The New Space Age

#125: A deep dive on the modern space renaissance.

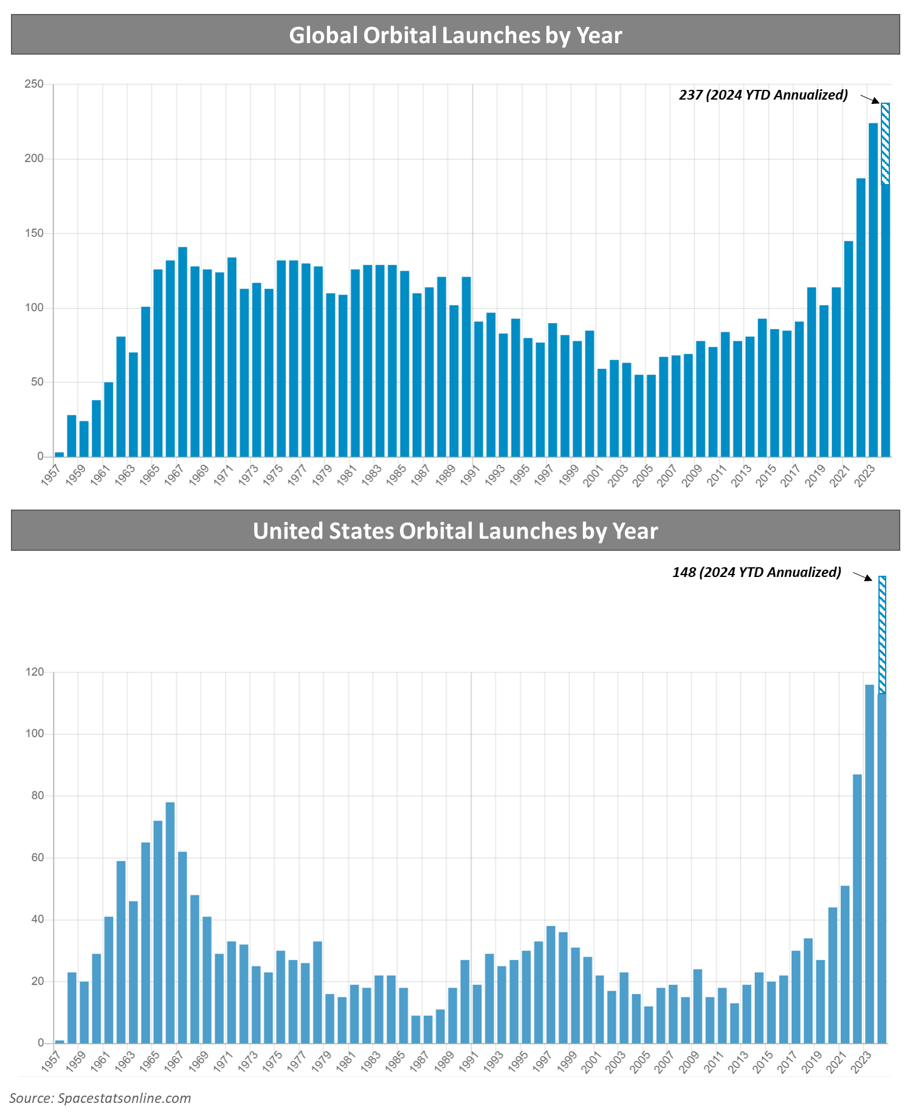

In 1957, Sputnik launched the first space race—a Cold War display of technological achievement and military capability, bankrolled by the two global superpowers. After the many accomplishments of the 1960s, however, shifting priorities and reduced budgets led to a multi-decade decline in orbital missions.

Now, sixty years later, a new space race has begun. Unlike the first, this space renaissance is driven by advances in the private sector—most notably by SpaceX—which have dramatically reduced the cost of orbital launches and opened a new world of commercial and technical possibilities.

In 2021, global orbital launches surpassed the previous high watermark set in 1967. This year, the world is on pace for 237 orbital missions, averaging a new launch every 1.5 days. Today’s activity is dominated by the U.S. (113 launches) and China (45), which together account for 86% of the missions to date in 2024, while Russian activity continues to decline.

Focusing on the U.S. alone, the increase in launches is even more dramatic, with a five-fold increase in just the past six years.

