One-Dollar Bond and The Platinum Coin

#37: Creative solutions to circumvent the debt ceiling.

Two weeks ago, we highlighted the impending debt ceiling showdown in Spotlight on the Treasury. Sure enough, the debt ceiling has taken center stage, roaring back into the public discourse.

The posturing has begun. The newly elected Republican majority in the House of Representatives have already promised a contentious fight that will come down to the wire.

In response, those who view the debt ceiling as a dangerous and ineffective tool have resurfaced creative ideas that might allow the Treasury to circumvent the statutory limit and continue funding deficits.

Today, let’s consider the feasibility and implications of two workaround strategies being proposed.

The One-Dollar Bond

The Platinum Coin

The One-Dollar Bond

This week, Matthew Yglesias published a creative debt ceiling workaround on his Substack, Slow Boring. The column generated a lot buzz on social media, mostly due to some notable errors in the piece, but these criticisms overshadowed a creative (if far-fetched) concept.

The idea is pretty simple.

The Treasury could issue a new unique bond with a low face value or principal ($1 in my example) but a high interest rates. The higher interest rate would compensate the investor for a smaller repayment at maturity, and if sized correctly, would allow the Treasury to raise the same amount of upfront proceeds while only increasing the outstanding Federal debt by a small amount.

I’m not sure if such a bond has ever been issued, but its theoretically possible.

First, here is the cashflow of a typical 10-year Treasury bond with a 4% coupon, issued at par.

The math is straightforward. An investor pays $100 for this bond upfront and receives $100 back at maturity. In the meantime, the investor earns $4 per year in interest payments, generating a 4% yield on their investment. Issuing this bond adds $100 to the Federal debt.

Alternatively, here is a theoretical 10-year One-Dollar bond.

The bond only repays $1 at maturity, but would generate the same 4% yield on an $100 initial investment because it pays 1,225.0% or $12.25 per year of interest1. This bond would generate the same upfront proceeds for the Treasury, but would only add $1 to the Federal debt, based on its technical $1 face value.

The Treasury could issue a One-Dollar Bond for $100 and use those proceeds to buyback outstanding standard coupon bonds, and reduce the technical tally of government debt by $99, increasing headroom under the debt ceiling. Neat!

But this theoretical exercise is highly improbable due to practical, accounting, and cash flow concerns.

Practically, it would require the creation of a totally new security structure that doesn’t conform to existing US Treasuries or the bond market generally, for the sole purpose of circumventing the powers of Congress.

Second, this instrument is only a $1 face value bond with 1225% interest in the most superficial sense. Instead, these cash flows look nearly identical to a fully amortizing loan (such as an auto-loan or mortgage) where the borrower pays both interest and principal in fixed payments through the term of the loan.

It is clear that the a large majority of the “interest” payments are actually “principal” payments in all but name, and the “face value” massively understates the true obligation of the borrower. If a private company pulled such a stunt to minimize the debt on its balance sheet, we would probably call it fraud (and it almost certainly wouldn’t pass an audit).

Finally, there is the cash flow concern. The One-Dollar Bond has three times higher annual interest payments ($12.25 vs. $4.00) in every year prior to maturity2. The Treasury’s interest burden is already set to increase dramatically based on the Fed’s rate hikes - the idea of further tripling debt service through this refinancing is… unpalatable.

The Platinum Coin

Another more popular workaround concept is the Platinum Coin - an idea that dates back to the early 1990’s that gained popularity during the debt ceiling debates of the early 2010’s3.

Every year, the U.S. Mint produces commerce coinage (pennies, nickels, dimes, quarters, half-dollars) which it sells to Federal Reserve Banks as well as precious metal bullion coins (gold, silver, palladium, platinum) which it sells to authorized purchasers and the general public.

