The Ugly Duckling

FY2026 federal budget sets the stage for a small-cap turnaround.

Let me tell you about an Ugly Duckling.

This company operates in a capital intensive and dangerous business. The common shares sit behind mountain of high-cost senior capital. It’s public share price plunged 90% since its debut via SPAC merger in 2023. Its 2023 annual filing came stamped with the scarlet letter — a “going concern” warning.

The company is not clean. An investment is not “safe”. But if you can look through the risks, a compelling narrative emerges.

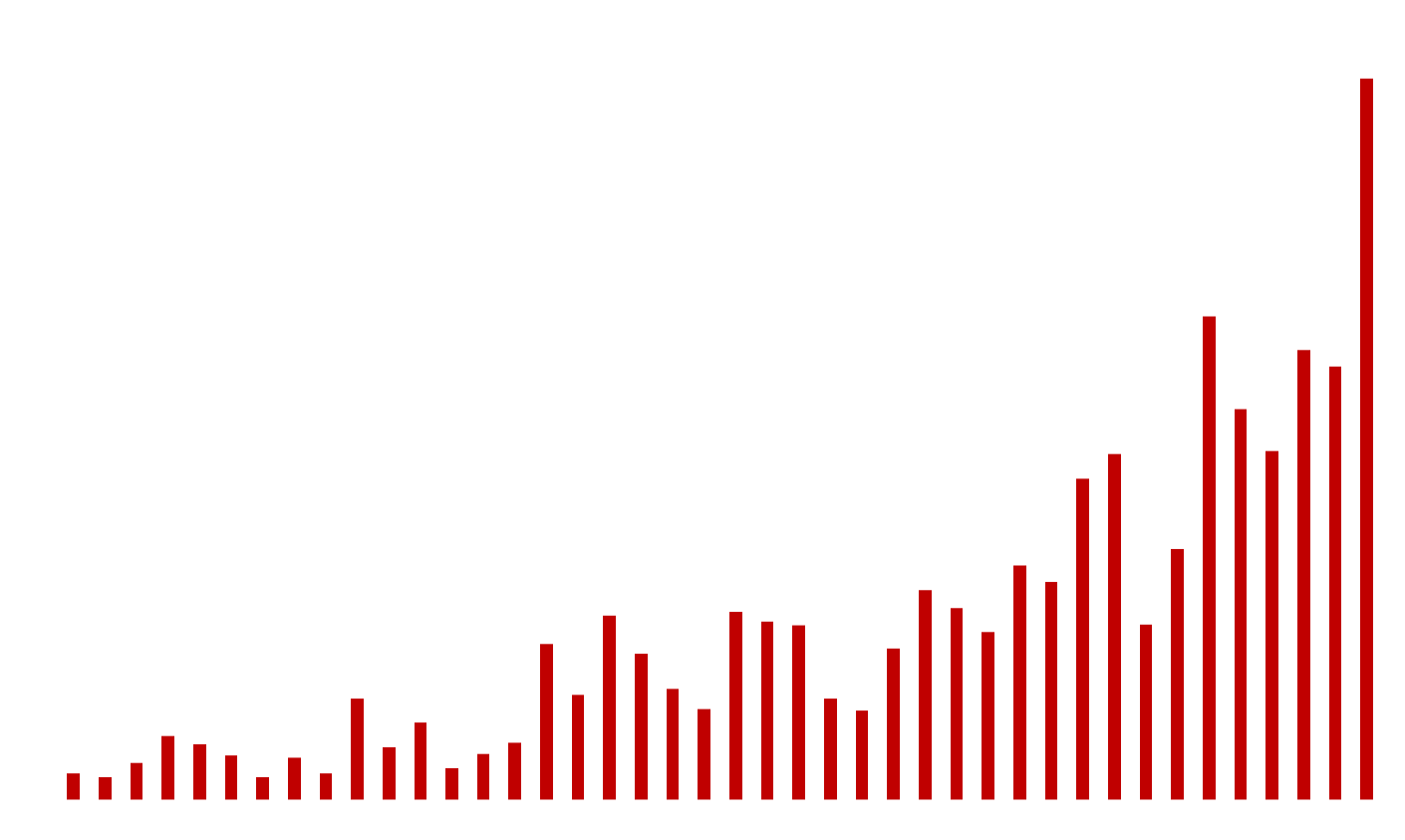

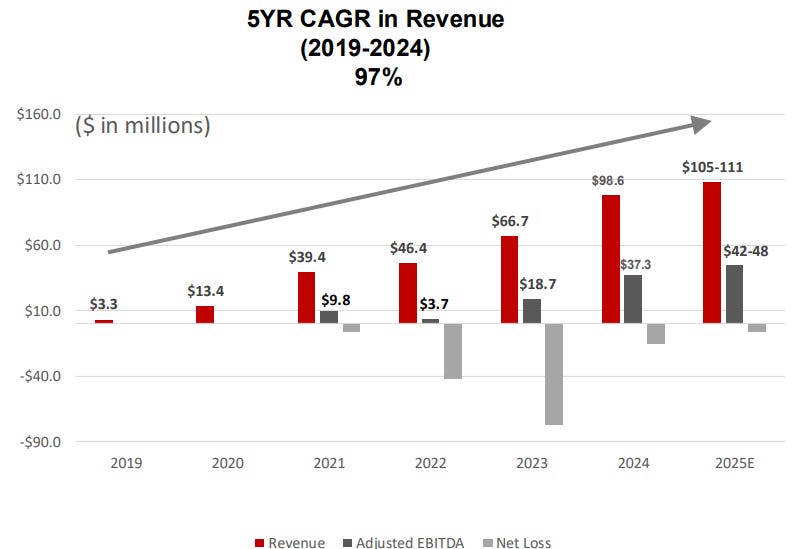

The company saves lives and property from intensifying risks. Its revenues have grown at a 97% CAGR over the past seven years, and its earnings are benefiting from operating leverage. The wave of capital investment has created rare assets that generate strong cash flow. Last year, the company flipped cash flow positive and shed its going concern precaution.

Over the past year, the company crossed a critical point of inflection, boosting hopes for its shareholders. But that future just got much brighter. New legislation, new budgets, and new executive orders all announced in the past eight weeks stand to accelerate this industry and unlock a new phase of growth.

