The Aftermath

#129: Post-Election Market Action and a Monetary Update

Election Aftermath

Early Wednesday morning, Donald Trump declared the beginning of a new “Golden Age for America” as he celebrated a decisive and sweeping victory in the U.S. Presidential election. While the President-Elect promised to simply “fix everything” the market is left to interpret his platitudes, sifting campaign promises and pragmatic realities, and preparing for four years under Trump and his new coalition.

We now have two days of data.

Markets surged on Wednesday. Most U.S. indices hit new all-time highs, with gains led by the small-cap Russell 2000 and the Nasdaq 100. Partisans will claim this as an endorsement of Trump’s economic proposals, but that certainly isn’t the whole story. As I wrote last week, pre-election jitters were manifest in the conspicuously elevated levels of implied volatility over the prior month. As political uncertainty was squashed by a swift and uncontested outcome, the result was almost surely a smothering of volatility and massive rally at the index level.

Individual stock reactions have varied. Most Trump trades have followed the script, while some bucked convention.

Perhaps the most consensus Trump picks, border security plays Geo Group Inc. (GEO) and CoreCivic (CXW), were among the biggest winners, surging over 60% since the election was called. Bitcoin notched a new all-time high over $75,000 and Coinbase (COIN) jumped 32% as crypto-backers are likely to carry influence in the new administration. Likewise, Tesla (TSLA) has gained over 17% since Tuesday given Elon Musk’s ascension to the GOP’s inner circle. Meanwhile, Trump’s personal meme-stock — Trump Media & Technology Corp (DJT) — has been dumped, disappointing speculators.

The response in other policy-sensitive industries has been mixed. Despite Trump’s promise to end foreign conflicts, U.S. Aerospace and Defense stocks are up on the week. International automakers have also held firm despite serving as a campaign punching bag.

But the reaction in energy has been split between fossil fuels and renewables in a more predictable fashion. Solar stocks were clobbered at the open on Wednesday, while the traditional energy complex has risen along with the rest of the market.

But despite the Drill Baby Drill rhetoric, the executive branch has relatively limited influence on domestic oil and gas production today, which primarily occurs on private land. Approving infrastructure and dialing back environmental regulations is likely the most effective lever for the president to pull to encourage fossil fuel development. But the LNG market is already fairly balanced, with plenty of FERC-approved projects yet to be constructed. Further, many controversial pipeline projects have already been abandoned after years of regulatory resistance.

On the other hand, new solar and wind developers, which are heavily subsidized through production tax credits (PTCs) or investment tax credits (ITCs) extended by the Inflation Reduction Act, might be more directly in the firing line.

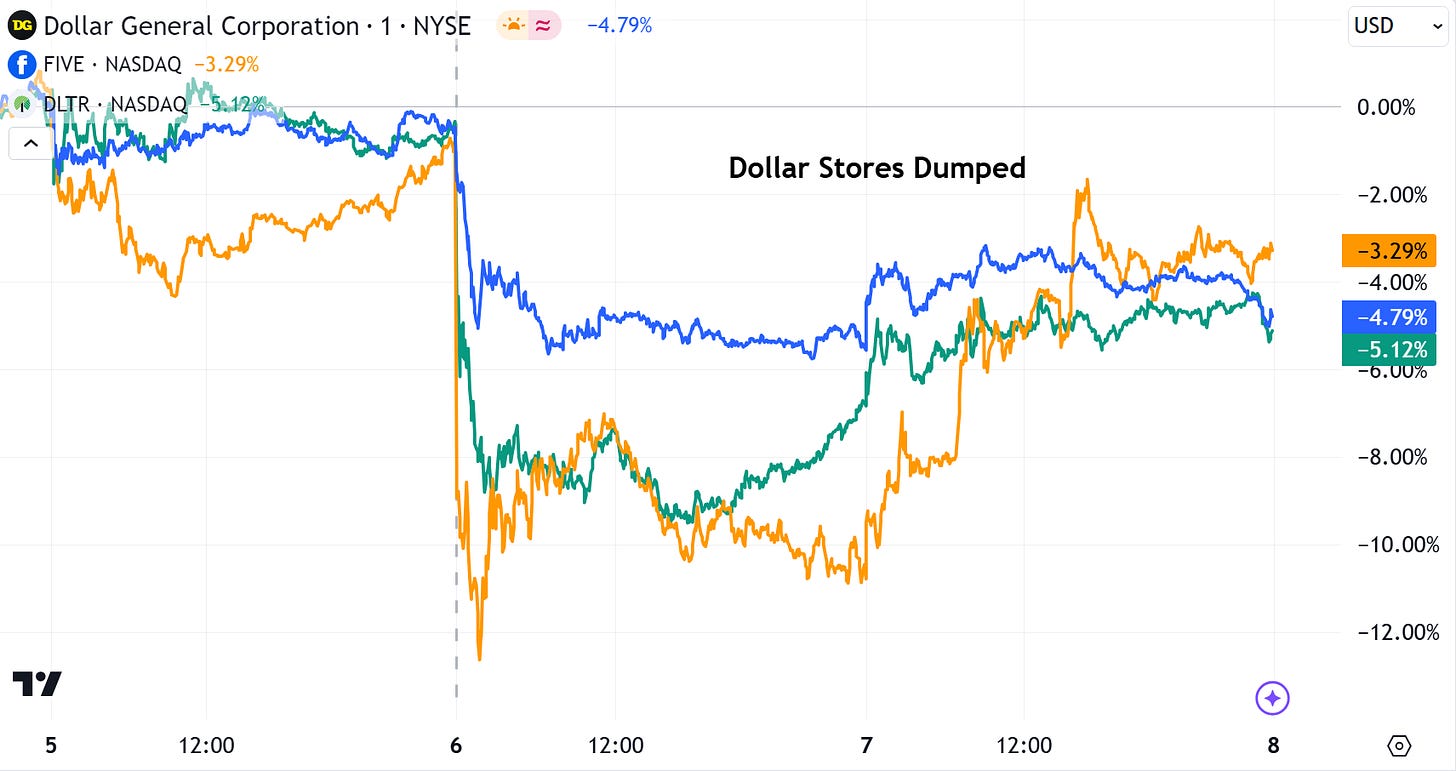

On trade policy, tariffs have become a ubiquitous concern in earnings calls this week, as analysts dig in on supply chains and executives seek to calm concerns. Import-heavy retailers have been hit as dollar stores — Dollar General (DG), Five Below (FIVE), Dollar Tree (DLTR) — slumped between 5% - 12% on Wednesday morning. Major clothing retailers have also shown some weakness (i.e. NKE, AEO, LULU, LEVI).

Several companies have already mentioned plans to shift manufacturing away from China and towards other nations or the U.S., perhaps an early vindication of the aggressive trade approach. To wit: