Pavlov's Pivot

#11: Don't Fight the Fed (as it fights inflation).

The first rule of markets is “Don’t fight the Fed”.

The Federal Reserve spent the past decade supporting financial assets at every turn. From the 2008 Global Financial Crisis, to the 2013 Taper Tantrum, to the 2018 Pivot, to the 2020 COVID bailouts, the Fed always saved the day and prices always climbed higher. Any downside was an opportunity; bad news was good news.

Like Pavlov’s dogs who were conditioned to drool at the ring of a bell, investors have been conditioned to believe the Fed will intervene at any market downturn. This impulse has been the guiding principal of the post-financial crisis bull market - one in which the S&P 500 grew at an 18% annual rate over twelve years, compounding to a 7.2x gain from trough to peak.

It’s not some dirty secret - it is an openly discussed investment strategy amongst banks, investors and financial media. It has cute nicknames like, the Fed Put or the Powell Pivot, or for the apes, stonks go up. Goldman Sachs put it bluntly:

“Markets often have a “win-win” relationship with economic news: strong economic data signal healthy fundamentals, while weaker data encourage greater monetary policy support (or the Fed put) and indirectly lift equity markets.”

In 2022, stocks have been slammed, bonds have been bludgeoned, crypto’s been clobbered. Bad news is good news - a chunk of red meat should be on the way.

Investors are already positioning themselves for the “put” or the “pivot", buying beat up stocks and long-duration bonds. If the slump in asset prices has been driven by the Fed’s aggressive tightening, prices must soon rebound as the Fed relents. This is the playbook. If you listen closely, you can hear the salivation; slobber hanging from the jowls.

But the true pivot already happened. For the first time in decades, the central bank is more concerned with inflation than growth.

Influencing asset prices is a tool in both low-inflation and high-inflation environments but with opposite signs. When inflation is low, juicing asset prices promotes growth. When inflation is high, crushing asset prices reduces demand.

In the current high-inflation environment, falling asset prices means the Fed is doing its job. Don’t fight the Fed.

Dual Mandate

The dual mandate of the Federal Reserve is to maximize employment and ensure price stability.

Practically, this means that the Fed will encourage growth so long as inflation remains near the target of 2%. If inflation runs above its target, then the Fed must find the optimal tradeoff between employment and inflation, which means slowing or reversing economic growth to tame prices.