What happens when a company teetering on the edge of bankruptcy tips in the right direction? When new legislation brings a windfall? When a capex leads to cash flow? When leverage becomes a springboard?

When the ugly duckling sheds its feathers will the flock begin to notice?

The Duck

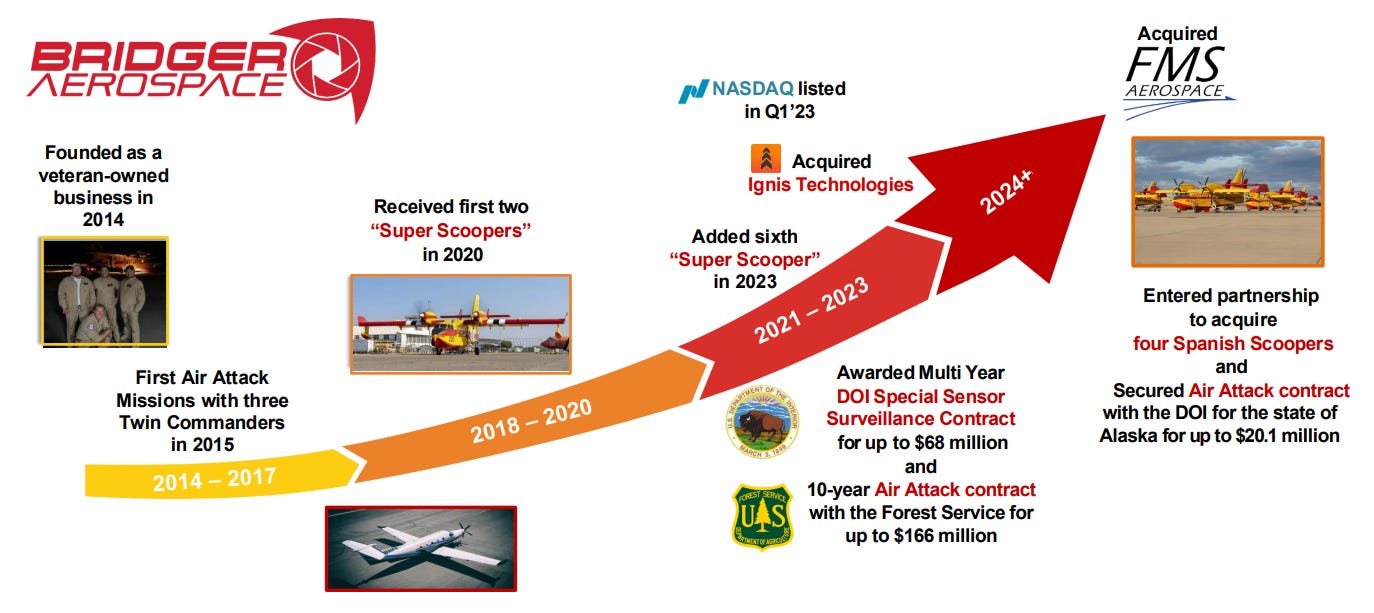

The Duck is Bridger Aerospace (BAER). Founded in 2014 by former Navy SEAL Tim Sheehy and based in Belgrade, Montana, the company operates a fleet of specialized planes used to fight wildfires. (If the name sounds familiar, its because Sheehy was elected to the US Senate in October 2024 — more on this later).

To scale from a small time operator to a serious national player, the company took growth investment from Blackstone Tactical Operations group, with funds used to expand its aerial fleet. Blackstone remains the largest equity holder through its common and preferred equity positions. In 2023, Bridger came public via a merger with SPAC Jack Creek Investment Corp, and today trades under the ticker BAER. Common equity warrants trade separately under BAERW.

