The Bear is Back!

The Last Bear Standing has been renewed for Season Two.

It’s been a year since the official launch of The Last Bear Standing. First, I must sincerely thank you all for reading. Without your engagement and support, this column would not exist1.

Season One of The Last Bear Standing is officially in the books. The inaugural year clocked in at 50 posts, 96,242 words2, 231 visuals, and 284 footnotes. We covered a range of topics from monetary policy and plumbing, to macroeconomics and inflation, to markets and volatility (and crypto, and energy, and geopolitics). Some weeks brought fiery critiques and bold predictions, while others offered pensive reflections.

While no predictions are perfect, Season One has held up well.

The most consistent and vocal prediction was that the Reverse Repo Facility would be stickier than anticipated and that Quantitative Tightening would instead drain bank liquidity. Almost a year after we made the case (and after the largest bank failure since 2008), this concern is now being widely discussed in financial media.

In August, in we argued that equities were overextended and set to fall. Over the following six weeks, the S&P 500 fell 16% and has yet to fully recover.

In November, we highlighted the fragility of FTX on the Friday before the FTT token crashed and the exchange collapsed.

In December, we wrote that the spotlight would be on the Treasury in 2023 as the debt ceiling first reduces Treasury General Account, ironically providing liquidity to the market. But a resolution of the debt ceiling would have the reverse effect as the significant new treasury issuance comes to market. Sound familiar?

I hope that you found each installment insightful, informative, and entertaining in some way.

Season One was a pilot - a time for both me (the writer) and you (the reader) to figure out what The Last Bear Standing would become. The only parameter was that it would arrive every Friday morning. And so it has.

And you have read each one. In total, the column has been viewed over half a million times by tens of thousands of unique users, generating thousands of likes and comments in the process. Beyond the numbers, the positive feedback and engagement in the comments and in private conversations demonstrate that many of you really value this column.

Put simply, the pilot was a success.

And so, I’m thrilled to announce that The Last Bear Standing has been renewed for a SECOND SEASON!

Season Two

Season Two will follow the same format. One long-form piece will arrive in your inbox every Friday at 8am Eastern Standard Time3. There will be 50 new posts, hundreds of new visuals, and many more footnotes.

The topics will fall under the wide umbrella of finance and economics - either building on existing themes or venturing into new territory like single-stock and industry analysis. Monetary policy was the leading topic of the first 50 episodes because monetary policy was the most important story of the past year. But next year will be different. We will follow the world as it comes, always looking forward.

And while the pilot was successful enough to get picked up for another run, The Last Bear Standing is still evolving and improving. With a year of practice under our belt, Season Two will be much better (as most TV shows often are).

But putting 96,242 words on the page takes time and effort. Writing words worth reading is even harder, and unfortunately the promotional budget is running dry. This means Season Two will require ticket sales for admittance.

For the upcoming year, The Last Bear Standing will need to rely on paid subscriptions.

Pricing and Paywall Policy

The subscription model will be as simple and straightforward as possible.

Full access to Season Two will cost $200 billed annually, or $20 per month, through a standard paid subscription.

(For anyone inclined to be a ground-floor mega-supporter - perhaps someone who shorted Country Garden bonds - a Founding Membership is also available.)

All subscribers, free and paid, will continue to receive every post in their inbox but many articles will now include a paywall after a preview. If you are on the fence or unable to become a paid subscriber at this time, some full articles will be available to you but substantially fewer than the past year. Unfortunately, all products of value come with some cost, and life is full of tradeoffs.

The goal is to add more benefits and access for paid subscribers over time, such as live chat forums, and I will seek feedback from subscribers on the most effective way to implement these ideas.

Back in the first post, we conditioned the success of this publication on its quality, and appointed you (the reader) the judge…

While enterprising self-publishing financial writers seem to multiply daily, I don’t see a crowded market. There is ample demand for deep, high-quality analysis and arguments. Ultimately, whether this publication becomes successful will be decided by the quality of its content – as judged by you the reader.

Now, I’m asking you to judge. I hope I have earned your business.

…

Now back to the good stuff. Season Two will technically start next Friday, but we can’t skip a week of financial content. For those upgrading to a paid subscription today, let’s talk quickly about some weird things happening the Treasury market.

T-Bills and the Debt Ceiling

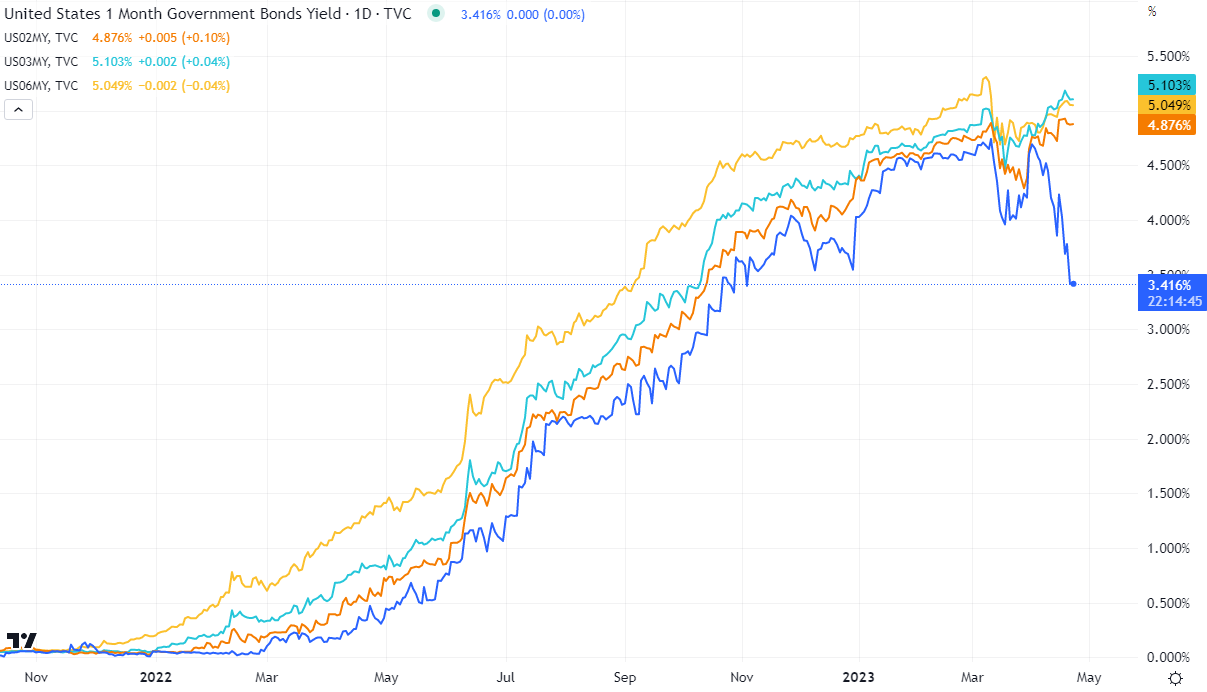

Something odd is afoot. Since early April, yields on 1-month U.S. Treasury Bills (T-Bills) have plunged.

Over the past two weeks, T-Bills maturing on May 16th have fallen from 4.75%, (in line with the Federal Funds policy rate) to 3.42% today, the lowest level dating back to November 2022 and far below comparable short-term financing rates. Meanwhile T-Bills maturing in June and beyond have risen over the same period along with the rest of the Treasury yield curve.

While there are competing theories to explain this divergence, the most obvious explanation is fear around the upcoming debt ceiling.