Inside the Vault

#28: Re-examining Stablecoins.

It’s been a wild week.

Last Wednesday, Coindesk published a report on the makeup of Alameda Research’s assets. Six days later, FTX and Alameda collapsed in the most public and dramatic crypto blowup yet. Last week SBF was a billionaire, this week he is $10 billion in the hole, and under criminal investigation. Life comes at you fast.

Many are now trying to explain in hindsight how the face of crypto fell so fast. But TLBS readers got a sneak preview days before the collapse in last Friday’s timely post, A Billion Bananas1.

Amidst the crypto volatility this week, we saw a bit of stablecoin instability. As I joked on Twitter, we were briefly back on Tether Watch. But, it prompted me to refresh more serious thoughts on an important issue in crypto: stablecoins.

Inside the Vault

Imagine that the entire crypto ecosystem is a casino. When you enter a casino, the first thing you do is hand over paper dollars to the house in exchange for chips. Then, you can take your chips to the tables and try to double your money playing blackjack or craps. At the end of the night, if you have any chips left, you can cash them out for dollars.

The same is true in crypto. First, you trade paper dollars for some digital chips, then you hit the floor2. You can sit down with any dealer you like - FTX, Binance, Coinbase, etc. - and move from one to the other between hands. You have to be a bit careful, because unlike a real casino, your dealer can bust. But that’s kind of an accepted part of the game.

When we talk about making or losing money in crypto, we are usually counting chips. Chips are important - your night ends if you run out of chips. 3AC ran out of chips. Alameda ran out of the chips that it borrowed from FTX, busting both firms in the process.

But an often overlooked question is what happens with the paper money while everyone is gambling. If you think that a dealer going bust creates problems, imagine if the entire floor realizes the casino vault is empty.

Of course in this analogy, stablecoins are the vault. Stablecoins are the connective tissue between the fiat and crypto worlds - providing liquidity from dollars into chips and vice versa. While everyone is gambling, they are holding the pot.

For much of the past two years, the looming, existential question facing the industry was, what exactly was in the vault, and how did its custodians manage it?

And, for good reason. For a long time, there was little transparency other than some shady figures who had a history of theft saying “trust us”. In the meantime, the pot has only grown. Today, it sits at around $135 billion.

The Big Three

One good thing is that there isn’t just one big vault - rather there are three big ones, Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