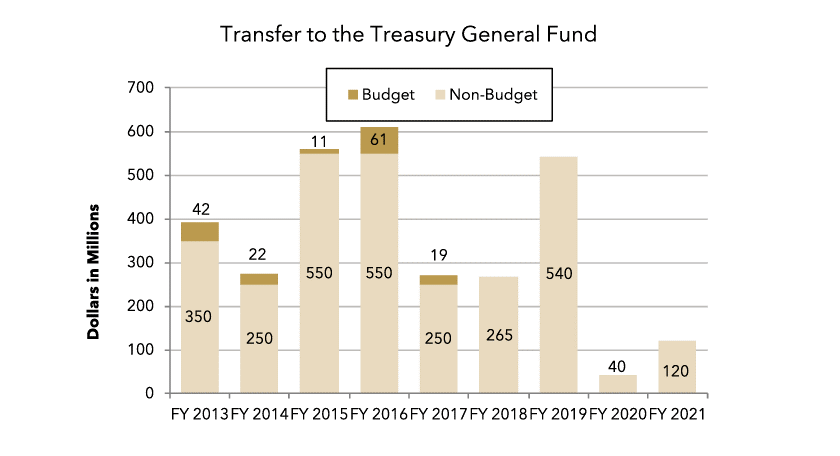

It costs less to produce coins than their face value as currency4, which results in profits for the US Mint, called seigniorage. This profit is sent along to the Treasury General Account in the same way that the Fed remits interest profits from its portfolio of securities. These seigniorage profits generate several hundred million dollars per year for the Treasury historically - an immaterial figure relative to the $5.8 trillion 2023 fiscal budget.

While all other coins and paper currency are subject to denomination limits by law, platinum coins are the one exception. While the platinum coins produced today have a $100 face value as legal tender, there is no prescribed denomination in law, and this face value can be changed at the discretion of the Secretary of the Treasury.

Therefore, the Treasury Secretary could theoretically direct the Mint to create a Trillion Dollar Platinum Coin, which it could sell to the Federal Reserve Banks or the private financial institutions5, generating nearly 100% profits in the process6. This profit would be passed onto the Treasury General Account where it would fund the government’s expenditures without the need to issue debt.

Such extraordinary use of the Mint was never envisioned when these laws were written, but many contend that a literal reading of the law would allow it. While any attempt at implementation would certainly face legal opposition, let’s ignore this concern for the purpose of argument.

The most aggressive interpretation and implementation would grant the Treasury (and by extension, the current President7) the power of large-scale base money creation - a power currently held by the Federal Reserve. In doing so, the Platinum Coin would destroy the Fed’s ability to control money supply and effectively implement monetary policy. It would allow for unlimited government spending without borrowing, funded instead by freshly printed dollars8.

Indeed, that is the entire point9. While currently marketed as a “workaround” to avoid the debt ceiling, the practical implication would be to upend the entire monetary system by giving the Treasury its own printing press. What could possibly go wrong?

The pandemic was a grand experiment in mass deficit spending funded by new base money creation (via the Fed’s quantitative easing). This experiment lead to the highest inflation in decades, and forced the Fed to aggressively raise rates and reduce money supply, tanking asset prices and individual wealth in the process. By contrast, an unchecked Treasury would more likely address inflation by sending new inflation relief checks10.

Our recent experience should take the shine off the Platinum Coin. Fortunately, the idea has never been seriously considered by policymakers and hopefully remains relegated to opinion pieces (such as this).

An Audacious Alternative

Many consider the debt ceiling an ineffective tool to control government spending and increasingly dangerous tool of political brinkmanship. I have sympathy for this position.

Holding the country’s creditworthiness as a perennial political bargaining chip does seem pretty stupid, even for politics. While I’m in favor of additional checks and balances on the powers of government, the impact of spending decisions on the Federal debt should be carefully considered when Congress approves spending, not after the fact.

But the debt ceiling is the law. Laws are enacted and repealed by the legislature. If there is sufficient support to remove the debt ceiling it should be done in ordinary course by Congress rather than circumvented by unilateral action, especially given the problems with the workarounds being proposed.

As a matter of creative finance, I appreciate the concept of the One-Dollar Bond, but consider it practically infeasible. Further, introducing questionable accounting gimmicks to the nation’s finances seems unwise.

