The Housing Bubble

#10: A reckoning of rising rates.

This week, we venture into new territory: the housing market.

But first, I have a favor to ask. If you are a Gmail user and any TLBS posts have been filtered into your “Promotions” folder, would you mind dragging them into your “Primary” inbox? This will help train their algorithm and ensure you see posts weekly. Many thanks!

Question: Is there a housing bubble in the United States?

Answer: Yes. But it is a rational one.

Or, more precisely… There wasn’t a housing bubble, but now there is, and it’s mostly due to rates, but it probably won’t be as bad as last time.

Let me explain…

Perfect Storm (how we got here)

Price Points (where we are now)

Perspective (where we are going)

Perfect Storm

From January 2020 to April 2022, the price of the average home in the U.S. rose by 42%.

The most common explanation for the run up in price is demographics and a shortage of supply; that Millennials entered home-buying age during a period of underinvestment in housing over the past decade. This argument is not persuasive.

Demographics, while perhaps relevant in longer term trends, are gradual forces. “Millennials” born from 1981 to 1996 cover a 15 year period - not a single graduating class that simultaneously entered the market. Further, overall population growth came to an unprecedented halt during the pandemic. Finally, while new housing construction in 2010’s lagged prior decades, we entered the decade with massive glut and vacancy from the last bubble.

In other words, we have roughly the same number of people and houses in 2018 and 2022, so what explains such a rapid appreciation in price?

The perfect storm was not one of demographics, but rather a changing set of circumstances surrounding the pandemic that supported housing prices.

Mortgage Rates: From late 2018 to late 2020, mortgage rates fell from 4.9% to 2.6%, dramatically increasing purchasing power

Work-from-Home: WFH and restricted social activity put a new premium on housing and simultaneously opened up the entire country to high earning buyers from urban centers

Down Payments: Lower spending combined with stimulus during the pandemic left prospective homebuyers flush with cash

These ingredients formed a potent brew that has driven home prices to new records. None of these factors relied on tulip mania - each were rational. But they also are not permanent.

Price Points

Let’s take a look at nominal prices1. Below are housing prices for the U.S. as well as some of the more bubbly metros of the prior cycle.

The eyeball test is ugly. While prices predictably have risen over the 35 years of the series, a clear acceleration began in 2020 and looks eerily familiar to the mid-2000’s run-up. Indeed, the 42% increase in prices from January 2020 to April 2022 outpaces the 35% peak growth over the same time period from 2003 - 2005.

The current price increase is more broad based as well. Of the 20 metro areas included in the dataset, the “slowest” growth over the pandemic has been in Chicago, which has still seen a whopping 25% increase. Comparatively, in the 2000’s, price appreciation was uneven with some metros sitting out of the gains altogether. Central cities like Denver, Dallas, Detroit and Cleveland saw less than 10% growth.

But a Big Mac also cost $0.65 in 1970 and $6.50 today. Below is the same graph, adjusted by CPI2.

Adjusting for inflation takes some of the steepness out of the curve, though the price action over the past two years still looks very familiar. Given today’s inflation is running at a much higher pace than the prior period, this adjustment helps bridge the gap between the two. In fact, in CPI-adjusted terms, the price growth since 2020 matches that of the 2000’s bubble exactly - uncanny.

Housing price gains have significantly outpaced inflation over the past two decades - with national prices increasing 70% in real terms.

Which brings us to the last piece of the puzzle - mortgage rates.

Fixed monthly payments of $1,000 would get a buyer double the mortgage in 2021 with rates below 3% than the same $1,000 could in 1990 with rates at 10%. Mortgage rates have been falling since the early 1980s.

