Turkey, Twitter, and Tesla

#30: Food for Thought this Thanksgiving

Giving Thanks

First, a happy Thanksgiving1 to all who celebrated this week! This year, I have a couple thousand new reasons to be thankful - each of you who read The Last Bear Standing every week. My typical signoff - “Thanks for Reading!” - may seem like a throwaway line, but I mean it sincerely. I have no idea who the vast majority of you are2, how you came to find this column, or why you choose to read it. But I know that none of this works without you. It’s rewarding for me personally to know that others are grappling with my wacky ideas. and knowing that you take time out of your week to read keeps me motivated to put out good content.

As I have said before, if you keep reading, I’ll keep writing. I hope you do.

Meanwhile, for this short holiday week, we will keep it light and crisp, like an apple cider or a pilsner, depending on your preference.

Twitter

Have you heard Elon Musk acquired Twitter?

Most analysis on the topic seems indicative of an opinion of Mr. Musk3 rather than a critical analysis of the deal of itself. And as much as it pains me to spill more ink on the topic, I have to say it’s pretty interesting as a matter of finance.

The Twitter deal is one of the biggest leveraged buyouts (LBO) of all time. With a total value of over $44 billion, the transaction is only rivaled by the infamous 2007 buyout of TXU Corporation. TXU, the largest utility in Texas at the time, was acquired by KKR, TPG, and Goldman Sachs Capital Partners, the highest profile mega-funds at the peak of the mid-aughts financial bombast.

TXU - renamed Energy Futures Holdings after the deal - was a levered bet on higher energy prices that collapsed under the weight of its $40 billion of acquisition debt and depressed natural gas prices. The company filed for bankruptcy protection in 2014. Fairly or not, the deal is often considered a cautionary tale of hubris and excess.

Twitter, meanwhile, is being taken down largely by an individual - the poster child for this decade’s excess. So, will this buyout fare any better than TXU? We will have to wait and see, but here are three things I’m thinking about…

Relative Value

The first thing to consider is price.

It seems to go without question that at the buyout price of $54.20 per share, Elon overpaid for Twitter. For one, the stock was trading as low as $33 before the announcement of the deal and reverted to those lows over the summer as the transaction seemed less likely to close. Second, after signing binding acquisition documents in April, Musk tried to very publicly cancel the deal (or at least use the threat to lower his own offer price).

Clearly a lower price is always better, and maybe Musk really did have buyer’s remorse after signing the documents.

But all of this misses half of the equation. As we learned in A Billion Bananas, billionaires don’t actually have billions of dollars. In the case of Musk, the vast majority of his wealth is in Tesla stock. Therefore, the question for Musk is not necessarily about Twitter’s absolute value, but rather its value relative to Tesla.

In other words, you may be willing to pay above sticker price, if you are paying with inflated stock. According to Form 4 filings, Musk sold over $28 billion in Tesla stock over the past year to help fund the buyout (along with a big tax bill last year).

Elon sold his TSLA stock at an incredibly high valuation on an absolute basis and relative to Tesla’s historical trading range. Importantly, nearly all the sales were also done at a premium to the implied take-private valuation of Twitter. The impeccable local timing of the sales only bolsters the argument.

By trading a higher multiple stock to buy a lower multiple, Elon is averaging down and actually improving the “underlying cash flow” supporting his wealth. It’s an “accretive” deal for him. And would you rather own a cyclical, capital intensive business, or a scalable software business?

Think about it this way, Tesla’s stock is down nearly 60% since last November, when Musk started his timely monetization (and began accumulating Twitter common shares). Had he held those shares through today they would have lost over half of their value.

Or take the 10,000-foot view. As Elon’s mega-bet of the past decade - Tesla - reached mass production and the shares found new creative ways to go vertical4, what should he do? Sell the top and parlay it into your next gamble.

Pro Forma Cost Savings

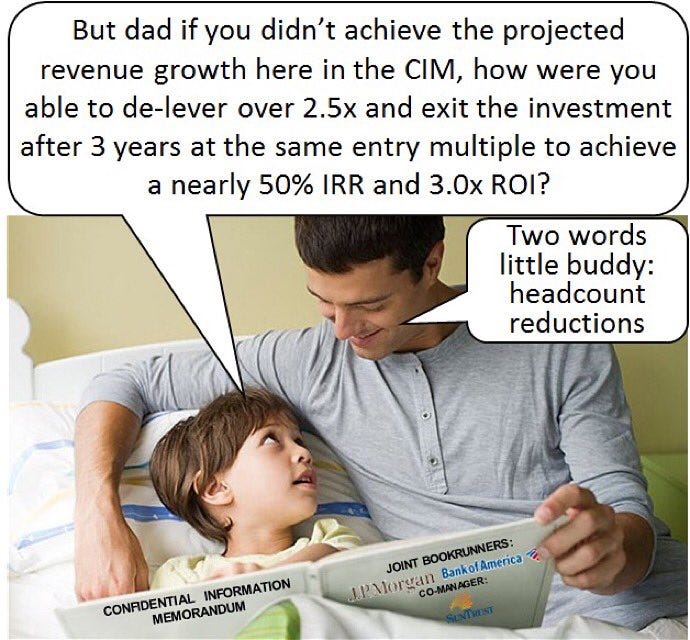

A long-running stereotype is that villainous private equity funds buy a company and “create value” for themselves by axing employees. There’s even a host of fun euphemisms to use, redundancies, headcount reductions, pro forma cost savings…

