Caffeine in a Can

#75: Celsius vs. Monster plus Tesla's Terminator.

In early August, I posed the following napkin math, comparing two of the largest publicly traded energy drink companies, Celsius Holdings (NYSE: CELH) and Monster Beverage Corp (NASDAQ: MNST):

Celsius $CELH is trading at 10.7x sales (LQA) with a 95% YoY sales growth

Monster $MNST is trading at 8.9x sales (LQA) with just 11% YoY sales growth.

Celsius is gaining market share and is more respectable for desk jockeys. Seems like an obvious pair trade?

For growth investors, the suggestion was mundane. Celsius has long been a popular and well-performing name, found in portfolios next to hyper-scalers and tech darlings.

Meanwhile, value-minded contrarians bristled at the idea of a $13 billion single-product, over-hyped, moat-less, consumer packaged goods company that had yet to string together a full year of meaningful profits.

Since then, CELH is up 20.7% while MNST is down 12.7%. This relative performance is likely to continue.

Killing Kyle

Over the past two decades, energy drinks have grown into a massive and profitable global market.

Selling caffeine in a can is a pretty good business. Monster — the current market leader in the U.S. — has posted consistent revenue growth and ample margins for decades. In investing circles, it is well known as the best performing stock in the Nasdaq over the past 25 years with a 117,360% gain or a 30% annualized return.

But despite the widespread consumption of caffeine across all demographics, energy drinks are typically associated with a certain type of consumer. The Nutrition Journal puts it scientifically:

Higher energy drink prevalence was associated with male gender, younger age, less formal education, white race/ethnicity, higher BMI, more resistance training, current or former tobacco use, higher alcohol consumption

The internet just calls him “Kyle” — a pejorative meme of a lower-class white male.

Perhaps because of their success within this demographic, energy drink companies have marketed to Kyle almost exclusively, alienating others in the process.

Celsius markets to everyone else. Instead of aggressive names and logos, it positions its beverage as a wellness product, with light coloring, yoga poses, and fruit flavors — despite containing the same active ingredients as its incumbent peers.

This branding has proven incredibly successful, opening up a previously untapped market which the company now stands to dominate. Celsius estimates that 44% of its customers are new to the energy drink category entirely. The company strongly outperforms among women, older demographics and the higher educated, as well as college students and image-minded young people.

Indeed, numerous articles from college newspapers describe the surging popularity of the drink on campuses over the past several years. From HerCampus:

Celsius Fitness Drinks have become very popular among college students and have seemingly replaced drinks like Monster Energy and Red Bull.

‘I think Celsius is for people who don’t want to think they’re drinking an energy drink. It is more socially acceptable to drink a Celsius than a Red Bull’.

My first taste of Celsius came from the fridge of a tech founder, and I increasingly see the white cans in the hands of folks who would never deign to drink Monster. Plenty of people will happily consume a highly-caffeinated, zero-calorie beverage, so long as you don’t call it an energy drink.

As a result, Celsius has become one of the fastest growing consumer products on the market.

