Riot's Gamble

#74: The miner's power play is paying, but at what cost?

In early September, Riot Platforms Inc. (NASDAQ: RIOT) was eager to report some good news. It had just made a windfall - the key pillar of its energy strategy was yielding big gains. But not everyone was so keen on the results.

“Texas paid bitcoin miner Riot $31.7 million to shut down during heat wave in August”

- CNBC, September 6, 2023

Two days later, the largest publicly traded bitcoin miner issued a follow-up press release to address “recent inquiries” on its power strategy. One can only assume that those inquiries were spurred by the flood of media headlines like the one above.

How did an energy gobbler like Riot find a welcome home in Texas, infamous for its rickety power grid? And how is it possible that Texas is now paying Riot to not use electricity?

Of course it wasn’t the first time that the miner’s electricity usage had come under scrutiny, and the company’s response flipped the argument on its head. Riot’s presence in Texas actually helps the grid, the company argued, promoting green energy and easing strain in periods of peak demand.

So, who is right?

As usual, the answer lies somewhere in the grey. Today, we explain Riot’s gamble - its power trading strategy, the implications for the company’s performance, and the true impact on the Texas grid and environment.

Background

Riot operates the single largest bitcoin mining facility in the world in Rockdale, Texas. With 700 megawatts (MW) of energy capacity, the firm provides hosting for third-party miners (~300MW) and operates its own mining equipment (~400MW). The company is also in the process of constructing a second facility in Corsicana, Texas which would more than double its own mining capacity. Miners maintain and secure the blockchain ledger and are rewarded bitcoin for their effort.

Economically, bitcoin miners sit between two volatile commodities. Miners earn the difference between the price of bitcoin and the cost of electricity required to mine it. This gross profit must also offset overhead and repay the substantial capital cost, but the root of its profitability comes from this spread. While the price of bitcoin is largely out of the control of the miner, electricity costs are influenced by firms location and power procurement strategy.

More than half of all bitcoin mining in the U.S. is hosted in Texas. Texas has some of the cheapest electricity in the country (most of the time) due in part to its renewable resource and cheap natural gas. The state is also commercially friendly, with the most deregulated power market in the country and plenty of cheap land to develop.

Riot’s Gamble

There are two basic ways a bitcoin miner can buy electricity - at the variable market spot rate, or through a fixed-price contract.

Originally inked in 2020, and expanded twice in 2022, Riot currently has a 345 MW Power Supply Agreement with TXU Energy Retail Company which runs through 20301. Under this contract, nearly half of the facility’s electricity needs are provided at a fixed price of $35 per megawatt hour (MWh).

Under normal circumstances it will use the power to run its miners and earn bitcoin. At current bitcoin prices, Riot’s miners earn approximately ~$70 in bitcoin for each megawatt hour of power used, a ~50% gross margin over its fixed $35/MWh cost.

Alternatively, if spot electricity prices are higher than what the company can earn by mining bitcoin, Riot can “re-sell” the electricity back into the market and take the spread between the market rate and its fixed cost. Under its Power Supply Agreement, these profits are not directly distributed to the company but are credited towards its future power bill - offsetting its electricity cost. To a lesser degree, the company also earns money by participating in the Electric Reliability Council of Texas’ (ERCOT) Demand Response program, which pays the company for curtailing energy usage during periods of peak demand.

The company provides a handy graph of all of these prices in its recent investor presentation. In blue is the spot electricity rate, in orange is bitcoin mining revenue, and green is the company’s fixed cost power supply.

So long as the bitcoin revenue exceeds the company’s cost of power, mining bitcoin is profitable (orange minus green). But during periods of electricity price spikes, the company can re-sell power at spot rates (blue minus green).

Through this supply agreement, Riot locks in much of its electricity costs for the remainder of the decade, while also benefiting from volatility in the Texas power market. But this strategy also comes with major tradeoffs.

First, under normal conditions, $35/MWh is fairly expensive. Most of the time, spot rates are lower (as shown above) and therefore Riot earns less profit.

Second, the company has a firm obligation to purchase 345MW of electricity around-the-clock, or $105.8 million of annual cost2 regardless of the profitability of mining.

Third, the company is also exposed to forward power prices. If the forward power curve declines, creating a negative mark-to-market on Riot’s Power Supply Agreement, the company would be forced to post cash collateral, which could amount to a substantial capital need.

