and the weakest report since last October.

April inflation data released this week also showed a moderate step down in YoY core CPI inflation to 3.6%, with a 0.29% monthly increase. And while core inflation is still annualizing at nearly double the Fed’s target, the latest data is still being perceived as a constructive step-down compared to the previous readings. And of course, at the FOMC on May 1st, Powell dumped cold water on the outside chance that the policy rate might actually move higher, not lower.

Interest rates were the last to move, but the 10-year U.S. Treasury rate has fallen 32bps over the last two weeks providing relief to rate-sensitive names and financial conditions more broadly. The 2-year, which is seen as the most direct proxy for medium-term Fed policy, has fallen 25bps as the market has effectively priced in a full rate cut vs. the expectations one month ago.

By the Fed’s measure, national financial conditions have taken another step looser, and are now the easiest in over two years.

In this context, the S&P 500’s 6% month-to-date rally can theoretically be explained almost entirely by the easing of interest rates. Perhaps it’s as simple as that. My friend Eliant’s Exploits, whose barometer was much better calibrated for these market moves, puts it in simple terms with the following flow chart.

Simple enough. But where do we go from here?

To the extent that price leads sentiment, the rebound seems to have put bulls back in the driver seat. Equity volatility has been pummeled back to the lowest level in months, and call-buyers have come out of the woodwork. The put-to-call ratio on Thursday was the most call-heavy reading in months, having steadily trended bullish over the past several weeks.

From where I sit, the fundamental story really hasn’t changed. The recent movements in markets fit within a normal band of undulation. And recent economic data, while marginally comforting to the markets, hasn’t changed these key points:

U.S. economy remains solid and growing

Inflation remains well above target, but the Fed maintains a loosening bias

Against this backdrop, it’s hard to create a truly bearish case for stocks. Valuations are probably stretched, but with nominal GDP and PCE holding above 5%, real growth clocking at ~3%, earnings gains, and payroll growth, there isn’t an obvious reason to re-rate growth expectations lower. Without a clear catalyst or true macroeconomic weakness, fundamentals may cause some headwind but aren’t likely to sink the ship.

We could be on the verge of the next leg higher — maybe April’s hiccup provided sufficient digestion. Some wind has returned to the sails of leading themes like AI, crypto, and precious metals, though higher quality names have fared much better than lower quality counterparts (i.e. NVDA vs. AMD, DELL vs. SMCI, BTC vs. SOL). This week was jam-packed with AI news, with Google hosting its I/O conference and integrating Gemini into its search function, and Open AI releasing GPT-4o, as so the train rolls on1.

Elsewhere in the market, interest-rate sensitive sectors like utilities2 (XLU), financials (XLF), and real estate (XLRE) have bounced on the bond rally, while energy (XLE) has sagged with oil. Economic stalwarts like healthcare (XLH), industrials (XLI) have risen with the market, (though interestingly, construction companies took a big step down on Thursday). Precious metals have bounced under looser conditions, sending silver to new highs and gold pretty darn close.

And of course the meme-stocks meme’d this week, with GME briefly tripling on the return of Roaring Kitty. This prompted a brief but brutal squeeze in names with high short-interest on Tuesday. Folks like X user Zack Morris, re-energized from the dismissal of SEC charges of market manipulation, have returned in full force to pump microcaps. The last time we saw this action was in February 2021, and I while believe it marked peak exuberance, the market would go on to climb another 25% by year end. I have much to say on this topic, but will reserve that for another week.

All of the above tilts bullish, particularly if we continue to see a rally in rates (which isn’t a given). Consolidation may still be on the menu, but I would view it as a healthy bull-market digestion.

Until we see a true deterioration in macroeconomic conditions that would point to an earnings recession (which I don’t), or a legitimate hawkish pivot from the Fed, the path of least resistance is up.

Year of the Dragon

In our Macro Outlook for 2024, I wrote the following:

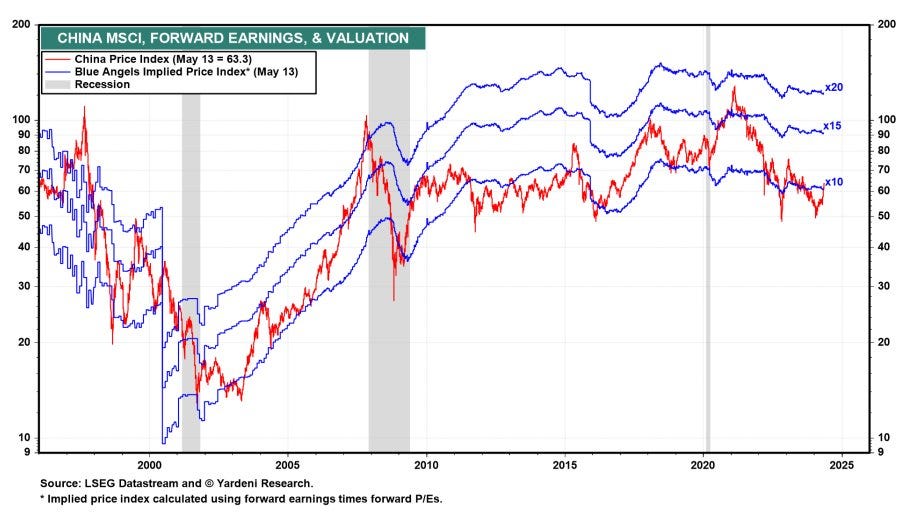

The one international market that seems ripe for outperformance is China. The divergence between Chinese stocks and all other major economies has been extreme […] Moving forward, I think that investors will shed some of their pessimism and begin to see value in the country. With a dividend yield of over 4.3% and significant room for capital appreciation, the Hang Seng is my candidate for the “obvious in hindsight” pick of 2024.