Super Scoopers

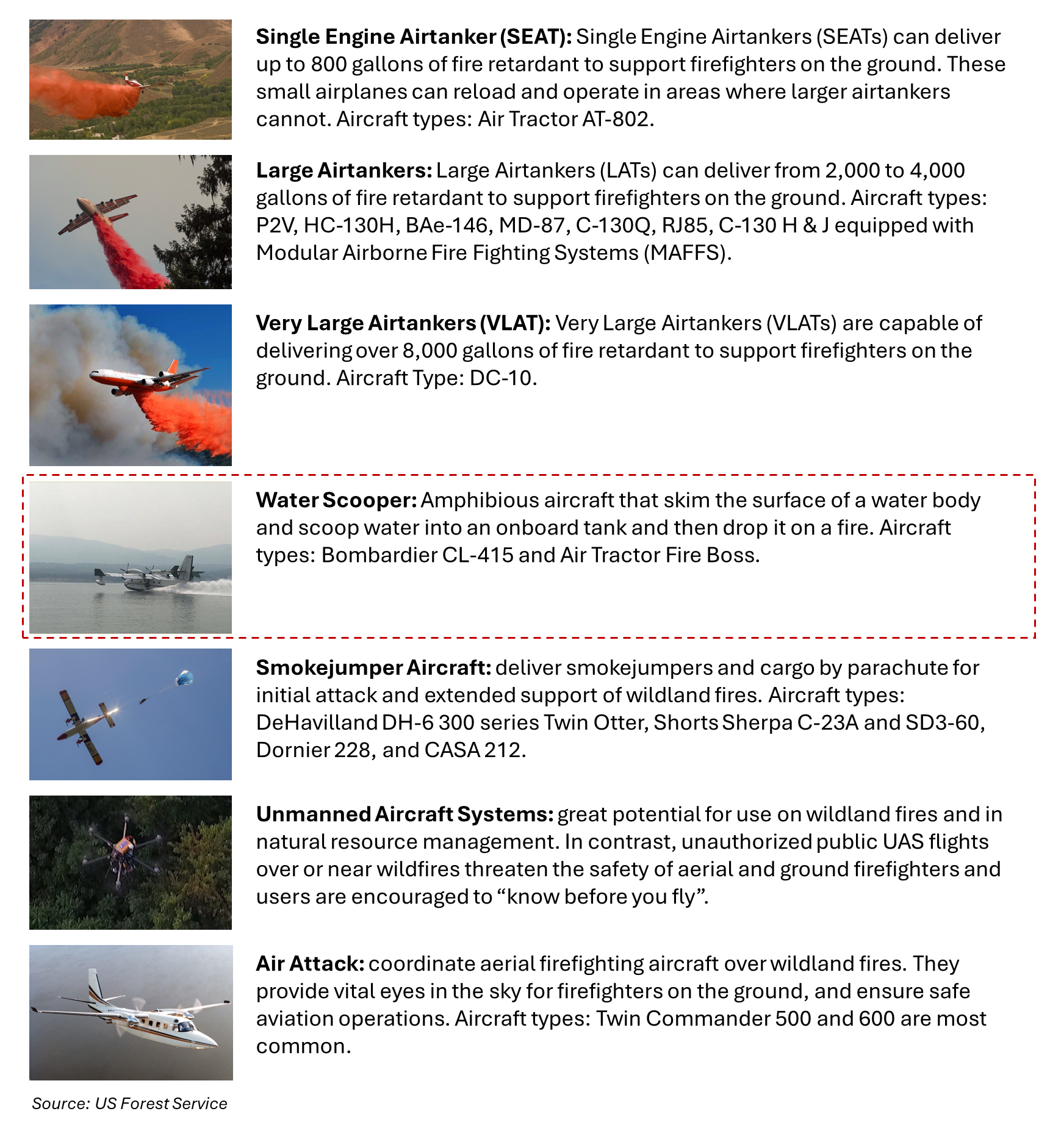

Early in its life, Bridger operated a handful of small planes for reconnaissance, surveillance, and coordination — serving as a “quarterback” for large tankers dumping water or retardant. But since 2020, Bridger has expanded its fleet to include 14 planes, including its prized assets — six “Super Scoopers”.

Super Scoopers are a unique firefighting asset. Rather than loading up water or retardant on the tarmac for a single drop, these planes can repeatedly refill their tanks by skimming the surface of a nearby bodies of water. Smaller and more maneuverable than large tankers, Scoopers can fly lower (dropping water more accurately) and refill their tanks much quicker — making them a highly effective component of the aerial firefighting arsenal.

For more on these planes, see this Business Insider rundown with Bridger.

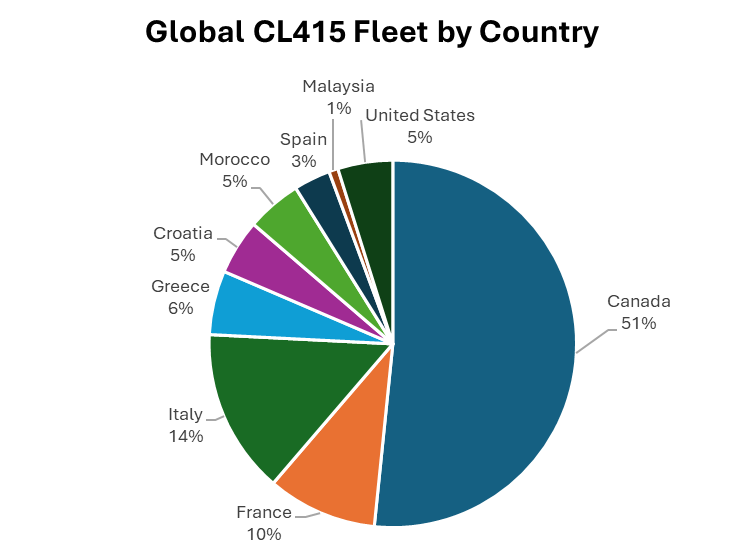

Scoopers Scoopers (CL-415s) are highly specialized, rare aircraft. These planes (and the predecessor CL-215s) were only produced by from 1993-2015 and less than 100 exist globally, almost entirely owned by governments. Bridger’s six aircraft is the largest private fleet and the only scoopers owned in the United States1.

Given the unique capabilities and rarity of the assets (especially in the US), demand for Scoopers significantly exceeds supply, with roughly a third of federal flight requests going unfulfilled.

Beyond its active US fleet, Bridger also won a bid from the Spanish government to return four older CL-215 Scoopers to service for use in Europe. Two of these aircraft should be active for the 2025 wildfire season in Europe this year, though the company has yet to reveal contracts or estimated financial uplift.

The global supply constraint, combined with growing concerns of wildfire destruction has prompted two OEMs to restart production of scoopers. First, a new CL-515 Super Scooper is under development by Canada’s De Havilland, but first deliveries are not expected until 2028 and nearly all of the order book is slated to head to Europe and Asia. Second, France’s Positive Aviation Inc is in the early stages of development of a FF72 aircraft and signed an MOU with Bridger as the exclusive North American customer, though the earliest planes aren’t expected until at least 2029. In other words, the US market will remain supply constrained for years to come.

While the Scoopers and smaller reconnaissance plane constitute the majority of Bridger’s business, the company is also developing software data platform — Ignis — and has acquired a specialty maintenance and repair organization FMS Aerospace. Given the level of bespoke work in upgrading and maintaining these specialized planes, the acquisition of FMS was a strategic play to continue to vertically integrate the operations, including installing specialized equipment (i.e. sensing technology on smaller planes) and reducing ongoing maintenance expenses. FMS also opens the door for more consistent year-round revenue and non-firefighting assignments.

