Blade and the Trough of Disillusion

#99: An Earnest Pitch for Blade Air Mobility (BLDE)

This is not investment advice. I own shares of BLDE and BLDEW.

In last Friday’s post, Gems in the Junkyard, I included Blade Air Mobility, Inc (BLDE / BLDEW) as one of seven deSPACs that I thought looked intriguing. I was happy with the whole list, but there was only one company that I couldn’t stop thinking about, on Friday, and Saturday, and Sunday…

After much deeper diligence, I am confident that Blade is a great company. In just two years, it has disrupted and consolidated the fragmented organ transplant aviation market to become the largest player in the country. Its passenger business is logistically advantaged, has almost no existing competition, and is growing in scale and profitability. It posted its first quarter of GAAP profitability in 3Q23.

Blade is a technology and logistics platform — it connects a growing network of helicopter and jet operators with demand, whether it’s NYU Langone or Lizzie from the West Village. The platform has the ability to scale with almost no capital investment. It has crushed antiquated charter brokers, and has significant opportunities well beyond its existing business lines.

But what makes Blade an intriguing investment opportunity is that no one seems to think it’s a good company. Today, with a basic market capitalization of $244 million vs. a cash balance of $166 million, the market is ascribing almost no value to the enterprise.

When I posted about the company on Twitter/X, many thought it was an April Fools Day joke1. The company is saddled with a negative market sentiment based on its historic losses, poor stock performance, competitive concerns, and its (inaccurate) image as a capital-intensive, cyclical, discretionary-spending company. Without these perceptions, the investment opportunity wouldn’t exist.

The company of course has risks — principally, its path towards profitability and the competitive threat of Transmedics Group (TMDX) in the medical segment — which I will address below.

But I believe that Blade is one of the most unappreciated and undervalued stocks in the market.

Company Overview

Blade, founded in 2014 and based in New York City, began by providing short-distance passenger service in its core Northeast U.S. market. Blade went public via a deSPAC merger with Experience Investment Corp and began trading under the ticker BLDE in May 2021.