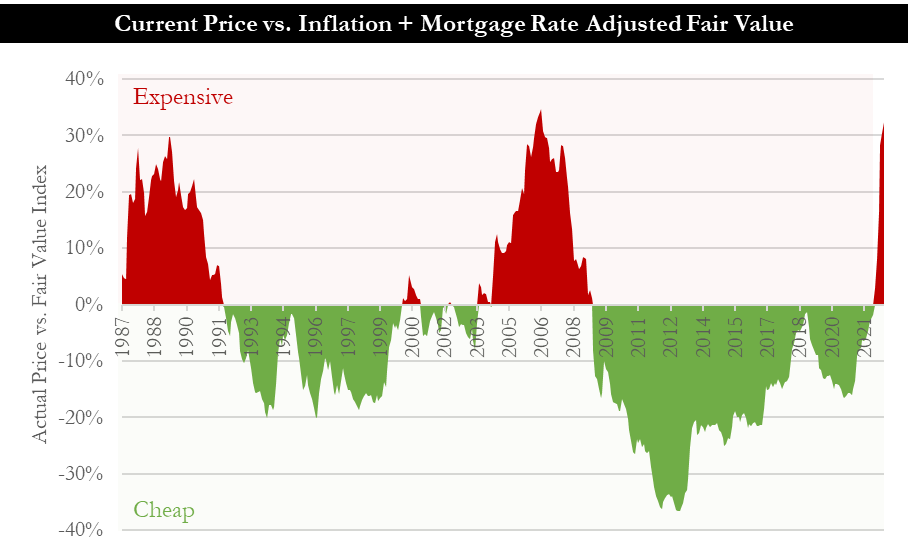

Below, I’ve adjusted for both inflation and the 30-year fixed mortgage rate (overlaid in purple in the background). Continuously declining interest rates explain all of the excess price appreciation above inflation.

With the exception of the 2000’s bubble and the deep trough following it, housing prices have largely followed the path of rates and inflation. At least, until recently…

Since the beginning of 2022, 30-year fixed rates have nearly doubled, increasing by 270 basis points, and now at the highest levels since 2008.

Six short months have reversed fourteen years of declining mortgage rates and the purchasing power they provided. The result is a neck-snapping whiplash in buying power and fair values.

The chart below shows inflation and rate adjusted fair values using 2000 as the baseline and is updated through today’s 30-year rate of 5.81%.

Despite the massive run in prices over the past two years, housing actually continued to be cheap up until the end of 2021. This stands in stark contrast with the 2000’s bubble, where housing began to look expensive as early as 2003, in the early stages of the bubble. But the rapid rise in rates from such a low starting base3 has reversed the dynamics.

At prevailing rates, housing is as overvalued as it was at the peak of the prior bubble.

So where does this leave us today?

Perspective

At the outset, I described the bubble as rational. The rapid price increases over the past two years were a continuation of the trend of the last forty years - ever lower rates and inflation lead to higher nominal housing prices. Pandemic-specific factors only added support.

But rates giveth and taketh away. Now we sit on a significantly overvalued housing market, due for a price correction so long as mortgage rates hold up at current levels.

So far, leading indicators have yet to show outright price declines, but plenty of warning signs are flashing as the reality of higher rates begins to set in. Price cuts are accelerating and inventories are growing. Homebuilder sentiment has caught-down to homebuyer sentiment and share prices reflect it. The sellers’ market is quietly beginning to swing back.

But there is good news as well.

The cardinal sin of the prior housing bubble was its adjustable rate mortgages which put homeowners on the hook for interest rate increases (as well as the teaser rate step-ups).

Today, only a tiny fraction of mortgage debt is floating, meaning existing borrowers will not see their monthly payments increase. Unless they seek to sell their house into a down market, they will simply get what they signed up for assuming they can continue to afford it. Those with buyer’s remorse may be forced to stay put longer than they wish to ride out a correction in the market, but that is preferable to default and eviction. Further, the average consumer de-levered dramatically during the pandemic meaning that many are on very strong financial footing as a starting point.

The direction of the housing market will be dictated by the direction in rates. If sticky inflation forces rates higher, there may be a dramatic reversal in price. If the Fed pivots, there could be relief.

A rational bubble, but a bubble nonetheless.

For this analysis, I’m using Case-Shiller pricing data which is high quality, has a long history, and detailed geographic breakdown. The data is through April 2022, and each monthly reading is a smoothed 3-month figure, so the data is slightly lagging.

There’s a number of different ways you could try to adjust for purchasing power and inflation to try to normalize prices. I’m not sure CPI is perfect, but it at least gets us in the right direction. Another decent alternative might be a measure of income, such as per capita wages.

With ultra-low interest rates, any move is a big one, in fact this was one my key arguments in favor of higher policy rates. A 25 bps rate hike is a totally different animal if its coming from 0.00% starting point.

Very useful balanced analysis. Makes the case that this time isn't different in either direction. As an investor who bought in Austin 2009-10, I have been selling for the past year. I hope to buy back in a few years. Much appreciated.

it would be interesting to see the average monthly payment compared to average salary over time. I would expect this ratio to converge to a fair value.