Contracting & Competition

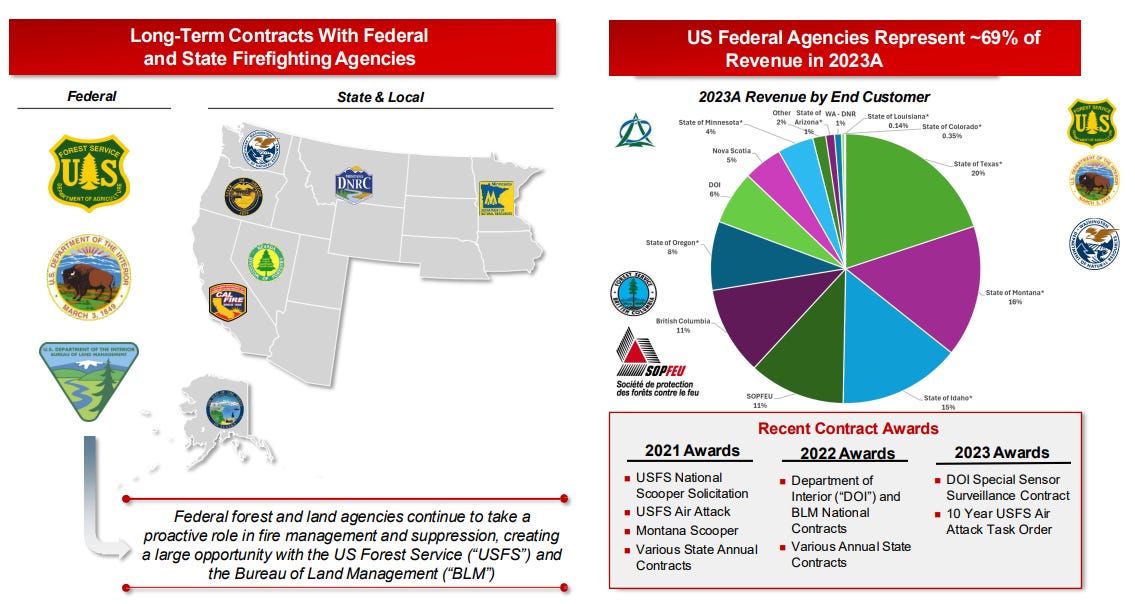

The vast majority of Bridger’s revenues are derived from government contracts, with most funding coming through a web of US federal agencies. The budget is provided through the Department of the Interior (primarily, the Bureau of Land Management) and the Department of Agriculture (the US Forest Service) which partners with state-level operations.

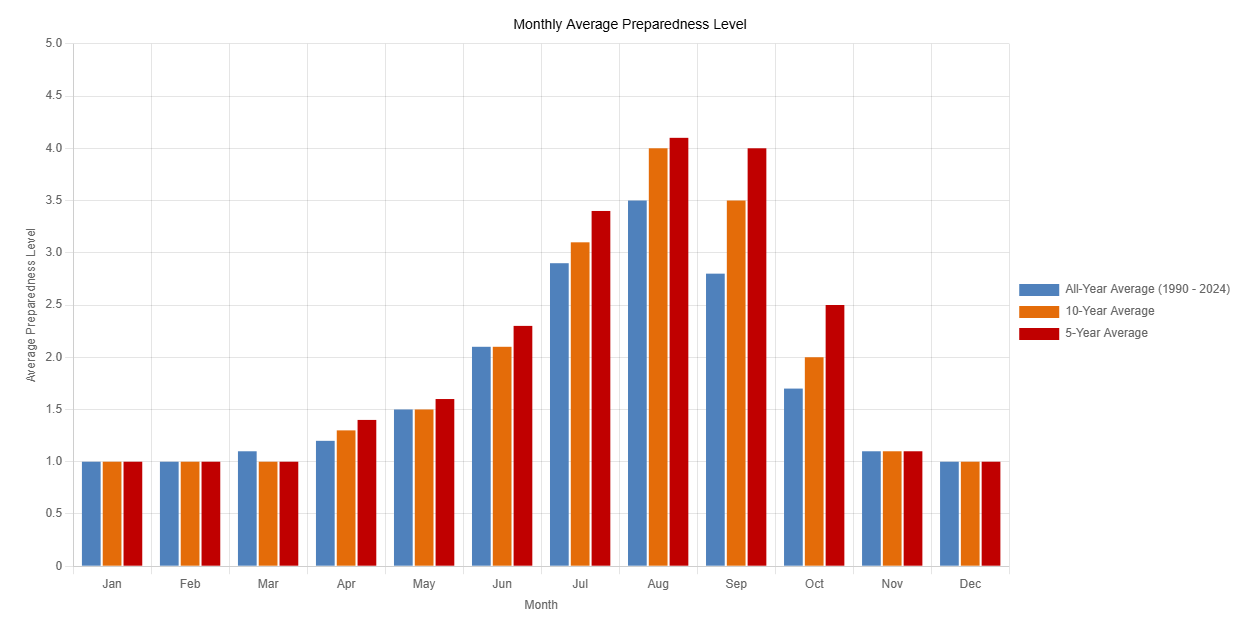

The company enters into both “Call When Needed” (on-demand) and “Exclusive Use” (dedicated) contract structures, which generate revenue for both standby and flight hours. For the peak wildfire season (July - October), most of the company’s assets are contracted by a state or federal government agency, while shoulder months see infrequent, sporadic utilization. Bridger has achieved a 100% federal contract renewal rate since its inception.

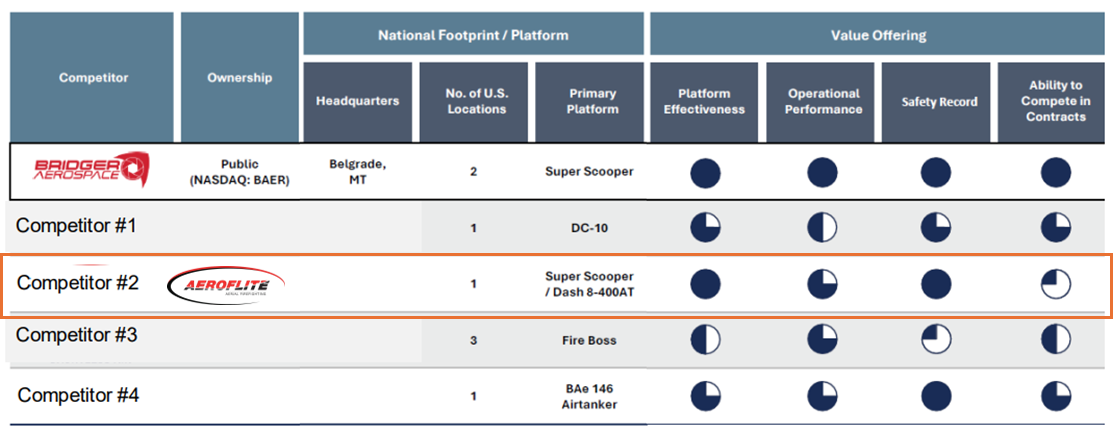

Bridger is one of several private contractors in this space. Its primary competitor is Aeroflite, the US subsidiary of Canada’s Conair, which is the largest private aerial firefighting company globally, with operations in Canada, US, Australia, and Europe. Aeroflite is also the only US-based competitor with access to Scoopers, while other companies only operate large tankers or helicopters. Even as Aero-flight competes with Bridger in the Scooper market, demand still significantly exceeds supply.