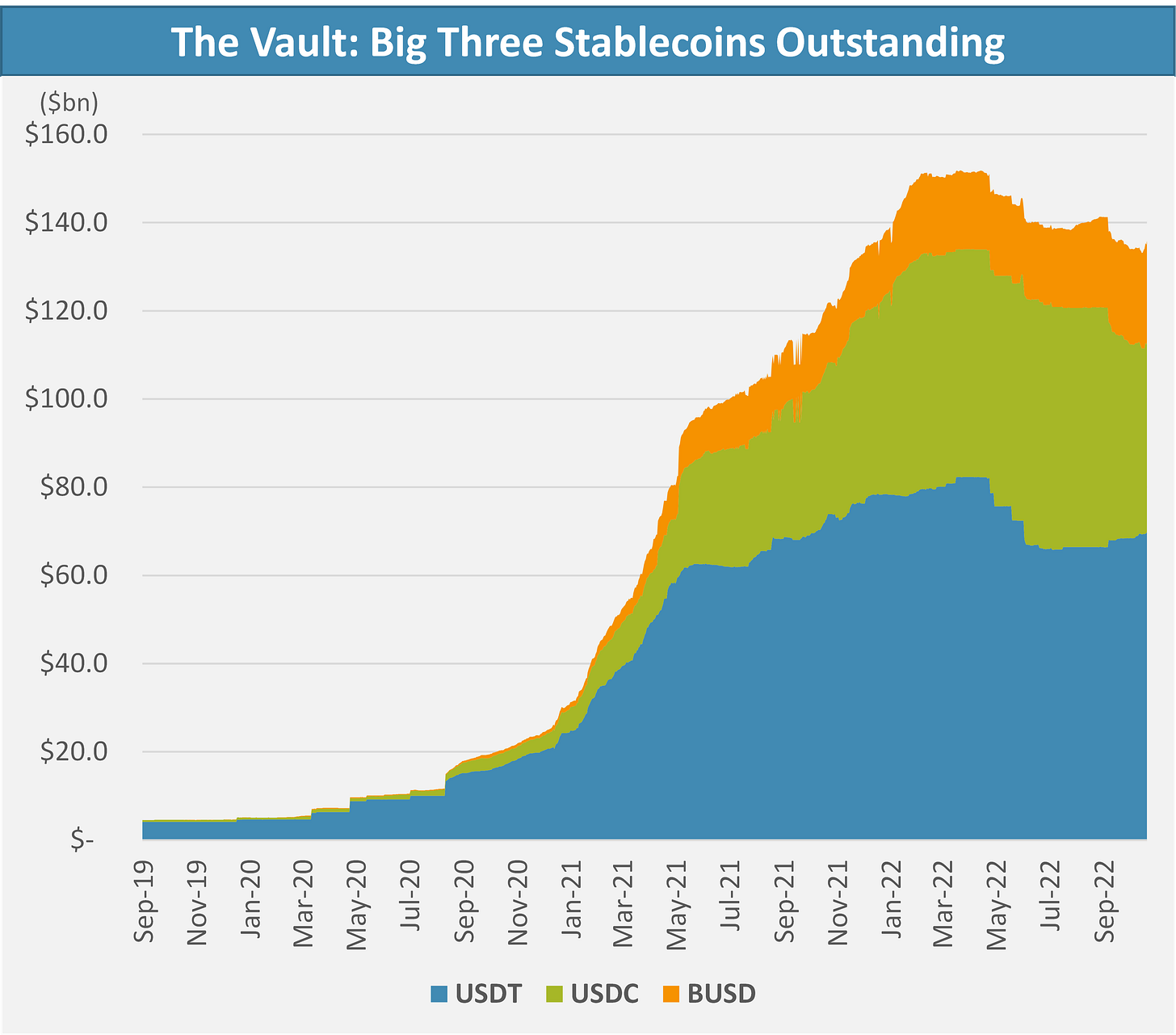

Together, the circulation of these stablecoins have exploded over the past two years, reaching a peak of around $150 billion this past spring. Since the Luna/3AC debacle, circulation has been slowly declining3.

USDT makes up about half of the total circulation but dominates trading volumes. Meanwhile USDC has the second largest circulation but is the least frequently traded.

Each of these coins also has different level of controls, quality, and transparency. From best to worst…

USD Coin (USDC): USDC is widely considered the highest quality stablecoin. It is a licensed US Money Transmitter; it holds its assets with large US financial institutions. Grant Thornton (a reputable U.S. auditor) provides monthly assurances out of its New York office, which include specific CUSIPs of its Treasury holdings. Its assets as of the end of September included $38 billion of Treasury Bills and $9 billion of cash in the bank.

Binance USD (BUSD): BUSD, sponsored by Binance and operated by Paxos Trust, falls somewhere between USDC and Tether in reputation. It self-reports its reserves within five days of the end of the month and provides external attestations from Withum - a small but real U.S. advisory firm - on a lagging monthly basis. Both reports include specific CUSIPs of its securities holdings. As of the end of August, BUSD held $9 billion of Treasury Bills, $9 billion of US Treasury-backed repo lending, and $1 billion of cash on hand.

Tether (USDT): Tether is the elephant in the room, both with respect to its size and concerns about its credibility. The original stablecoin, Tether has a checkered past, including lying about its reserve backing and covering up $850 million of losses at Bitfinix, which earned it a $18.5 million fine from the New York Attorney General, which included a ban from further operations in New York. Further, as many traders will note, new USDT often seems to come hot off the press just when Bitcoin could use a little bump in price. Up until recently, Tether provided no disclosure into its backing. Its first breakdown of reserves in June 2021 led to more questions than answers4 and was stamped by a Cayman Island auditor that appeared to be little more than a P.O. box. An Italian office of BDO - a well known global firm - began providing independent audit of the Company's quarterly reserves beginning in June 2022, though the report falls far short of its rivals. According to Tether, reserves include a combination of cash and equivalents5, corporate bonds, secured loans, precious metals, and "other" investments, including digital assets. Tether does not provide monthly reports, CUSIPs of its holdings, or details on the wide range of non-cash investments.

So what does this all mean?

Between USDC and BUSD, we can get pretty comfortable with roughly half of the major stablecoin supply as having real, stable, dollar backing. The real question, as always, is with Tether.

First, the negatives.

Tether’s current disclosures remain woefully inadequate. If Tether’s reserves were as clean as they portray, it wouldn’t take years to get a simple attestation from a reputable auditor, or provide monthly balances (which they still do not do)

Tether’s banking relationships and depository locations remain unknown

Tether’s self-reported assets extend far beyond cash and treasuries and raise questions of price volatility, liquidity, credit exposure, and losses

Tether has lied about its backing, and its reserved have historically been pilfered to cover losses of its related entities

But, at the same time, Tether’s standing has improved over the past year. BDO provides far more credibility than its former auditor. More importantly, Tether has proven that it can handle sizeable redemptions6, as it burned over $15 billion in short order in the wake of the Luna/3AC meltdown, even as its peg slipped in the process.