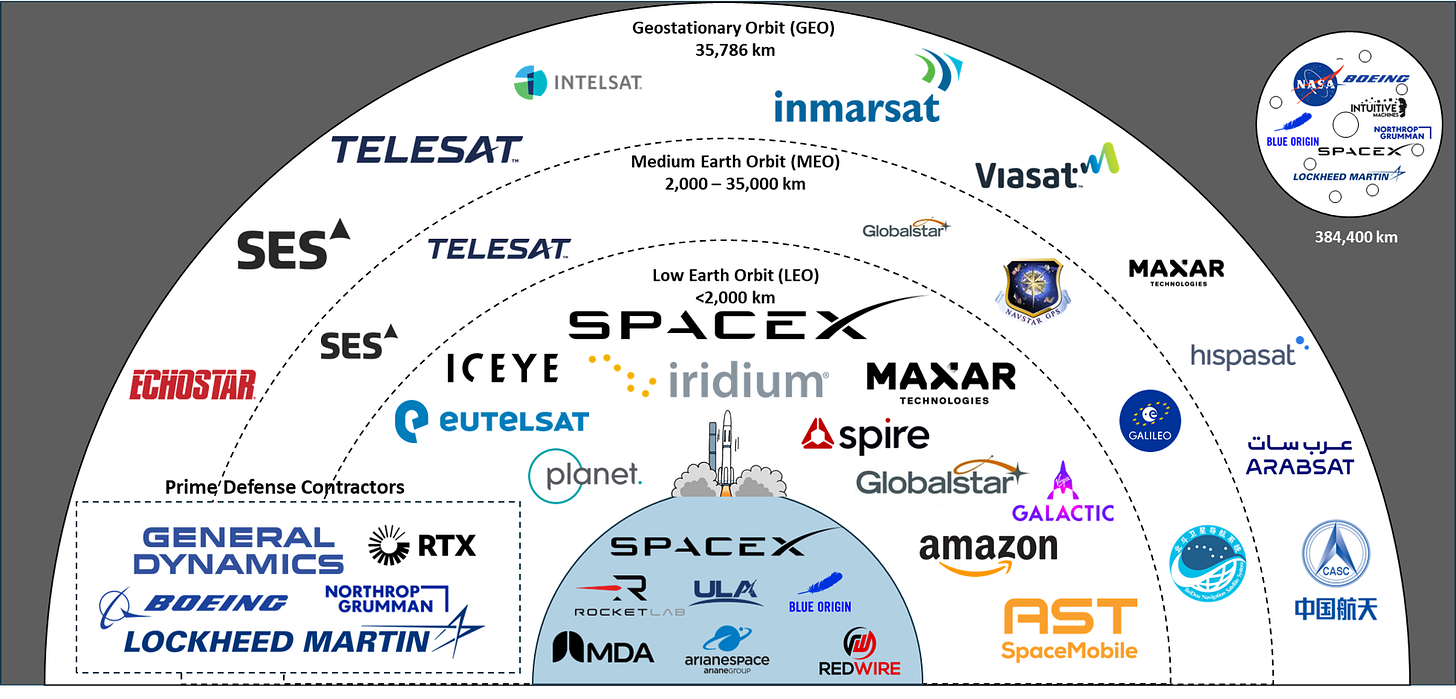

The creation of the U.S. Space Force in 2019 and the involvement of major defense contractors underscore the military and defense implications of orbital technologies, and there has also been a resurgence in government-funded lunar missions and deep-space aspirations. But most activity is happening much closer to home.

A majority of spaceflight is driven by commercial applications. In particular, the shift toward Low Earth Orbit (LEO) satellite constellations is enabling major advances in data and communication technology—imaging, data collection, and internet or mobile connectivity. These developments are upending the existing satellite industry and are increasingly impacting terrestrial networks. For certain industries, the implications of high-bandwidth, low-latency satellite connectivity are immense, and it’s still very early days.

This article explores the critical developments in launch services, satellite deployment, and connectivity, highlighting the key players and transformative technologies reshaping the space industry.

The Space Economy

Launch Services: A critical enabler of the second space age has been advancements in rocket technology, including the development of partially reusable rockets that have dramatically reduced launch costs. Traditional players with government and defense ties have rapidly lost market share to more innovative companies like SpaceX—and, to a lesser extent, Rocket Lab, Blue Origin, and Relativity Space. These lower launch costs have opened the door for a much broader range of satellite providers to place technology into orbit.

The trend of reducing costs and turnaround times, alongside the development of a wider range of purpose-driven rockets, will continue to define the rapidly evolving launch service landscape. Over time, the desire for diversification beyond SpaceX may also prove beneficial for smaller companies.

Satellites and Communications: Satellite technologies can be divided into three categories based on their orbits around Earth.

Low Earth Orbit (LEO): LEO satellites are positioned closest to Earth, allowing low-latency, high-speed data, which is ideal for broadband internet and Earth observation. A majority of current deployments and technological advancements are focused on LEO.

Medium Earth Orbit (MEO): MEO satellites occupy a middle-ground orbit, offering broader coverage than LEO satellites but at a higher latency. This segment is dominated by positioning systems such as the GPS, Russia’s GLONASS, the European Union’s Galileo, and China’s BeiDou.

Geostationary Orbit (GEO): GEO satellites are positioned much farther from Earth, where they match Earth's rotational speed, allowing them to "hover" over a specific point on the equator. This enables continuous connection to a specific region, beneficial for consistent, wide-area coverage, especially in communications and weather observation. However, GEO satellites have higher latency due to their distance from Earth and require more intensive hardware.

Traditional satellite communications have typically relied on GEO orbits, but there has been a rapid shift toward LEO clusters. LEO enables low-latency, high-speed internet connections (e.g., Starlink) and even direct communication with mobile cellular networks, eliminating the need for receivers, dishes, or antennae. In other words, LEO satellites are transforming global connectivity, enabling the “Internet of Things” and integrating with terrestrial networks. On the flip side, incumbent GEO satellite networks are struggling to compete.

The increasing deployment of satellites also benefits manufacturers of satellite components, who serve customers across the orbital spectrum.

Research and Defense: Sponsored largely by government agencies like NASA and the Department of Defense, research spending has intensified with deep-space probes, lunar missions, and projects involving the International Space Station (ISS). However, today we will focus on commercial endeavors.

Let’s dig in…