Reading the Tea Leaves

#137: The Sentiment Cycle and Late Stage Dynamics

Right now the earth is hurtling through the vast expanse of space and time, traveling mind-numbing distances at incomprehensible speed. Within our own neighborhood, we follow a more routine path, making a 584,000,000 mile trek around the sun only to return to the same (relative) spot every 365 days or so. All the while, blades of grass bend with the wind.

Life is progressive, cyclical, and random, all at the same time. The same is true in markets.

Over a lifetime, markets follow the trend of economic progress, powered by technology, productivity, population, and cooperation. Economic advancement throughout history is not linear nor always upward sloping, but we are blessed to live in a period of significant and sustained expansion. This overarching trend is contoured by cycles; business, monetary, and market. On a single day, asset prices are as fickle as the breeze.

Today I’d like to focus on one particularly cyclical market element: sentiment.

Sentiment can be spurned by tangible changes, but it is ultimately a product of human emotion — one that tends to amplify and overshoot fundamentals both on the downside and upside. But if you pay attention, you can watch the pendulum swing.

A Brief History

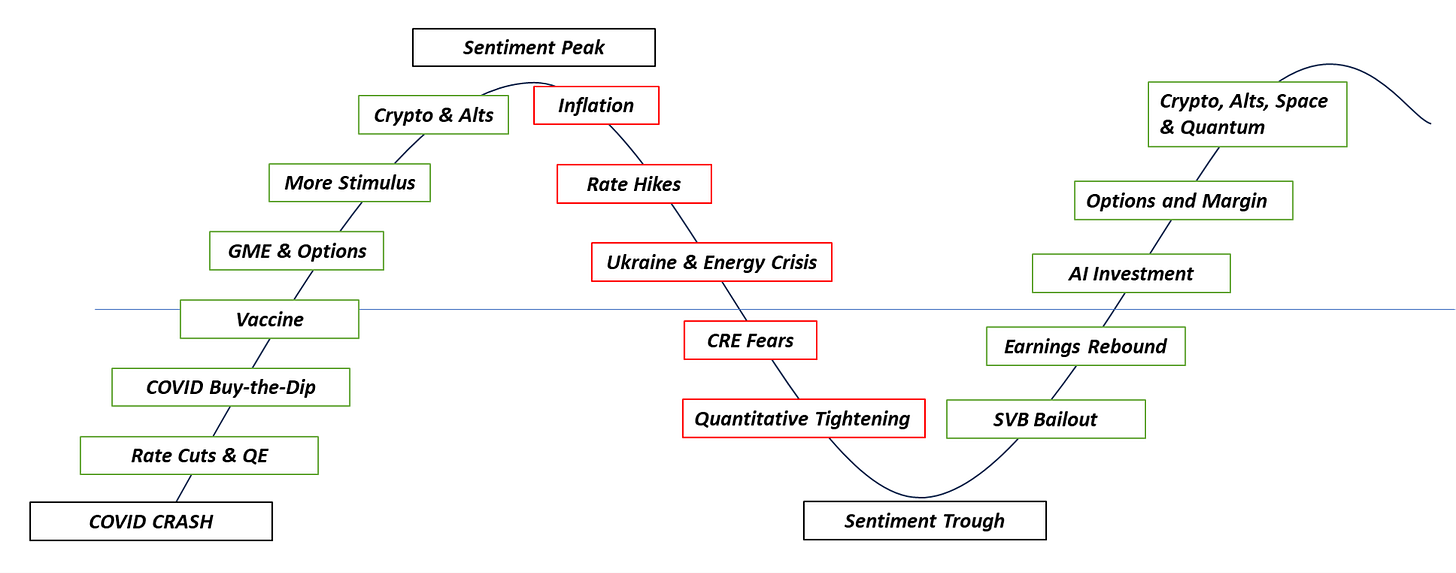

The Last Bear Standing was born on Twitter on April 1, 2021 as a rebuttal to the mania of the day. The bull market that began with contrarian optimism around COVID a year prior had morphed into a frenzy, fueled by easy money, options, and social contagion — YOLO meets FOMO. Optimism led to ignorance and eventually an unwind — one that began almost exactly three years ago.

The bear market of 2022 was brief but punishing. Despite ongoing economic growth, stocks and bonds fell on fears of rising inflation, rapidly tightening monetary conditions, margin compression, global instability, macroeconomic pessimism, and an energy crisis. The tide of sentiment washed out — evidenced by declining margin debt balances, rising put volumes, and widening volatility indices, credit spreads.

But the economy did not crater — in fact, it proved far more durable than most expected, leaving a tall wall of worries to climb. By 2023, the trough in mega-cap tech earnings which had pummeled Nasdaq turned upwards. Massive new investment in infrastructure, manufacturing, and data centers reinvigorated the landscape. Interest rates steadied as inflation waned, banks were bailed out of their bad bets on duration, the commercial real estate implosion never arrived. As contrarian optimism became conventional wisdom, the new bull market took full swing.

Having climbed the wall of worries, 2024 was a year of extension. Extension in valuations, as expanding multiples provided outsize returns. Extension in leverage via margin debt and call options. Extension from demonstrated technological winners to speculative technological gambits. By the end of the year, it became impossible to avoid the déjà vu. Or, as I wrote in November, the market has Jumped the Shark.

In short, over the nearly four year history of TLBS, market sentiment seems to have come full circle.