Inflection

Since 2020, Bridger has spent ~$200 million to bring the six-plane scooper fleet into operation. This wave of capex continues to burden the company’s balance sheet through its expensive senior debt and preferred equity, but the company appears to have turned.

Now online and operational, these Scoopers are highly cash-flow generative. The company has not required outside capital since the SPAC infusion, and it generated positive free cash flow and cash from operations for the first time in 2024. With strong demand for its assets, cash flow positivity, and limited capex, the company is beginning to reap a return on its years of investment.

In 2025, the company expects further growth in revenue, EBITDA and cash flow.

All of this bodes well for Bridger. But renewed federal focus on wildfire prevention is set to provide a massive new tailwind for the business.

Legislation

In the past several years, North America has experienced a series of highly destructive wildfires that have forced the attention of the public and lawmakers. In 2021, an extreme wildfire season blanketed much of the continental US in smoke. The 2023 Maui wildfires were the most deadly in a century, creating $5.5 billion in damages. Most recently, the January 2025 wildfires devastated regions of Los Angeles, with the economic toll estimated to reach $50 billion.

As peak wildfire season is extending later into the fall, and fires are more frequently impacting historically low-risk areas like the East Coast, there is a growing need for more comprehensive year-round solution.

While fingers point blame in different directions (climate change, forest management), the reality is the governments are usually reactive, not proactive, to crises. This case is no different. Recent wildfire devastation has forced an overhaul in federal wildfire fighting strategy.

The need to streamline federal contracting and prioritize aerial firefighting assets holds widespread support. A bipartisan Wildland Fire Mitigation and Management Commission, created by Biden’s Infrastructure Investment and Jobs Act (IIJA), found the need for enhanced federal contracting for aviation assets that prioritizes strategic value over cost.

“The Commission recommends that contracting process should meet operational demands, including the option of reliable longer term contracts for baseline capacity needs and every effort should be made to improve the effectiveness and efficiency of the contracting process. The consideration of longer-term contracts should include both multi-year contracts and contracts that extend for longer operational periods within the year. More generally, the type of contract used should meet the needs of a national strategy rather than allowing cost considerations and established procurement policies to override programmatic needs. Aviation operations should drive contracts and not vice versa.”

Now, concrete actions are being taken.

Federal Overhaul

On June 12, 2025, Trump’s executive order “Empowering Commonsense Wildfire Prevention and Response” fundamentally reshapes how the federal government will handle wildfire prevention.

The devastation of the January 2025 Los Angeles wildfires shocked the American people and highlighted the catastrophic consequences when State and local governments are unable to quickly respond to such disasters.

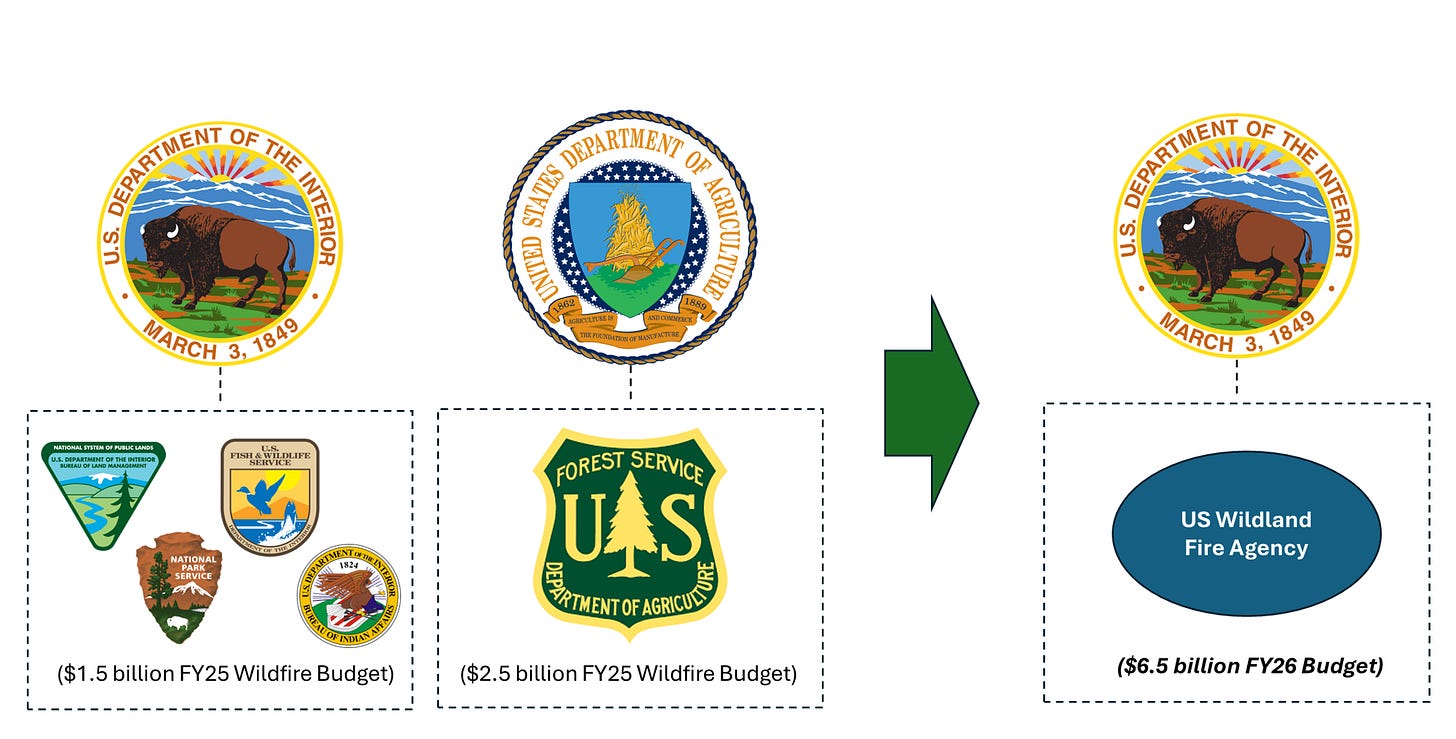

The order consolidates federal wildfire operations across departments into a single newly created entity — US Wildland Fire Service — to be housed within the Department of the Interior. (Along with this consolidation, the Executive Order also calls for the Department of Defense to auction off excess aircraft for wildfire fighting purposes.)