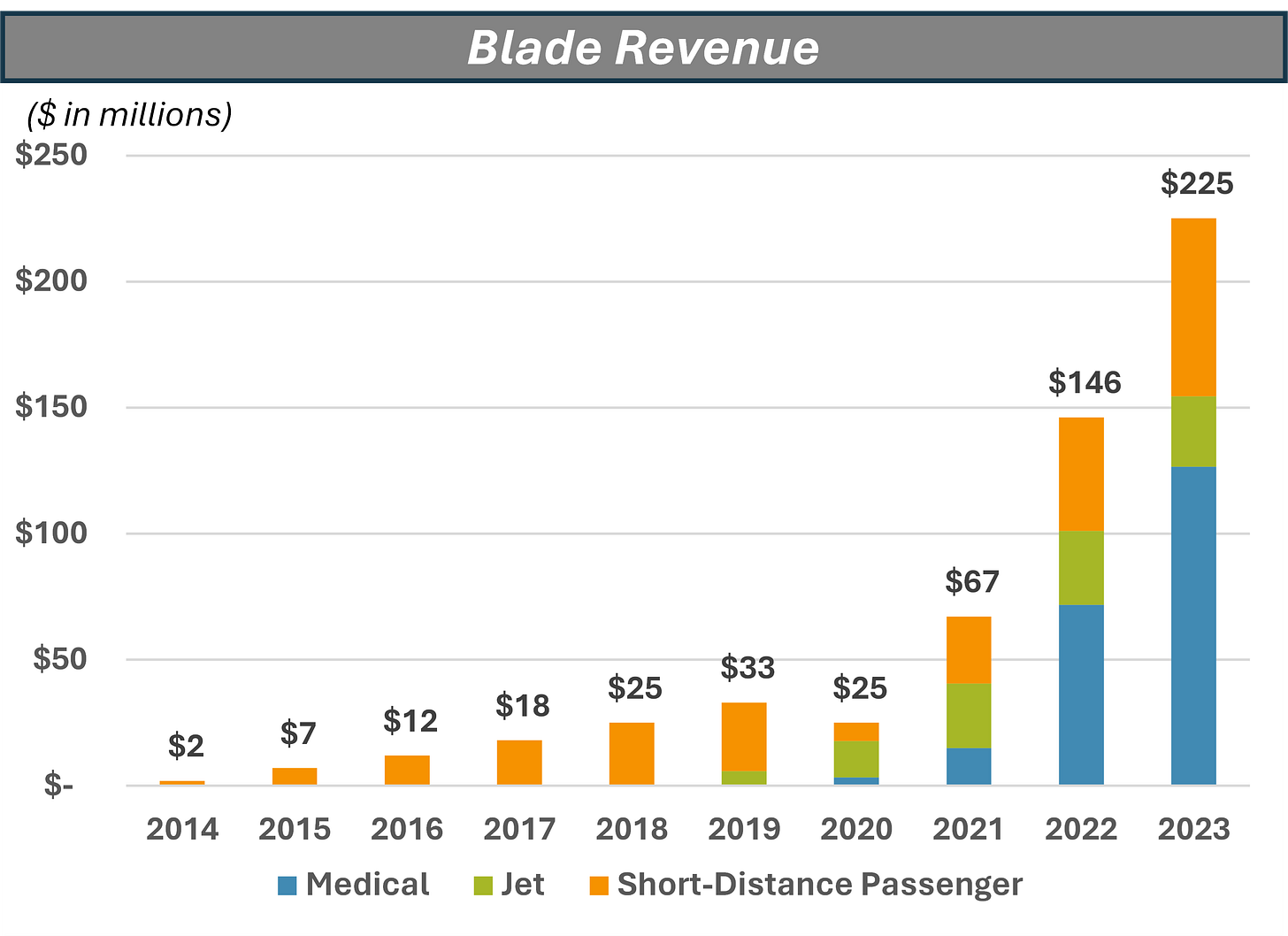

The company has since expanded its geographic and product offerings, adding passenger services in Canada and Europe and expanding its medical business partially through the acquisition of Trinity Air Medical in September 2021. In 2023, the company posted $225 million in revenue (+54% YoY), flying 154,608 passengers (+45% YoY), and coordinated over 20% of all organ transplant aviation in the country2.

Blade operates an “asset-light” model, meaning it owns only 10% of the aircraft it flies, and contracts the majority of flights under either fee-plus-capacity structure (30%) or a fixed-fee structure (60%) — essentially owned, on-call, and fully flexible capacity.

This contract structure allows Blade to maximize profits on its most highly utilized aircraft, while maintaining the flexibility to meet variable demand and at reliable profit margins. Blade does not take the risk or costs associated with utilization, equipment maintenance, pilot training, or hanger space. Over the three years, the company has spent just $3.3 million in cumulative capital expenditures.

Aircraft are dispatched across business lines (i.e. both medical and passenger), driving incremental volume for operators and efficiencies of scale for Blade and its customers.

In its medical business, the company maintains service contracts with 70 hospitals including a special partnership with NYU Langone which is the number one transplant hospital in the Northeast.

The company maintains strategic logistic infrastructure, notably its terminals at the West 30th Street and East 34th street helipads in Manhattan, across the street from Hudson Yards and NYU Langone, respectively.

Organ Transportation and Transmedics

The aviation market for organ transplants is a large and growing industry. Because organs like hearts, livers and lungs can only survive for several hours outside the body, they usually must be flown from the point of donation to the point of transplant often via privately chartered aircraft. While the network of organ donation is nationally organized by the United Network of Organ Sharing (UNOS), the time constraint (along with certain regulations) has historically limited organ transportation to short distances, leaving a highly fragmented industry, with numerous small regional providers.