Unlike certain commentators who suggest that Tether is mostly unbacked, I think it’s more likely that it does indeed hold significant real reserves, even if the details remain murky or the total falls short of its $70 billion circulation7. If this is the case, then there is the possibility of partial recovery even if Tether breaks the buck with its non-cash investments (assuming of course that those funds stick around for USDT holders and don’t find a way of disappearing).

While far from an endorsement, this is still a higher assessment than what I would have made a year ago. If Tether really wants to prove its haters wrong, it must go much further in its transparency and disclosure.

Conclusions

Throughout the recent crypto bull market, my biggest concern has been the contents of the vault. All the table games on the floor are an irrelevant distraction if the casino itself is broke.

The increased market share of newer, credible stablecoins like USDC go along way to placate these concerns, as they provide over $65 billion of real dollar backing. Over the past year, these coins have grown to represent 50% of the total stablecoin market which until recently was nearly entirely dominated by Tether. In fact, they provide a pretty clear template for how a regulated, well-functioning crypto market could operate in tandem with the traditional financial market.

Tether, to its credit, has withstood the adverse market conditions thus far and has made marginal steps to improving its credibility.

A doomsday scenario for Tether is not out of the question - as we have seen in other instances, money can disappear very quickly in the wild world of offshore crypto. And, if push comes to shove, it would not be surprising if USDT holders hold bags while remaining reserves mysteriously disappear. Given its outsize role in trading, any disturbance to Tether’s stability would likely have huge impacts on the price of other cryptocurrencies.

But its also certainly possible that Tether remains pegged for a long time. So long as traders are willing to accept the risk of holding USDT, they will continue to arbitrage it to back to par. Unless there is a Alameda moment, where the emperor is publicly revealed to be naked, all Tether has to do is remain liquid - an easier task given it controls withdrawals.

The crypto industry remains rife with fraud and risk, but it continues to mature regardless. A good critic must constantly re-test their hypothesis, remain grounded in fact, and open to opportunity. Hopefully, this bear market separates the truth from fiction and leaves behind fertile ground for the future.

As always, thank you for reading. If you enjoy The Last Bear Standing, tell a friend! And please, let me know your thoughts in the comments - I respond to all of them.

-TLBS

But if you’re interested, here is how things went down from my perspective. The Coindesk report was released on Wednesday and immediately began circulating on Twitter. My first exposure was through a great thread by @DylanLeClair_. Over the next 24-48 hours more and more people began to dig into FTT (including this column), most notably the Dirty Bubble Substack, which provided more detailed and direct case that Alameda was insolvent. By Sunday, CZ had launched open war on FTX, and the rest is history. While I thought the topic was worthy of covering, I did not expect that it all would happen so soon. There wasn’t any reason why it had to happen right now. CZ was the spark that launched self-fulfilling doom loop.

The crypto gaming floor is way wilder than anything in Vegas. Rather than narrowly defined games controlled by the house, in crypto, pretty much anything goes. You can set up your own game with its own rules and are free to trade your chips with anyone else willing on whatever terms you set. You can even print your own unbacked chips to trade for casino chips backed by the vault.

Interestingly, the change in size of the stablecoin universe actually mirrors the change in the Fed’s balance sheet from mind 2020 onwards - providing further evidence for the liquidity theories in The Pool.

For one, its assets included large sums of undisclosed commercial paper. As long-time Twitter followers will recall, I speculated (with heavy caveats) that this paper could be Chinese commercial paper and therefore tied into the stressed Chinese credit and property market debacle. This theory was at least partially vindicated by Bloomberg reporting that Tether’s assets in 2021 indeed included commercial paper of Chinese corporates. Several weeks ago, Tether announced that it had finally rid its reserves of all commercial paper, though until we see a detailed, updated and audited reserve report, we will not know for sure.

Cash deposits, CDs, Treasury bills, money market holdings, reverse repo lending and commercial paper holdings.

There is still a question of exactly what these burned tokens represent. Did Tether wire out $15 billion dollars to USDT holders, or did tether liquidate crypto loans to counterparties, reducing circulation in the process? Tether also decides who they redeem.

For example, I also think its possible that Tether could be providing unbacked tokens to trading firms as leverage, and that as they go bust Tether liquidates the loan and burns their USDT.

Master TLBS, thanks for your write ups!!

The Last Bear Standing. I came across your twitter a little over a year ago form a friend and have been a avid reader since. I'm so grateful for these write ups, keep up the great work.