Inherently, Riot’s gamble hinges on two components - that bitcoin mining rewards continue to exceed the company’s fixed electricity cost3, and that electricity price volatility persists, allowing the company to capitalize on energy re-sales. With respect to power market volatility in Texas, this is a pretty good bet.

Volatility by Design

ERCOT, the operator of the Texas power grid, often makes headlines for extreme price movements. But contrary to popular conception, this volatility is by design.

Most power markets consist of both an “energy” and “capacity” market. Energy payments compensate generators for actual electricity produced, while capacity payments reward generators for simply being available to meet peak demand. Capacity payments allow high-cost and quick-start generators, like natural gas peaking plants, to stay in business even if they only operate during brief periods of the year.

But ERCOT only has an energy market. During periods of high demand, power prices can spike 200x from a median price around ~$25/MWh to a cap of $5,000/MWh. These exorbitant prices are necessary to keep peaking plants in business, serving the purpose that capacity payments serve in other markets.

Today, zero-marginal-cost renewables in ERCOT are forcing the retirement of traditional baseload fossil-fuel generators at the same time that electricity demand in the state is rapidly growing. The logical result - which has been playing out for the last several years - is thinner reserve margins and more frequent price spikes.

Even though Riot does not produce electricity, its Power Supply Agreement effectively allows the company to earn a similar profit profile as a 345MW peaking generator through its energy re-sales. The company stands to earn major windfalls every time the grid comes under strain.

This summer, Riot’s gamble paid its first major dividend.

The Windfall

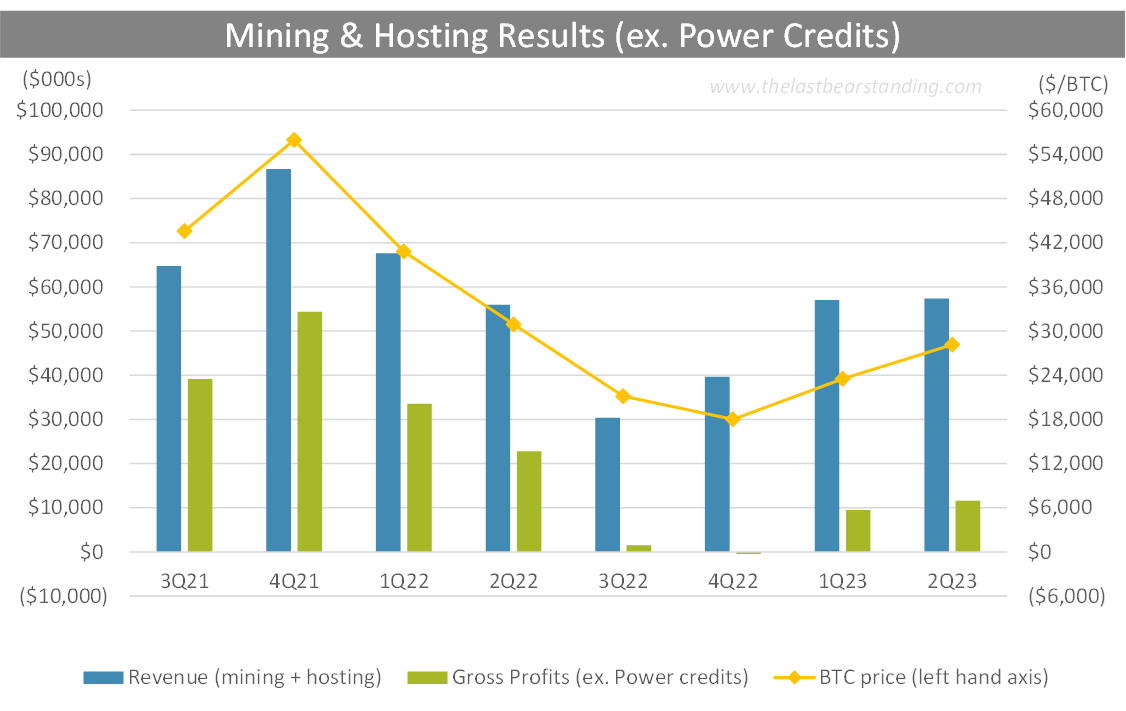

Riot’s financial performance of course is highly correlated to the price of bitcoin. The combination of falling bitcoin prices, and negative margins from its hosting business have led to significant margin pressure over the past year. Excluding energy credits, the company’s gross profits have fallen 85% from $150 million in 3Q21 - 2Q22 to just $22 million over the last reported twelve months.