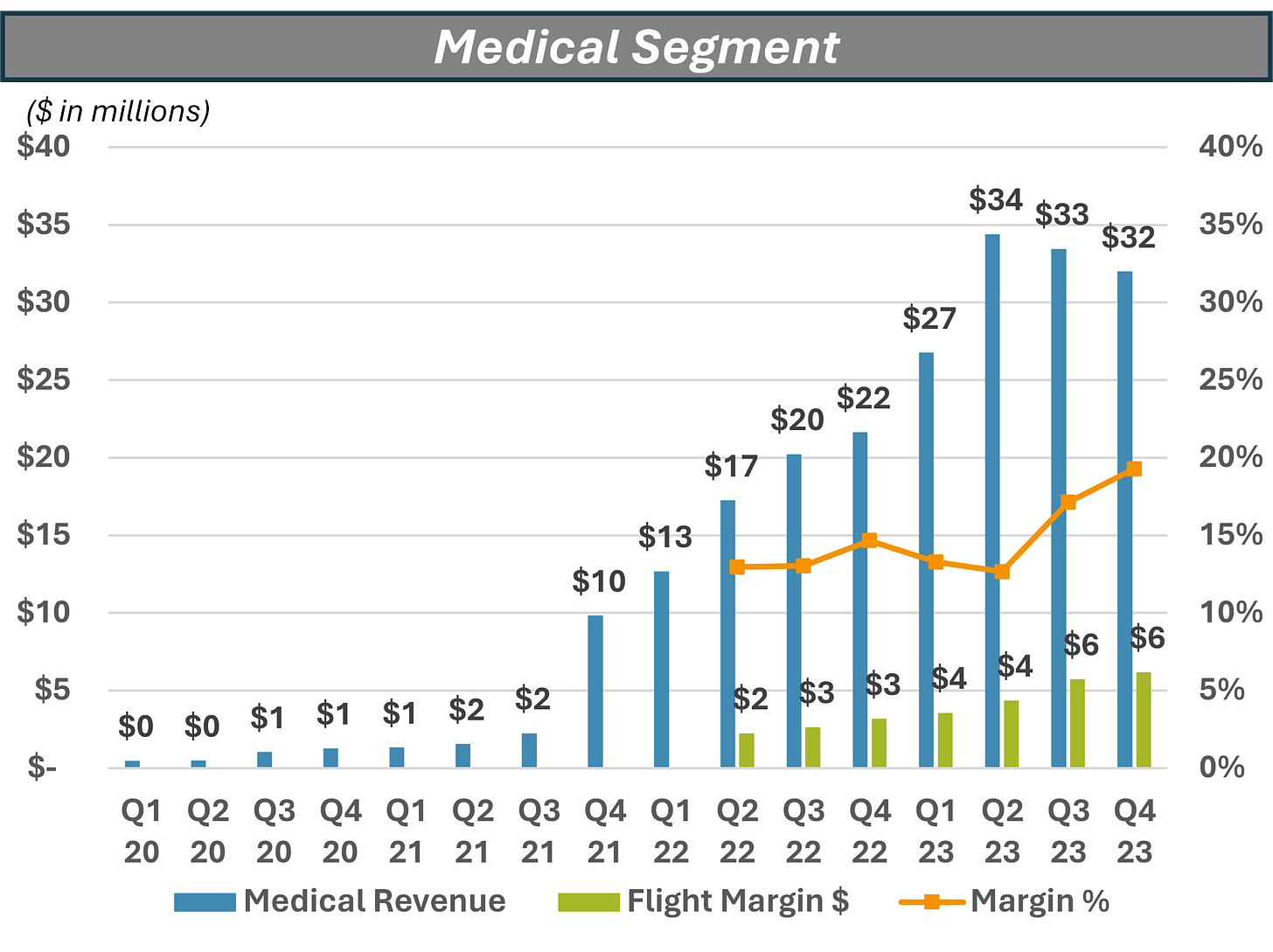

Since acquiring Trinity in September 2021, Blade has organically grown the business to $127 million in 2023, leveraging its operator network and technological scale to outcompete mom-and-pops with resounding success. Today, the medical segment makes up 56% of Blade’s revenue, and generates $11 million of “segment EBITDA”. Blade estimates it now has over 20% share in the market, making it the largest player but with significant room to continue to consolidate.

And the organ aviation market is rapidly growing… bringing both disruption and opportunity.

Perfusion and the Growth of Organ Transplants

The number of organ transplants has consistently grown over the decades, but has been turbocharged in the past several years due to technological advancement. Perfusion technology, which helps keep organs oxygenated and preserved, allows organs to survive significantly longer outside the body than traditional cold storage.

This technology and other advancing preservation methods are rapidly increasing the number of transplants for two reasons. First, it increases the number of organs available for transplant by enabling recovery from circulatory deceased donors. Second, by extending the life of the organ, it also extends the distance it can travel, making it more likely for organs to find a suitable match.

While there are several medical device companies advancing portable perfusion, the leader in the space is Transmedics. TMDX has a suite of portable perfusion devices that gained FDA approval in 2021 and has since seen increased usage of its technology in the past two years and is a key source of growth of organ transplants overall.

While these technologies have enabled long-distance organ transportation, it has also created a massive logistical bottleneck. Flying long-distance requires jets, not helicopters, and existing aviation providers simply don’t have capacity to meet this new and rapidly growing demand. Blade has generally benefited from this trend, brokering jet charters for companies like Transmedics, which generates significantly more revenue than short-distance helicopter flights.

But flying private jets across the country is extraordinarily expensive, particularly when using non-dedicated aircraft, further exacerbated by this rapidly growing demand.