This new agency consolidates firefighting contracting, preparation, and operations into a single streamlined agency. Rather than a patchwork of assets and agencies, this move paves the way for a single continental dispatch model. Ideally, this should lead to more efficient asset utilization and coordination across the nation, which currently suffers from the disjointed approach.

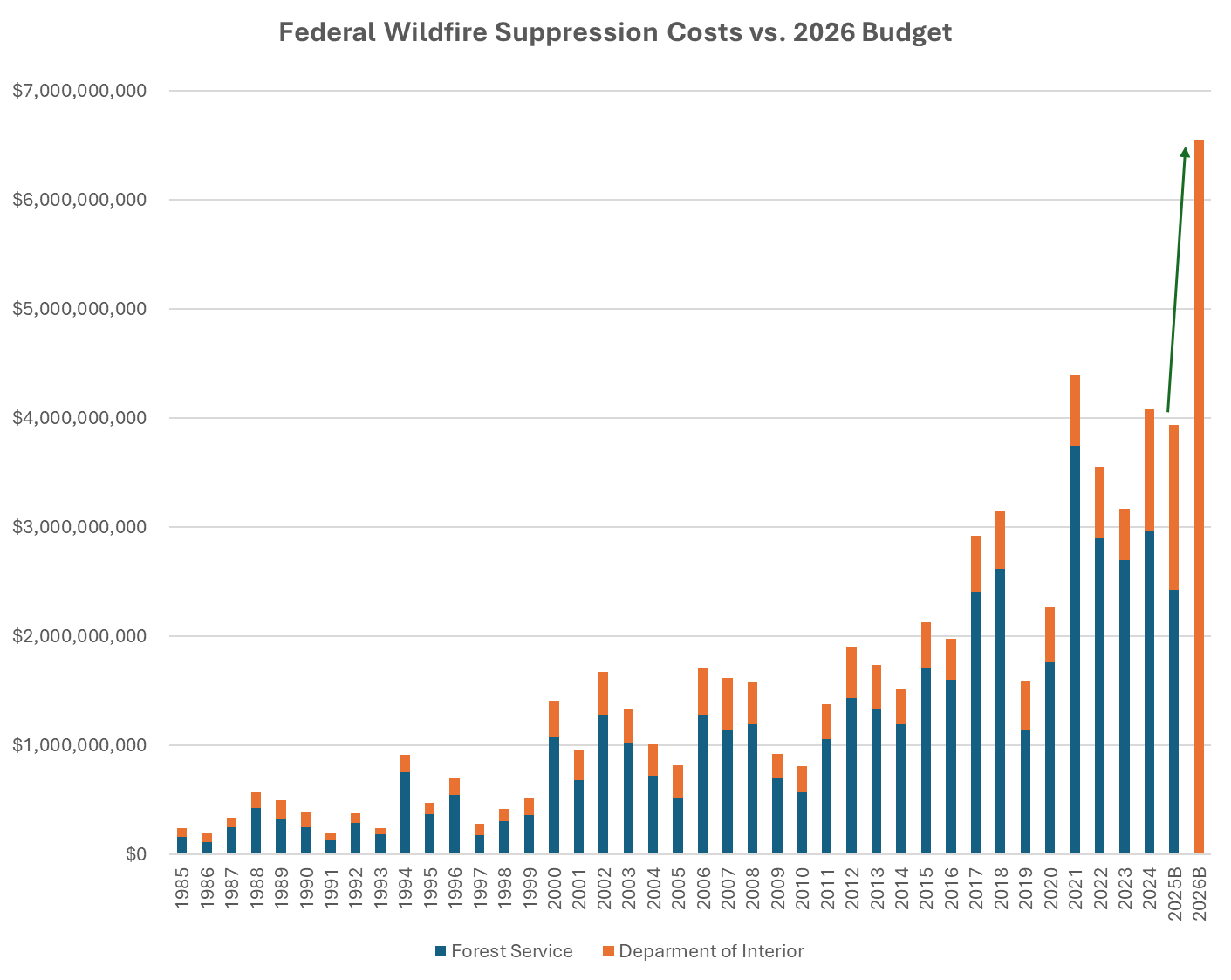

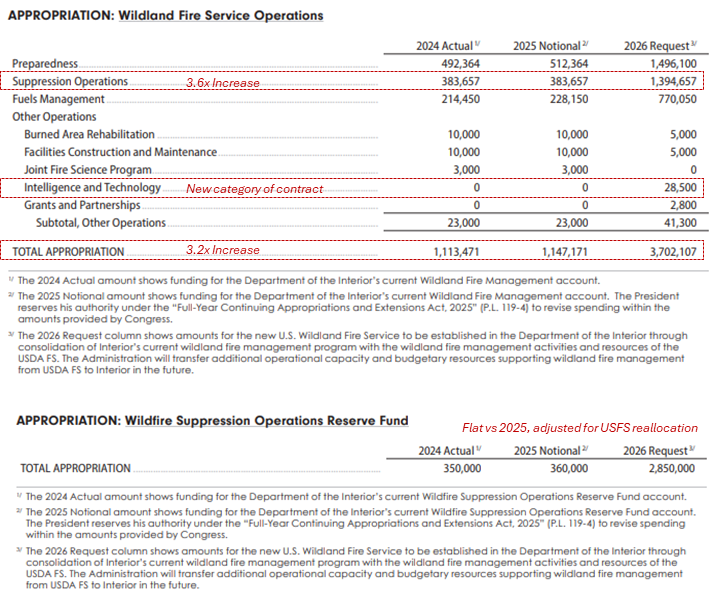

This new agency is also set to see a massive increase in budget for FY2026, which begins in October 2025. As shown below, the total federal wildfire budget is set to jump over 67% next year, from ~$4 billion across departments to $6.5 billion consolidated in a single agency.