Growth

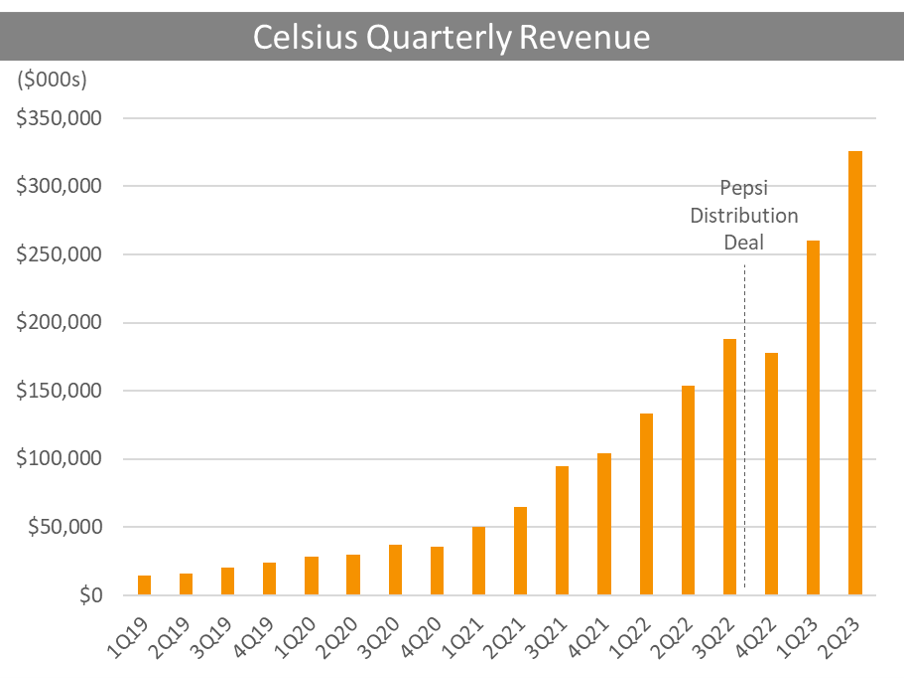

Since 2019, Celsius has achieved a 110% revenue CAGR, increasing sales 13.5x from just $24 million in 4Q 2019 to $325 million in 2Q 2023. Its expansion has not slowed even as its revenue base has grown, with the company posting 112% YoY sales growth in the most recent quarter.

While Celsius does not provide forward guidance, it has given winks and nods that 3Q 2023 results will not disappoint. Real-time tracking data suggest triple-digit revenue growth that has accelerated throughout the quarter. As of mid-September, IRI data showed 144% year-over-year growth1. Meanwhile Nielsen data from the end of September reportedly shows 127% volume growth and 18% price growth for 165% YoY revenue growth (Monster volumes were down in this flash).

In the past year, the company’s U.S. market share has doubled from 4.3% to 8.6%, trailing only Monster and Redbull2. On Amazon, Celsius is second in market share at 18%, trailing Monster by only a thin margin. And to date, Celsius has almost no international presence, leaving a massive growth opportunity in the years ahead.

Volume growth has also been aided by a new distribution agreement with Pepsi which began on October 1st, 2022 and dramatically expanded the company’s reach (Pepsi also took a 8.5% stake in Celsius as a part of the deal).

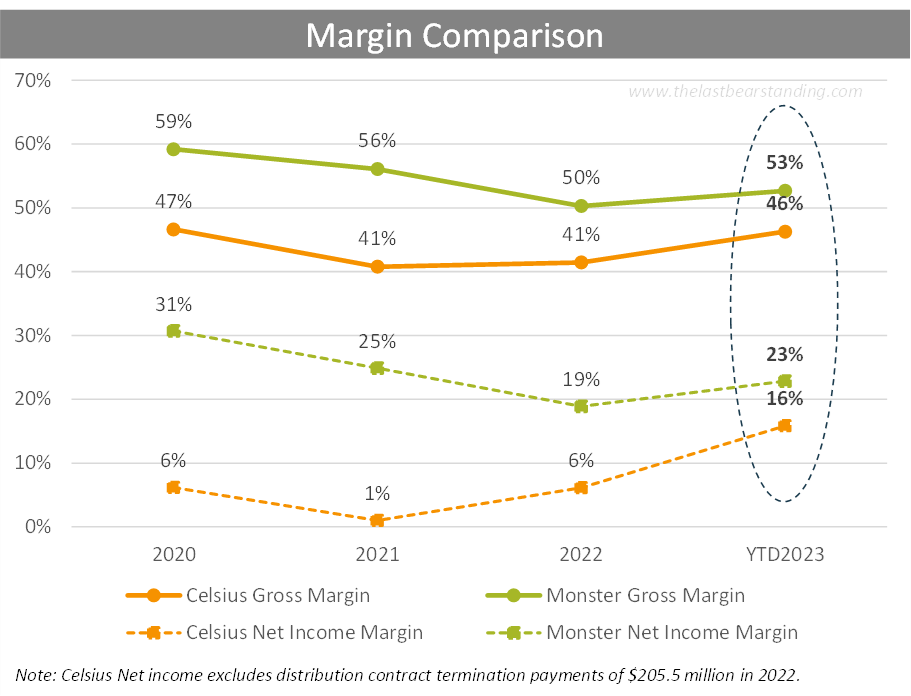

Topline growth has led to expanding profit margins, which are beginning to approach Monster’s leading standard. Further economies of scale should help Celsius as it attempts to close the remaining profitability gap.

Would You Rather?

Of course Celsius’ growth is no secret, and the company’s valuation implies as much. This is where the value hounds howl. But the question is one of relative value, a game of “would you rather?”