Transmedics Aviation

To address this bottleneck and capture the margins otherwise earned by charter operators and platforms like Blade, Transmedics began to acquire its own jets in September 2023 — vertically integrating its operations and establishing its own dispatch center. As of writing, TMDX owns 14 jets, and used its own planes for 35% of flights in the last reported quarter (4Q23).

This insourcing has coincided with declining medical revenue at BLDE for the past two quarters, disappointing analysts and investors. And while it’s never been explicitly confirmed, it is highly likely that some of this weakness has been due to TMDXs transition.

The concern around TMDX’s vertical integration is likely the single biggest investor concern on the name.

My conclusion is that these fears are misplaced, and fundamentally misinterpret the market dynamics.

Revenue vs. Margins

While BLDE’s medical revenue has declined by ~7% from 2Q23 to 4Q24, its flight profit has actually increased by 12% over the same period, with flight margins expanding from 16.6% to 20.1%.

Jets are big-ticket revenue drivers, but they provide much lower margins for BLDE. The company estimates jets at a 10-15% flight margin compared to short-distance travel of >20% in its medical segment.

This suggests that BLDE is indeed losing jet revenue to TMDXs integration, but is more than making up for it by wins in short-distance travel — not entirely on the topline but on the bottom-line. BLDE management is guiding for medical profit margins to increase to 25% by the end of 2024, which implies further mix-shift away from jets and towards short-distance flights.

BLDE management has also affirmed sequential growth in medical revenues in 1Q24, which is likely occurring despite the ongoing loss of TMDX’s jet business as it has acquired additional aircraft through the quarters. This suggests ongoing wins for BLDE in the remaining market.

The Prospects

Blade has significant room to grow with improving margins.

Perfusion is expanding the organ transplant market. Despite TMDX’s growing market share (12%), the total number organ transplants excluding TMDX grew by 4% in 2023

The industry remains highly fragmented, with significant room for BLDE to consolidate in short-distance flights

Traditional cold storage and less expensive preservation devices will be preferred for short-distance travel, and for situations in which perfusion is unnecessary

TMDX is only acquiring jets, not rotorcraft. Helicopters may be necessary for last-mile transfers and will be strongly preferred for short-distance travel due to cost

Other medical devices will continue to provide long-haul opportunities for BLDE

Short-distance travel is significantly higher margin for BLDE

In short, I believe that there is substantial room for both BLDE and TMDX to grow, occupying different segments of the industry and continuing to work together where appropriate.