I elaborated on these thoughts in The Tale of Two Chinas in January3. While a little slow out of the gate, the Hang Seng has caught fire over the past month, ripping 20% since late April, and handily outperformed all global markets since the January publication.

But even after the move, I think there is plenty of room to run through the end of the year, though perhaps not in as straight of a line. Both in absolute valuation and relative to global indices4, Hong Kong listed stocks are still cheap, sitting at the low end of their historical valuation ranges at a time when industrial profits are turning up. The index is still more than 35% down off its 2021 peaks, when the property crisis emerged.

(As a reminder, U.S. investors can access this market by ETFs that track the Hang Seng like FXI or EWH, and can buy Hong Kong listed equities directly from most brokerages)

The Sino bounce has extended to the once popular but recently beleaguered U.S. listed Chinese companies. Tech names like Alibaba (BABA), JD.com (JD), Tencent (TCEHY), PDD Holdings (PDD), iQIYI (IQ), or the popular Chinese Internet Stock ETF (KWEB) have rallied between 25% - 45% since late April but still remain well off former highs.

EV manufacturers Nio (NIO) Xpeng (XPEV), and BYD (BYDDY), another popular cohort of U.S. listed Chinese companies, have also seen positive moves in recent weeks but with more varied performance.

Given these companies’ popularity and accessibility among U.S. investors, they are likely to benefit if global sentiment on the country and its markets continues to improve, and make for a fairly easy way to play the theme.

But if you really want to get down and dirty, you have to get to the heart of the beast — the property sector. Property stocks and bonds have been thoroughly trashed over the past three years — the best names are down 70% - 80% while the worst have been de-listed or liquidated. The property sector has performed so poorly since 2021 that one of the few ETFs that tracked the sector (MSCI China Real Estate ETF (CHIR)), ironically stopped trading this February.

And while property stocks continued to fall through early 2024 despite the broader rebound, they have caught fire in recent weeks as a drumbeat of stimulus measures have been announced to support the sector. These policies importantly include the ability for governments to directly purchase housing units to clear inventory, fund ongoing construction, and support prices. In other words, the long awaited direct property bailout seems to be arriving — a massive development for developers in particular.

We’ve seen brief pops in property stocks on stimulus headlines before, but this time does feel different. Since late April, most “high” quality Hong Kong listed property stocks have risen by 50% - 100% off incredibly low bases (charted below). “Lower” quality names like Fantasia (HK.1777) or Agile (HK.3383) have tripled, though their true equity value is still probably zero.

Meanwhile, this week Caixin reports that USD-denominated bonds of property developers have risen to their highest levels in three years. As an example, bonds of Longfor Holdings (HK.960), a relatively clean shirt among the battered gang, rallied 30 cents on the dollar in just the past two week (pictured below).

To be clear, the housing market is still in the dumps. Housing prices fell again in the most recent monthly data, and prior stimulus announcements have done little to stall the decline.

But this time does feel different — both because of the broader improvement in Chinese equities and economic outlook, along with the more forceful policy measures.

For the intrepid and aggressive, below is a list of notable Hong Kong listed mainland-focused developers, banks, and insurance companies linked to the property sector that are still standing today.

Whether we have finally found the bottom of this property debacle remains to be seen. There still a mountain of liabilities to work through and many of these lower quality names may ultimately be liquidated. The most straightforward and low-risk investments are likely indices or US-listed large-caps. But it seems like there may finally be opportunity in property.

After all, it is the Year of the Dragon.

Until next week,

The Last Bear Standing

For the record, the smartest folks I know — ones who have been correct and early about the impact of AI — are as bullish as ever. Meanwhile I use Chat GPT and other AI services daily, and really think they are fantastic for certain purposes.

Utilities are also likely being bid on the power-demand thesis we discussed last week.

I can safely admit now that I was nervous in taking this stance. Having made a name as a China bear, I didn’t take this pivot lightly and was still nervous that the credibility I built on the topic would be erased if I got bullish just in time for the final flush.

Hong Kong valuations have historically traded much lower than elsewhere in the world, likely due to the inherent geopolitical risk and extensive authority the CCP wields over Chinese companies.

For any1 interested, here are my Apr PCE inflation estimates:

https://open.substack.com/pub/arkominaresearch/p/apr-2024-pce-estimate?r=1r1n6n&utm_campaign=post&utm_medium=web

Good stuff!