Meanwhile, the Platinum Coin is a far more radical proposal that would grant the executive branch extraordinary new power that would upend the monetary system as we know it. If it becomes a matter of more serious debate, we should oppose it more vigorously.

But perhaps the most audacious way to avoid the debt ceiling is to balance the budget11. Today such a notion is ridiculed as foolish. Both political parties have taken turns expanding the deficit over the past twenty years through tax cuts and spending increases. The Federal Reserve has enabled Congress by funding much of those deficits since the global financial crisis.

But now the combination of rapidly increasing interest burden, massive ongoing deficits, and contracting money supply, may finally challenge the viability of our current fiscal trajectory. In the scheme of things, the debt ceiling is merely a nuisance. The best long-term solution may just be the most audacious.

If you enjoy The Last Bear Standing, please subscribe, hit “like”, and tell a friend! Let me know your thoughts in the comments - I respond to all of them.

As always, thank you for reading.

-TLBS

To help conceptualize, think about it this way. For an investor to pay the same $100 upfront for both securities, they need to receive the same total cash flow over the life of the bond (ignoring discounting for a moment). So the $99 of missing principal at maturity must get broken up into equal parts and added to the annual payments - roughly $10 per year - which when combined with the $4 coupon equals $14/year. The actual annual interest cost of $12.25 is slightly less than this shorthand calculation because the return of capital actually happens quicker. The duration of the bond is shortened as cashflows are front-loaded.

Though the One-Dollar Bond would actually result in savings over the total life of the bond. Again, this is because the cash flows are front-loaded, and so less cash is required to generate the same discounted return.

Today’s most vocal proponent of The Coin is Joe Weisenthal, who puts out great and often provocative thoughts on Twitter, Bloomberg and the Odd-Lots podcast.

The economics of the mint are actually pretty interesting, and can be found here in the Mint’s Annual Report. The margins on minting common coins is pretty good - around 40% historically! Pennies and nickels have negative margins, but dimes and quarters more than make up for it.

It is unclear how this would work in practice. Common coinage is produced and sold to Federal Reserve Banks based on orders from Fed. If this same process applied to the Platinum Coin, the Federal Reserve would first need to order some quantity of Platinum Coins to purchase from the Mint. In this scenario, the Fed would effectively maintain control of base money production and monetary policy.

Alternatively, if the Platinum Coin was sold directly to the private sector, the Treasury could circumvent the Fed entirely.

For example, the Mint could sell a coin directly to J.P. Morgan which pays the Mint with existing bank reserves (the denomination would have to be less than $1 trillion - perhaps a $1 billion coin would be more practical). JPM then deposits the coin to its local Federal Reserve Bank and is credited with new bank reserves based coin’s value as legal tender. The net result is JPM’s cash balance remains unchanged, while the Mint earns $1 billion in profit that it passes on to the Treasury. The private sector effectively launders this money printing.

The cost to produce a one-ounce platinum coin in 2021 was ~$1,200. If sold for $1 trillion the Mint would mint a tidy profit of $999,999,998,800 per coin.

Consider Trump (or whichever President you view as the most reckless) as the Chairman of the Federal Reserve.

Here, it is important to be specific about what we mean by “printed money”. You may have heard that borrowing creates money out of thin air, so how would this be any different?

It is true that new credit (including government debt) expands money supply, but it does not create base money. When the Treasury issues new debt, no actual dollars are created - the monetary base does not expand. By contrast when the Fed conducts quantitative easing, it prints new dollars - base money. The Platinum Coin would allow the Treasury to literally create new dollars as the Fed does today.

When the trillion dollar coin was first proposed by Populist Party candidate Bo Gritz in 1992, the explicit purpose was to repay the entire national debt.

Which we have already seen happen at the state level.

Or at least making a dent in it, as a start.

The "Deficit" is the penultimate of political red herrings. Calling out excess, wasteful spending for what it is would be the better solution. That's what needs to be addressed, the spending.

Indeed. Simplest way is to balance the budget. Not sure we will see it on our lifetime though.

Brilliant analysis as ever Beae.