This budget includes major increases across line-items, including a 3.6x year-over-year increase for “suppression operations” within in the DOI’s budget, and the establishment of a new intelligence and technology category.

As federal contracts account for the vast majority of Bridger’s revenue, this increase in budget appropriation is a major boon. As one of only several aerial contractors, Bridger should receive at least some part of this growing pie. A consolidated federal framework also stands to improve efficiency and performance.

Streamlined Federal Contracting: Simplifies bidding process, likely leading to fewer but larger and more comprehensive federal contracts.

Higher Utilization: A consolidated federal dispatch model should lead to higher asset utilization and flight hours, as opposed to planes being held on standby through Exclusive Use contracts to a single agency.

Longer Contracts: As recommended by the commission, a larger budget allows for extended or year-round contracts with planes pre-positioned in high risk areas outside peak season.

New Categories: New intelligence and data contract possibilities with the company’s Ignis platform and FMS.

Expanded Fleet: Potential to acquire airframes from the Department of Defense, in mandated sales per the Executive Order.

Even in an above-average fire year in 2024, Bridger still maintained excess capacity on its Scooper fleet — operating 350 flight hours vs. 450/500 hour maximum before heavy maintenance is required. Incremental flight hours and extended contract terms would be highly accretive revenue.

The company’s 2025E guidance assumes no increase in federal budget (nor revenue from the Spanish Scoopers), and with contract terms locked for the current fire season, the new budget won’t have a meaningful impact on this year’s financial performance. But the company seems positioned for contract expansion in 2026.

The Insider Angle

While there is bipartisan support for improving wildfire prevention, we should acknowledge political factors at play.

Founder and former CEO Tim Sheehy stepped down from the company in June 2024 to run for the US Senate as a Republican, ultimately defeating three-term incumbent Democrat, Jon Tester. As one of three senate seats that flipped red, Sheehy’s Montana race was critical in delivering the Senate to the Republicans. Trump both endorsed and campaigned with Sheehy.

In just his first several months Senator, Sheehy has co-sponsored at least five bills relating to federal wildfire strategy, including the Aerial Firefighting Enhancement Act of 2025, which was passed into law on June 12, 2025 (with unanimous approval in the Senate). With the new US Wildland Fire Service set to be led by Trump appointees, its likely that Sheehy has already played some role in the structure, budget and priorities of the agency, if not directly then through his relationship with the administration.

Even before the executive order was announced, Bridger’s management suggested these changes were coming in the 1Q25 earnings call, implying foreknowledge if not influence.

“The good news is there has been significant movement recently in Congress where multiple bills have been introduced in the House and the Senate to improve the efficiency and regulatory structure impacting wildfire response. Additionally, we anticipate executive actions as well as additional agency changes that will support and streamline the ability of wildland firefighters to respond quickly and directly to wildfire crises that threaten the country […] Stay tuned as this develops further."

Notably, Sheehy has moved his assets — including his sizeable Bridger equity stake — into a blind trust just one week prior to the Executive Order, perhaps in anticipation of what’s to come.

Leverage

If all of the above sounds like a good story, you might be wondering why this company trades at just $1.84 per share.