Passenger

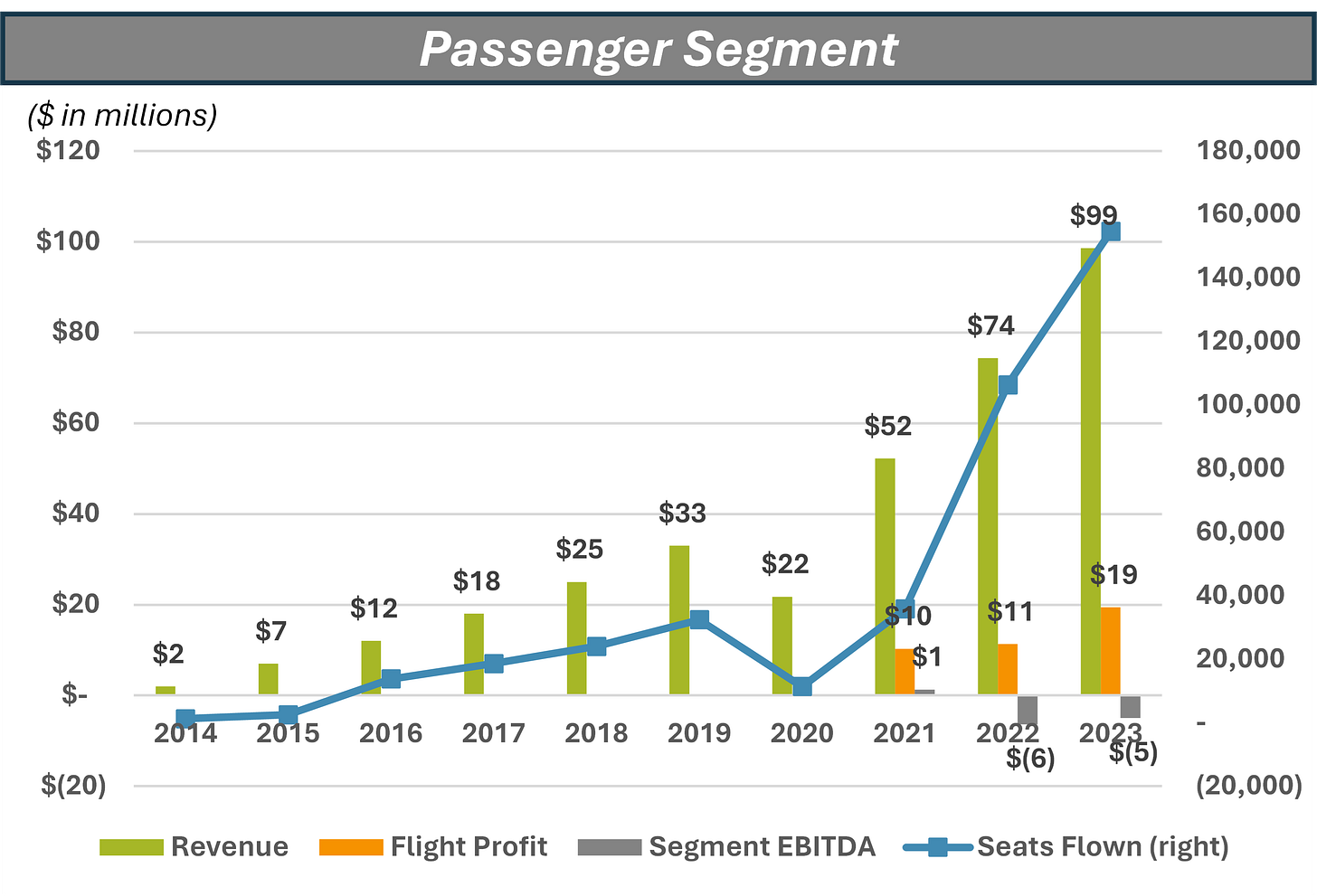

Blade’s passenger travel survived a pandemic and came out stronger. In 2023, the company flew nearly 5x as many passengers as it did in 2019.

The passenger segment includes several business lines, but mostly involve short-distance travel in and out of its New York City hubs. This includes both helicopters shuttles to NYC airports (i.e. Manhattan→ JFK) as well as longer trips to summer destinations in the Hamptons and elsewhere, which of course are seasonal.

Blade can also arrange custom helicopter charters and jet services. However, with lower margins and competition from commercial flights, its jet business is less compelling. The discontinuation of its South Beach jet service should improve profitability, though it is part of the reason for lighter revenue in 4Q24 and skews the implied growth rate in the company’s forward revenue guidance.

While the company’s flight margins (i.e. gross margins) are improving, the segment has posted a slight annual loss in the past two years. With the current reporting, it is hard to establish exactly which of these products are truly profitable. My understanding is that its seasonal NYC flights are high margin. Its Airport product — which may be the most compelling value proposition, but is higher risk given its by-the-seat booking— seems to be growing volumes and now has achieved profitability in 2023 according to management commentary.

Clearly this business is more sensitive to discretionary spending, but I do think there is a clear value proposition in the Airport shuttles in particular. The cost — starting at $195 — is not significantly more expensive than ground transportation at peak hours and can easily save two hours of commute to JFK from the West Side. When considering the location across the street from Hudson Yards, which now houses some of the biggest corporate tenants in the city, it is easy to see a sustainable demand for this service.

Further integration with airlines such as JetBlue, and streamlined airport access in Southern European operations, continue to make Blade’s offering more attractive as the first-or-last-mile leg of air transport.

Importantly, Blade has no capital requirements associated with expanding this business, and it is not at risk of stranding capital assets to the extent it discontinues unprofitable lines.

Financials & Cash Flow

On a consolidated basis, Blade has demonstrated its topline growth, and its gross margins have been improving in both absolute and percentage terms. It has also continued to gain leverage on its overhead, with SG&A as percentage of sales falling from 58% in 2021 to 33% in 2023 (excluding an impairment charge in 4Q23). Given the seasonal nature of the passenger segment, I’ve shown financials on a rolling LTM basis below.

While the company has yet to turn an annual profit, it does appear to have reached the inflection point in its “j-curve” at the end of 2022, with losses narrowing throughout 2023. Importantly, the company’s negligible capital expense means that it is recognizing all of its cash outlays in the current period through its income statement.

