Threads Unraveled

#62: On the "Twitter Killer" (and an update on the TGA and Regional Banks).

Bird on Fire

Back in December, we took a deep look at Elon Musk’s acquisition of Twitter in Barbarian at the Gate. While we have little interest in the personal drama of billionaires, a take-private of a major social media company1 in one of the largest leveraged buyouts (LBOs) of all time is fascinating as a matter of finance and investing.

We concluded with a surprisingly open-minded perspective on the possibility of success:

The Twitter buyout is a very high-risk transaction. Success is conditioned on a meaningful business turnaround, with high-stakes leverage and a high volatility CEO. A profitable outcome is far from assured, but not out of the realm of possibility […]

Or, it may all go up in smoke.

After nine months, it is hard to imagine a worse start. Perhaps naively, we assumed some level of tact and acumen - pushing hard on costs, piloting new revenue channels, rebuilding advertiser relationships, all while generally maintaining status quo user experience. Instead, the situation more closely resembles a dumpster fire.

Advertisers have not returned to the site after their initial flight - ad revenue is reported to still be down 59% from last year. In our simple model, a sustained revenue haircut of 50% would be devastating, regardless of operating expense reductions.

Meanwhile, nearly every strategic decision has backfired.

Significant changes to the algorithm have promoted click-bait and listicles to increase immediate engagement at the detriment of the niche, tight-knit communities that maintain user engagement over the long term.

Twitter also seems intent on isolating the app from the rest of the internet by putting a $42,000 per month price tag on its formerly free API services, while blocking or throttling links to other media sites like Substack. While this decision may generate new revenue from deep-pocketed corporations, it is also guaranteed to push many smaller developers or content creators to find alternative distribution networks and reduce reliance on Twitter.

Then there is the “blue check” debacle. A blue check was at one point a status symbol on the site because it could not be bought and indicated a person of importance. Selling blue checks was a cheap monetization strategy that degraded the status by allowing access to anyone for $8 per month. Then, by removing legacy blue checks, it left only payers - reversing the status signal entirely.

Every decision has come with the de-facto assumption of monopoly power, due to the deep moat of its network. You will pay us because you have nowhere else to go.

Largely this has been true. Twitter is one of the most important information platforms on the planet - the news is on Twitter first. Upstart rivals like Mastodon or Bluesky never sniffed at the critical mass necessary to threaten Twitter’s dominance. Then came Threads.

Bare Threads

Meta released Threads - a barebones twitter clone - on July 5th. Five days later, the app had reached 100 million users, the fastest clip of any social media platform in history, by leveraging Instagram’s >2 billion existing user base for near frictionless adoption2.

While the initial surge has slowed, Threads continues to add users at a clip of 2 million users a day, with the estimated total now reaching 110 million after just over a week. With the app still unavailable in the European Union, we expect that more growth is on the way.