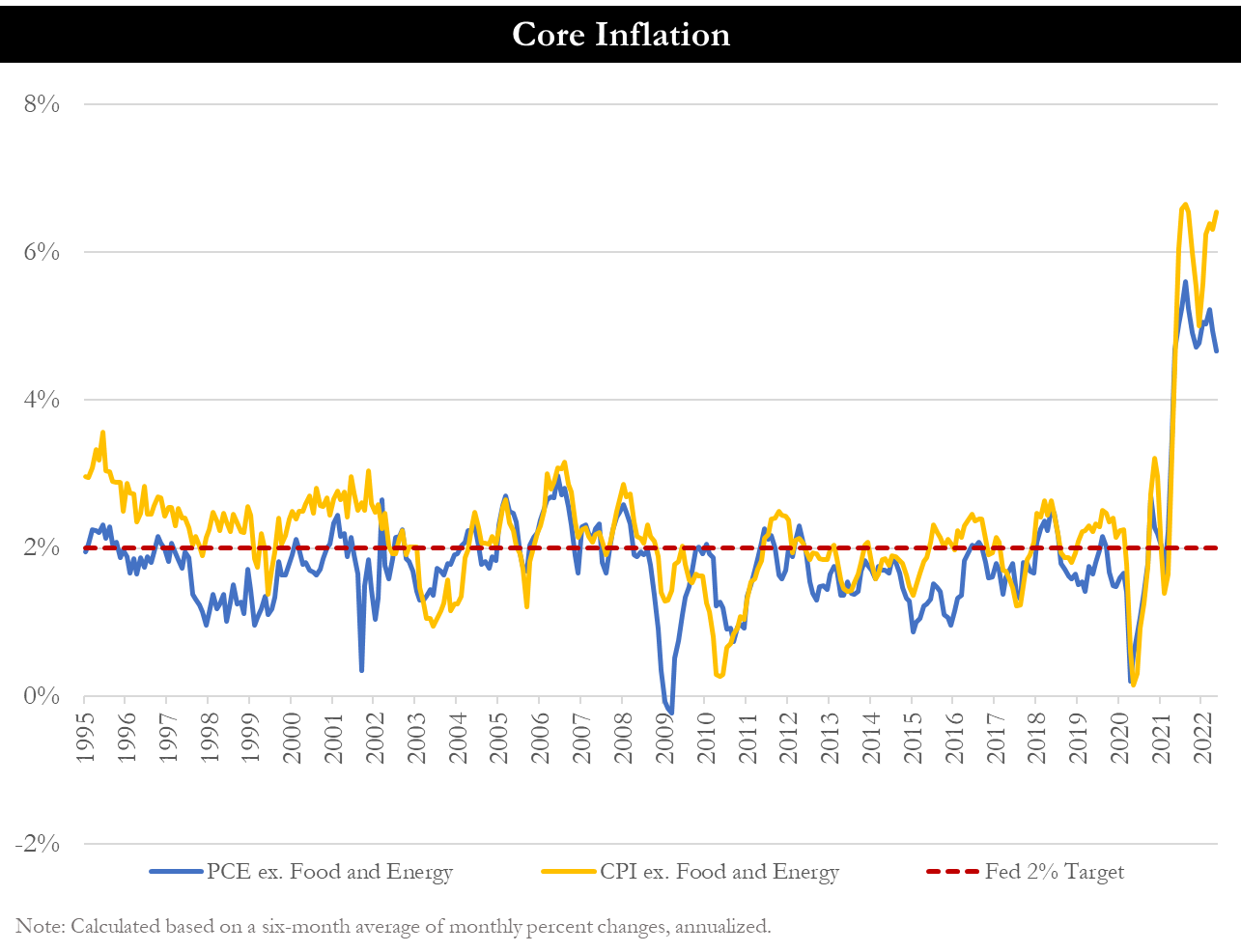

For the past several decades, the Fed has not had to choose. Inflation has remained very close to the 2% target allowing for incredibly loose monetary policy. Those days are over, at least for now.

All measures of inflation, including “core” inflation, have skyrocketed to levels last seen in the 1970s.

These core inflation measures exclude food and energy - the more volatile components further from the Fed’s control. Russia’s invasion of Ukraine may be exacerbating strains in oil and wheat markets, but it cannot explain the rising prices for everyday domestic goods and services1.

Meanwhile, the labor market is as strong as it’s been since the early 1970s2.

The circumstance today is as one-sided as it was in 2010 or 2020 when unemployment reached double digits and deflation was a bigger concern than inflation. But the signs are reversed. Inflation - by any measure - is broad based and far above target, and the labor market is the strongest of our lifetime.

The Fed does not have a choice - it must pivot from accommodative to restrictive policy until these dynamics reverse.

Financial Conditions

Asset prices (i.e. stocks, bonds, and houses) are a primary tool the Fed uses to achieve its goals3. While interest rates have always influenced asset prices, the Fed’s ability to influence asset prices was greatly enhanced by the invention of Quantitative Easing and Quantitative Tightening.

To encourage growth and employment, the Fed seeks to increase asset prices (stocks go up). To tame inflation, the Fed seeks to reduce assets prices (stocks go down).

Readers of this column are well versed in the interplay between interest rate policy, liquidity policy and asset prices, but Fed guru Zoltan Pozsar puts it succinctly:

“The ‘art’ of Quantitative Easing (QE) was forged under Bernanke’s stewardship, and the original aim of QE was to reflate in order to avoid deflation: reflating house prices, reflating stocks, and reflating the price level were the goals. Asset price growth was a target and positive wealth effects were a target too to generate growth and jobs. Looking back, QE was essentially monetary policy for the asset rich, with trickle-down benefits for the less wealthy.”

Even the Federal Reserve makes it clear that influencing asset prices is a key transmission channel of its monetary policy. Below is a diagram from article Monetary Policy: What Are Its Goals? How Does it Work?

When discussing QE specifically, the article states:

“Another key monetary policy tool deployed in response to the financial crisis was large-scale asset purchases, which […] pushed down other long-term interest rates, such as those on corporate bonds, and pushed up asset valuations, including equity prices.”

This policy has been highly rewarding for asset holders4. When the economy is strong, prices increase naturally, and when the economy tanks, the Fed forces prices higher to improve the economy! A win-win - so long as there is no inflation.