For the first time, the management has provided forward guidance3. The company expects slower topline growth (8-10%) in 2024, dragged down by the discontinuation of some Jet services, but mid-teens implied revenue growth in the core business, continuing through 2025. Further, Blade expects to be breakeven on an consolidated EBITDA basis in 2024 with “double digit” EBITDA expected in 2025. If these goals are achieved it would represent a significant improvement in profitability.

And while “EBITDA” often means “fake profits”, particularly for capital-intensive, or heavily indebted companies, that is not the case here. The company’s net cash position generates $8 million in interest income annually, and the company has practically zero capitalized expenses. As such, EBITDA is actually a fair view of net cash flow and profitability.

Since the company has no financing cash flows since its deSPAC, simply looking at its cash balance over time provides a direct view of its all-in cash flows.

Given the company’s current cash balance of $166 million, it can continue to sustain its current losses for years to come before running into financial constraints. If management delivers on its guidance, the company would show marginally positive cash flow this year, and significantly positive cash flow in 2025.

In other words, the company appears to have a clear path towards profitability in the coming years with incremental dry powder to use opportunistically. For this reason, BLDE’s management authorized a $20 million share repurchase two weeks ago, which at current prices would represent 8% of its total shares outstanding and 14% of the public float.

Platform Value

At this point in the lecture, we often see a “sum-of-the-parts” valuation. And indeed, if you chop the medical segment out of the financial statements, slap some fresh marketing on it and showed it to investors, I have few doubts it would attract excitement and a price north of $400 million based on a low $20-million 2025 EBITDA forecast and a ~20x multiple without any heroic assumptions (solid growth, no capex, strong free-cash flow generation). When combined with cash on hand, this would imply over $7/share with zero value ascribed to the passenger business.

But I don’t think this is actually how the business works. I don’t think you can (or should) attempt to separate the two lines. It’s thinking way too small.

I’m not attracted to this company by its immediate financial performance. I’m attracted to the company because of what it has proven is possible with its platform.

In two years, it took a $16 million revenue acquisition (Trinity) and grew it to $127 million in revenue and low-teens EBITDA with zero incremental capex, wrecking a fragmented industry of operators and brokers along the way. What multiple do you put on that?

Looking back at BLDE’s marketing materials prior to its deSPAC, medical transport is little more than a footnote. Now it is their largest business. It has achieved success not because of specialized expertise, but because it has a bigger and better network of helicopter operators to dispatch. Herein lies the fundamental value.

What other industries could it disrupt? Emergency medical services, offshore oil and gas, sightseeing and tourism, utility line inspections — theoretically any that use a helicopter. The current helicopter charter market is highly fragmented and it seems likely that Blade could use technology and scale to outcompete existing brokers, just as it has in the organ donor space. It is possible that Blade is creating the largest, most efficient, and technology advanced helicopter logistics platform in the world.

The asking price today is $244 million, and it comes with $166 million of cash.

Conclusions

Blade, in my opinion, is a classic example of the hype cycle.

It debuted to extreme excitement on the inflated expectations of electric choppers and an urban mobility revolution. Since then, it has fallen behind its lofty projections and been left for dead in the market. It is currently wallowing in the trough of disillusionment. But in the same time, it has actually scaled dramatically, proven the power of its platform, and is now heading towards profitability.

And here’s the thing. Electric aircraft are arriving, at least by 2026. While it didn’t meet SPAC investors’ timelines and won’t meaningfully impact the business in the next year or two, these vehicles have the potential to significantly expand the market for aerial mobility in dense and residential areas due to noise reduction and reduced fuel costs. And while the market has no problem ascribing a combined market capitalization of $4.7 billion to Joby Aviation (JOBY) and Archer Aviation (ACHR) — two of the many startup manufacturers that don’t have a certified aircraft let alone revenue — the company that seems best positioned to win from EVAs is Blade.

Risks remain. The company must continue to gain fixed cost leverage and achieve profitability. TMDX will remain an overhang, even though I truly believe Blade’s prospects in the organ aviation market remain bright. “Total Addressable Market” means nothing without execution.

But coming from the very recently awoken, the slope of enlightenment may be on its way.

Earnestly,

The Last Bear Standing

Admittedly, posting diligence on April Fools Day is an unintentional win-win.

Management estimates a market share of “high 20 [percent]” in its 3Q23 earnings call.

2024 guidance of $240 - $250 million of revenue and “positive” EBITDA. 2025 guidance of double-digit revenue growth and “double digit” (million) EBITDA.

An acquisition by UBER is a possibility. Also, what moat do they have against UBER eating their cake?

why no insider is buying?