Lessons from Failure

#108: Seven things I've learned.

Self-reflection is easy when your spaghetti sticks to the wall. Whip out the tuba and throw yourself a parade. It’s when your spaghetti isn’t so sticky that you should ask why.

There is a natural human morsel, somewhere deep down, that believes you’re batting 100% regardless of the stat sheet. Wins are a product of skill and losses are miscarriages of justice. But to win on the scoreboard, we should seek to squish this morsel as small as possible.

Making predictions in public is a great way to force this process. Across the 107 installments of The Last Bear Standing to date, there have been plenty of hits and misses. The misses are never fun, but they are in vain if simply ignored.

This week, I’d like to share some of my learnings from things I’ve gotten wrong. These are not rules — I claim no such authority — and they seek to correct my own personal biases which may not align with yours. Nevertheless, here are seven lessons I’ve learned from failure.

1. Which Dips

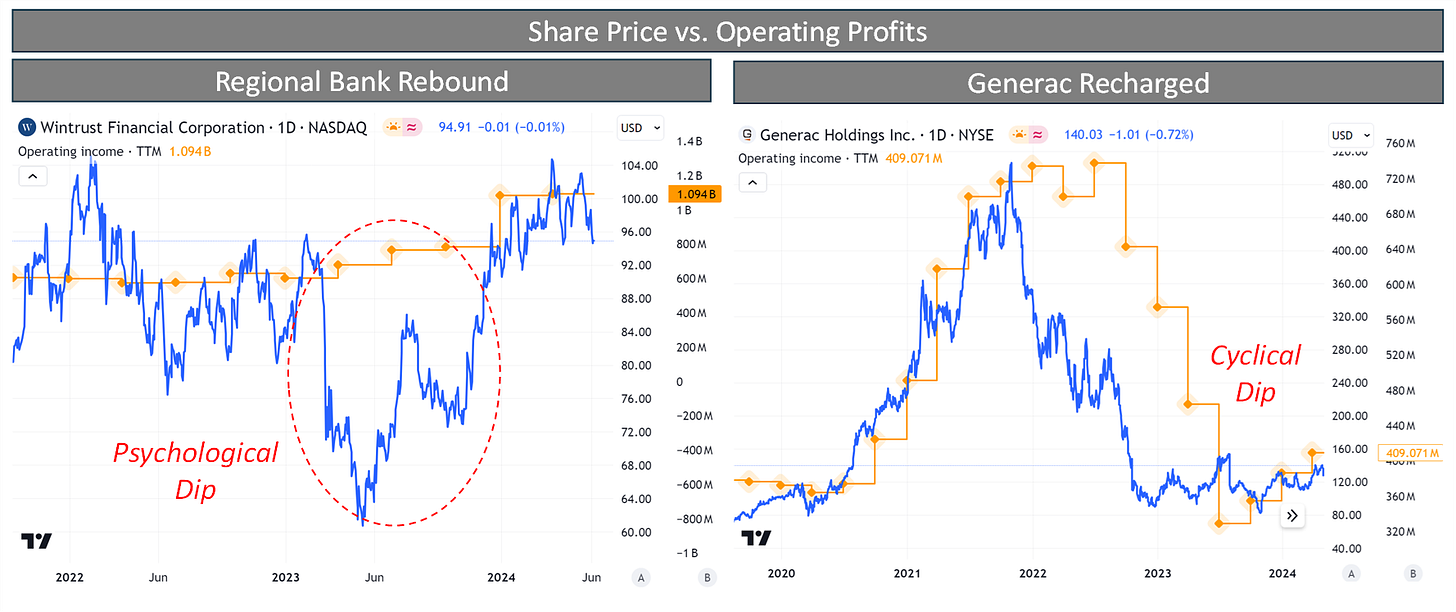

Last summer, I published two rebound ideas in quick succession — first the Regional Bank Rebound and second on the company Generac (GNRC) in Generac Recharged. The former was a fruitful, the latter a flop. But these examples represent two very different types of “dips” — psychological and cyclical.

While tightening monetary policy had created some legitimate headwinds for regional banks, the entire sector was pummeled because of the failure of Silicon Valley Bank and First Republic. The financial performance of many banks in the sector had barely moved and most banks didn’t have any serious risk of failure. A rebound across regional banks did not require any change in business performance but merely an easing of market nerves.

By contrast, Generac had been dragged down by its own financial performance. As a large durable goods manufacturer with explosive growth in the pandemic, it had massively overstocked its sales channels and was struggling with higher material costs — a cyclical dip that saw its operating profits fall by 55% from 2022 through mid 2023. While the business has a long term fundamental story that I still find appealing, the process of clearing excess inventory and improving margins in such a business is often a multi-year endeavor.

Generac’s operating profits did indeed bottom in mid-2023, but its rebound has been gradual and underwhelming to investors thus far. Compounding the problem was that Generac was not trading at “deep value” multiples. Even if its forward ~13x EBITDA and ~20x P/E seemed fair for a company with a long term 15% growth CAGR, it did not provide an adequate floor for the stock or a sufficiently attractive entry point.

As Generac’s stock fell in the following months, those multiples were slashed in half and eventually did present a good buying opportunity, but my call was too early in the cycle and too expensive to provide upside.

Takeaways:

Psychology dips provide short-term opportunities to capture dislocations between market sentiment underlying performance. Act swiftly.

Cyclical dips take longer to develop and require patience. Find companies with truly depressed multiples, and wait for a tangible inflection in underlying performance.