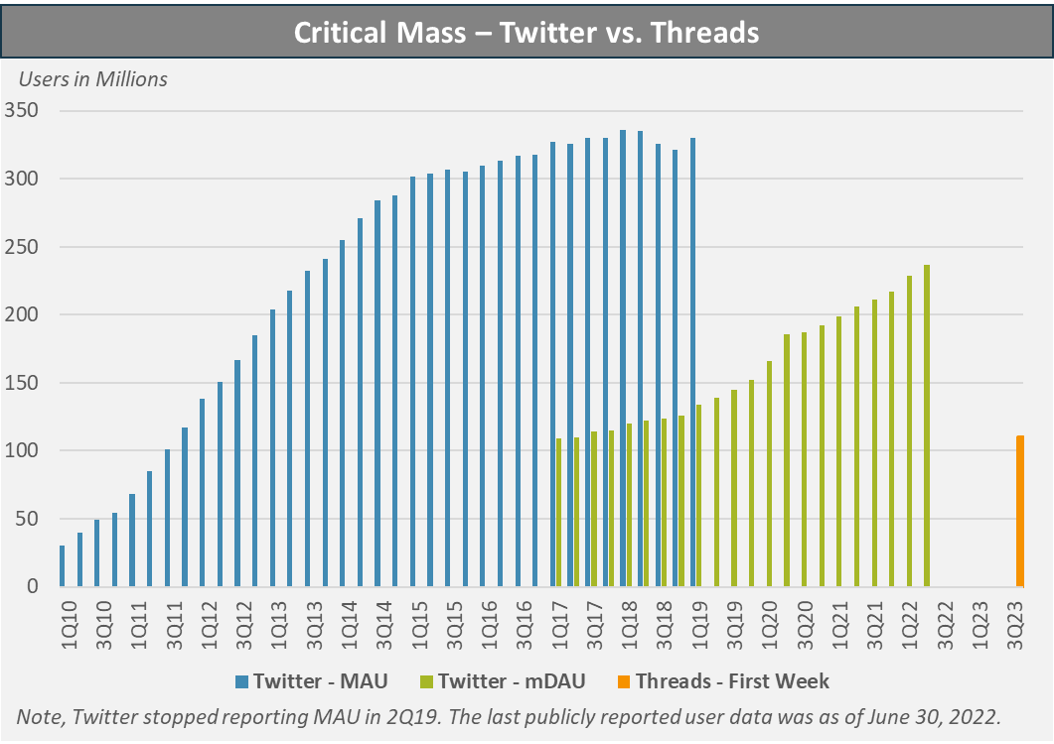

By comparison, Twitter first reached 110 million monthly active users (MAU) in 2011, five years after its founding. Twitter did not reach 110 million monetizable daily active users (mDAU), a more accurate measure of active human users, until 2017.

As of the most recent public data in 2Q22, Twitter boasted 237.8 million mDAUs. If we assume Threads’ initial users are high quality and engaged3, then the app is already approaching half the size of Twitter in a little over a week. Threads already has a critical mass of its own.

A new web of connections is rapidly forming, as users stake their claims in the greener pasture or rebuild networks from other platforms. In our corner of FinTwit, the vast majority of highly followed users are now active on Threads, motivated both by the opportunity for growth and the fear of being left behind (follow me at @lastbearstandng).

This can be self-perpetuating. The more folks worry that Threads is a Twitter killer, the more likely it is to be true. Web traffic suggests that Twitter has taken a 5% - 11% hit over the past week.

While existing Instagram users benefit greatly from their existing follower bases, completely new Threads accounts have already generated tens of thousands of followers organically. These numbers are large enough to be a valuable content distribution channel, even if Twitter remains the dominant platform.

To be clear, today Threads still falls well short of Twitter in terms of size, interface, and functionality. Threads lacks critical features such as direct messages, hashtag enabled search, and desktop accessibility (a key feature for content producers). The user interface feels more Instagrammy - a bit slow and clunky - and does not lend itself to free flowing interaction4. Perhaps the biggest challenge is in recreating the niche community that Twitter seemed particularly adept at cultivating.

There is plenty of work to do. Given the capabilities, resources, and experience of Meta, we expect new features to come in short order. Likewise, as users build their networks, we would hope that Threads will improve at serving up content in line with users’ specific interests.

However, time is of the essence. If Threads can’t keep users engaged long enough to see the buildout of these necessary features, the self-fulfilling cycle could be a doom loop of disengagement instead.

It is too soon to declare Threads a permanent success and far too soon to declare that Twitter is dying. There is plenty of precedent for co-existence of similar social networks, and it’s possible that Threads attracts a distinct user base from Twitter. Further, there are still significant switching costs for dedicated Twitter users that are unlikely to abandon their accumulated social capital and content history5. Today, the action still lives on Twitter.

Nevertheless, Threads is the only rival so far to pose a meaningful threat to Twitter’s dominance in text-based social media. When combined with the series of self-defeating decisions under Twitter’s new ownership, existential risk is at least on the table.

Meta Thoughts

Meta has proven itself highly capable of growing and defending social networks. Facebook - which turns 20 years old next year - remains the largest social network in the world, and its user base continues to grow internationally even if the site hasn’t been considered “cool” by trendsetters since 2010. Instagram meanwhile has staved off competitors by replicating the features of competitors, notably Stories in response to Snapchat and Reels in response to TikTok.

Yet rather than playing defense against a rising upstart, Threads is an offensive maneuver, striking while there is blood in the water. If successful, Meta may have just launched a valuable new long-term product that could enhance its stranglehold on the social media landscape.

Competing with a cash-strapped company swimming in $13 billion of high-cost acquisition debt, Meta enjoys $50 billion of cash flow from operations and near limitless ability to invest into a new platform.

Without pressure to monetize, Threads is likely to remain ad-free for the immediate future to maximize user experience and foster engagement and growth. And while Twitter never came close to matching the business performance of Facebook or Instagram, Meta will be far better positioned to profit from Threads when it eventually chooses to. Its vast trove of user data will allow for higher value targeted advertising, and its massive network of existing advertisers can easily be ported onto this new digital property.

Meta shareholders should be excited to see the company sticking to its core strengths6, leveraging its existing user base to create an exciting new platform that is already eating into competition.

Already one of the best performing stocks in the market this year after an awful 2022, Meta has outperformed the Nasdaq 100 by 6.9% since launching Threads.

Meta’s outperformance has been worth $51 billion in market cap - greater than Twitter’s $41 billion equity purchase price…

Now, for two quick updates on separate topics of interest.