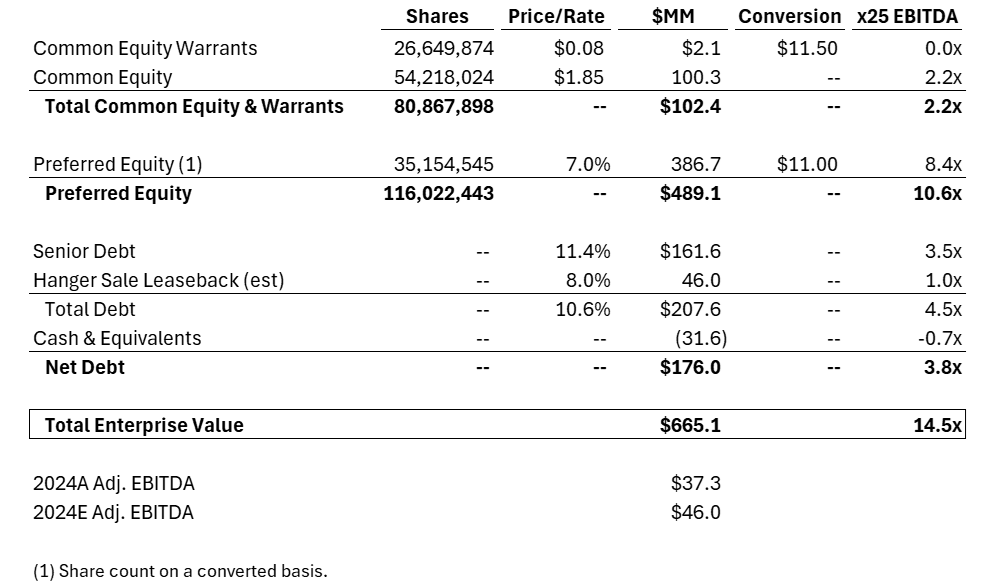

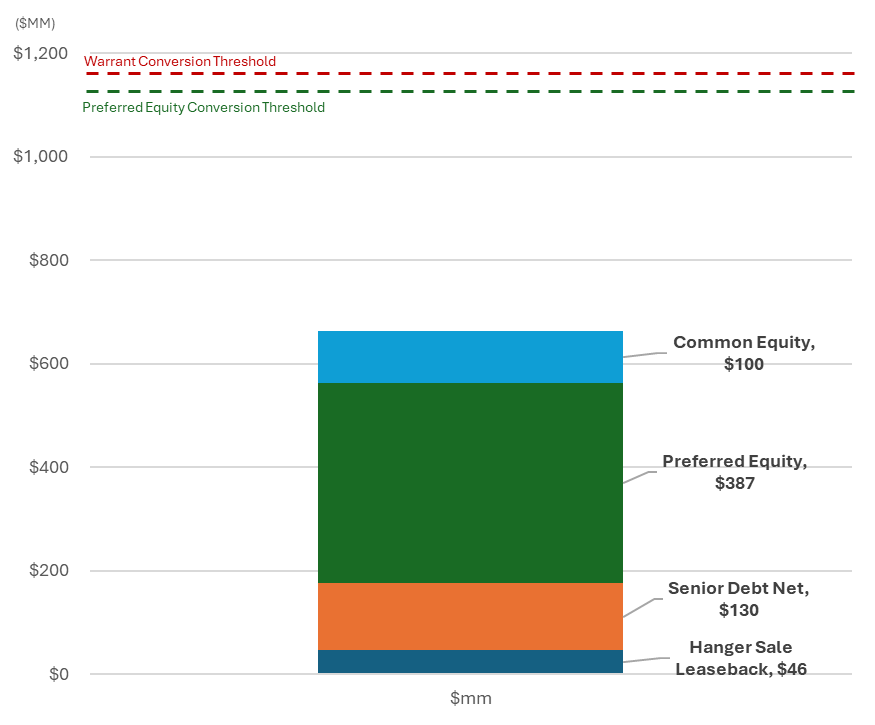

Bridger’s common equity makes up only a small fraction of its capital. With a enterprise value of $665 million today, its $100 million market capitalization is subordinated to $200 million of debt, and $387 million of preferred equity. Relative to 2025E adjusted EBITDA guidance, this implies a relatively healthy 14.5x valuation.

Bridger’s senior debt includes $160 million of 11.5% Series 2022 bonds due in September 2027, along with a recently completed $46 million sale-leaseback financing arrangement that will likely be used to pay off existing equipment loans. This high-cost financing demands over $20 million in cash interest payments annually — a cash flow burden that seriously jeopardized the company’s financial standing and forced the going concern warning in 2023.

But with net leverage now <4x, the company should be able to refinance these bonds before their maturity in 2027, perhaps saving a bit of interest expense in the process.

Meanwhile the preferred equity, owned by Blackstone, accrues at 7% annually through 2028, with the rate stepping up to 9% and then 11% before coming due in 2032. This preferred equity doesn’t eat cash flow, but its ongoing accretion takes value from the common equity at a rate of >$25 million per year. By the time of its maturity in 2032, these preferred equity shares will have a liquidation preference of $729 million — exceeding the company’s entire valuation today.

The combination of the preferred equity accrual plus other dilution from things like stock-based compensation will have a meaningful drag on the common equity valuation going forward, if the company only grows modestly.

But leverage works in both directions. Only a small increase in total valuation has an outsize impact on the common equity. And if the company sees a near-term boost in revenue, the benefit could quickly outweigh the effect of the preferred equity. With significant headroom before the preferred equity / warrants conversions are in the money, the share price can increase 6x before the dilutive effects of conversion.

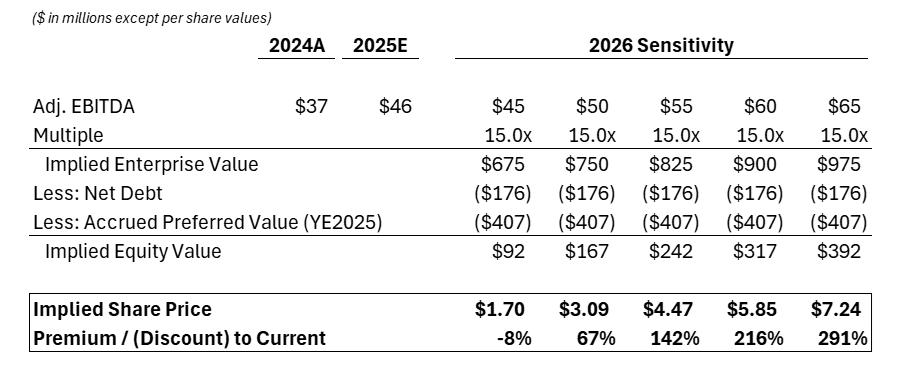

For example, every 10% increase in total valuation would increase the share price by 65% (at least in theory). Alternatively, assuming a constant 15x multiple, every $3.6 million of incremental EBITDA is good for $1.00 of share price appreciation (vs. $1.84 current price).

Near term catalysts for growth (Spanish Scoopers, increased federal budget), combined with operating leverage (through fixed costs) and capital structure leverage sets up an asymmetric risk / reward profile. It’s impossible to know the exact impact that the new budget will have on operations, but an illustrative example, below is an implied share price assuming a 15x multiple on an EBITDA range of $45 - $65 million (vs. the midpoint of 2025E guidance of $46 million).

In the worst case scenario, the common equity may go to zero. But improved performance and a rebound in sentiment could lead to quick appreciation. As the common stock traded over $4.00 as recently as January, a 2.0x return from here would constitute a more of a rebound than a breakout.

(And if the common equity already represents some sort of “option value”, its worth considering the publicly traded warrants — trading for $0.08 under the ticker BAERW — with a strike price of $11.50 and an expiry in January 2028).

Summary

I called Bridger an Ugly Duckling for a reason. The company is subject to year-to-year variability in weather and fire activity. Management has had a checkered history of underperformance vs. expectations in its limited public history, and has faced accusations of accounting deficiencies. The common equity sits behind significant senior debt and accreting preferred equity.

But I think there is an underappreciated equity story here that could play out over the next twelve months. The turnaround in cash flow in the past year has reduced existential risk and the market does not seem to be appreciating the budget and agency restructuring announcements of the past month. I expect that management will provide specific concrete color on the benefit of these changes in the 2Q25 earnings call on August 7th. Improved federal contracts serve as major catalyst leading into 2026.

With BAER shares already trading up 85% since bottoming at $1.02 in early April, it seems that some durable momentum is building for the first time in several years. In short, I believe Bridger is an interesting asymmetric market opportunity over the near term.

Conair’s US subsidiary, Aero-flite, has a fleet of 4 scoopers stationed in Washington.

I can't express how stoked I am to have a TLBS pub in my inbox every morning. Thanks!

Do you still think this is an interesting stock? Hasn't moved much since original publication