But now there is inflation. To tame it, the central bank will tighten “financial conditions”, which is a fancy way of saying it will make prices go down.

The market is down around 20% this year. This is not a cause for intervention, rather it’s a sign the Fed’s tools are working. Cries for reprieve will fall on deaf ears. Ironically, any rally in prices will only draw a harder response from the Fed until inflation has been extinguished.

A bit of long-term perspective is helpful as well.

Fool Me Once

I know many of you are screaming internally:

“But TLBS, this inflation data is backwards looking! Don’t you know that commodities are rolling over, inflation breakevens are coming down, and we are on the verge of a recession?”

Let’s take each point in turn:

Commodities: Certain raw materials - base metals in particular - have tanked in recent weeks. This will be helpful the next time I fire up my smelter. Tin tonnage price is not a component of CPI, and there is a substantial lag time between raw materials and finished goods. It’s not even clear that the peak in raw prices has shown up in consumer inflation gauges, let alone the recent declines. Could this eventually help bring down inflation? Sure, but it’s largely irrelevant today.

Inflation Breakevens / Fed Futures: Don’t confuse market noise for a rational narrative. Market-derived breakevens are simply credit spreads between regular US Treasuries and TIPS (inflation protected bonds). There is a significant volatility in the US Treasury market at the moment - yields and spreads are regularly moving 10 - 20 bps a day. Last month the narrative was untethered inflation because yields rose 50bps, this month it is recession because they have fallen 50bps. Further, if the market is pricing in rate cuts lower than the Fed’s targeted levels, it merely forces the Fed to be more extreme in order to achieve the desired financial conditions.

Recession: You may think we are on the verge of a recession (and we may be), but the Fed does not. The Fed’s communication suggests that the economy, and the labor market in particular, remain strong. It will not act proactively on the basis of a potential recession.

More importantly - even if all of these factors are true, it will not matter until reported inflation data convincingly reverts towards the 2% target for an extended period5.

The Fed relied on forward looking models and many of the same arguments listed above when it looked past the ugly inflation numbers in 2021. It proved costly in time and credibility.

Now, the Fed is deeply concerned about how broad based and entrenched inflation has become. It will not relent until the backwards looking numbers show a decisive and sustained return to target.

The Fed has been fooled once, and it won’t be fooled again (even if this time really is different).

Conclusions

Investors have enjoyed a win-win scenario for over a decade, but the paradigm has shifted. The labor market is booming while inflation broadens, reversing the Fed’s priorities of the past cycle. It is time to break the Pavlovian response - the piece of meat is not coming.

The Fed’s mandate is no longer to reverse market downturns but rather to create them. Its mission is far from accomplished - markets still remain above their pre-COVID highs, interest rates are below neutral, core inflation is above target, and rate-hikes and QT will continue.

The Fed is merely taking back what it gave freely in the first place. The deep concern on the Fed crushing the economy is unfounded so far. The economy today has not been crushed, it is merely asset prices that have given away some froth.

If anything, it’s downright progressive. Inflation is a regressive tax, and loose monetary policy benefits the rich disproportionally. Reversing each will help bridge the wealth inequality that was exacerbated by the Fed in the first place.

Until there is a convincing and sustained reversion in inflation (or perhaps a truly catastrophic market event far beyond the current downturn), asset prices are in the Fed’s crosshairs.

Remember, the first rule of markets is “Don’t fight the Fed”.

To help explain this step-change in inflation, you may find To Reap and Sow helpful.

An important dynamic with the labor market is the reduction in labor participation rate post-COVID. While for much of the past two years this was attributed to COVID concern - with the potential to revert, it seems less and less likely that this is the case. If you want a job, there has never been a better time to get one, and conversely, it is an incredibly hard market to hire people in. The drop in participation certainly helps explain the tightness in the labor market, but pinpointing one of the causes does not change the reality.

For this post we will put aside the obvious social and ethical concerns of a central bank that achieves growth through printing money to inflate asset prices. For now, let’s simply acknowledge that it is true.

And is a moral hazard inducing, wealth inequality exacerbating, inherently conflicted, and long-term unworkable economic framework.

To be specific, my guess is two to three sequential months of 0.1 - 0.2% monthly gains in core readings.

Thank you for your insights TLBS!!

Excellent commentary. It will be interesting to see if Fed really does break the pattern of the Fed Put.