But despite the narrative, layoffs are actually an uncommon assumption for a private equity buyout these days. Some shops may specialize in “operational improvements” (buy it, fix it, sell it), but that’s the exception not the norm.

Most private equity buyers are in desperate competition with each other to buy good growing companies with strong tailwinds. And there is risk in laying people off. If you buy a company because you like the management, you probably believe it is running its firm efficiently - that employees are there for a reason and that the company wouldn’t work without them. Plus, it’s not exactly great for morale if the new owner cans half the staff on day one.

Elon Musk has no such qualms. By all reports, Musk fired half of Twitter’s staff within the first week of his ownership, and after further voluntary and involuntary reductions the headcount now sits at a fraction of its pre-acquisition level. This is a far more ballsy play than I can imagine from any institutional investor. And Musk has a history of running companies without corporate functions most others deem essential.

Since a huge portion of Twitter’s operating cost is in its people, in just a couple weeks Musk has radically slashed the cost structure of the company - taking on operational and reputational risk in the process. Given advertisers fleeing and the added interest burden of $12.5 billion of acquisition debt, maybe there was little choice.

Intrinsic Value

The last thing to consider is that Twitter may actually be pretty valuable. Despite its cultural significance, Twitter has always been the ugly step-child when it comes to its tech peers because it has never been able to really make money. But it clearly is a powerful and valuable platform.

And no one knows this more than Elon Musk. It can’t be a coincidence that Musk is probably the most famous and influential user of the site. It has been essential in his success to date, giving him a direct platform to write his own narrative and disintermediate traditional media and securities law.

Would Tesla (or Doge) have ever reached the same valuation without Twitter? I have to believe the answer is no. So, how do you value a company that can increase the (market) value of other companies and coins by tens or hundreds of billions?

This isn’t an exaggeration. At their respective peaks, Tesla crossed a $1 trillion valuation while Doge reached $88 billion market cap. In that context, $44 billion for Twitter seems like a steal.

Conclusion

At the end of the day, I just don’t believe that even the most meme-obsessed billionaire spends $44 billion on a company for the “lolz”. Further, I think Musk is far too self and wealth obsessed to publicly take on a company he doesn’t think will succeed.

It’s almost like all the drama around the acquisition has been a clever distraction. Like remember that car company? What’s going on with that?

From where I sit, the whole thing does follow a pretty logical arc. You buy low and sell high. Musk sold Tesla at the highs and hopes he bought Twitter at the low. Maybe a decimated workforce and subscription revenue model are the right path for Twitter. Or maybe, this mega-deal proves to be yet another mega-bust. We will find out soon enough.

As always, thank you for reading. If you enjoy The Last Bear Standing, tell a friend! And please, let me know your thoughts in the comments - I respond to all of them.

-TLBS

Thanksgiving is maybe the most ubiquitously celebrated and appreciated holiday here in the states. Christmas is the biggest holiday but isn’t universally celebrated. The Fourth of July and New Year’s Eve rank up there, but feel a bit more like a party than a “holiday”. Family, food, and reflection on the good things in life we take granted. Plus, the leftovers.

I can only identify roughly 1 - 2% of all TLBS subscribers as people I know, in person or online. That leaves 98% of you for which I really know nothing about other than an email address. I do know that you guys are spread pretty widely around the globe - less than half are in the U.S. - which is cool and a bit surprising. In any case, what I do know about you is that you must enjoy the same niche financial topics that I do, and so I think it’s a great match.

I’ve long thought Tesla was the perfect sentiment litmus test for the stock market. But it’s been interesting to watch the trajectory of public sentiment towards Musk over the past couple years as well. It doesn’t seem that long ago that his popular reputation was that of a visionary billionaire futurist ready to unironically colonize mars.

After all, Tesla was the pioneer of the modern gamma squeeze. At some point, we will get to the bottom of who was buying all those calls.

Thanks for writing this and other posts. I always learn something. I'm a subscriber through your posts on Twitter.

"There’s even a host of fun euphemisms to use, redundancies, headcount reductions, pro forma cost savings…" My personal favorite is. "synergies"