Nine Charts to Chew On

#118: On the housing market, the consumer slowdown, and gold.

It certainly feels like August.

The July swoon that sent the Nasdaq into a sudden correction has snapped back even faster in a late August rally. The “growth panic” that had some calling for emergency cuts just weeks ago has been temporarily soothed by the buoyant rebound. With 2Q earnings in the books and limited economic data, there hasn’t been much new information to digest until the next round of monthly macroeconomic data hits in early September.

In the monetary realm, we hear from Jerome Powell at the annual Jackson Hole speech at 10 AM EST this morning, but it’s doubtful the chairman will say anything new. A September rate cut was all but confirmed in the FOMC minutes released this week which stated the “vast majority” of members supported a cut at the next meeting.

So in late summer lull, here are nine charts to chew on.

1 - Supply Constrained?

Is the U.S. housing market beginning to balance?

Nationwide housing inventory continues to edge higher after the COVID buying binge (funded in part by $1.4 trillion of MBS buying from the Fed) led to historically depleted inventory by 2022. But over the past two years, rate hikes have tempered demand while new supply continues to arrive. While total listings in most states remain well below pre-pandemic levels, the gradual increase in offerings is welcome news to potential homebuyers as well as policy makers suggesting that the deep freeze in housing transactions may begin to thaw.

Yet even if rising inventory suggests some degree of normalization, pre-pandemic conditions remain distant. Pricing is firm, with listing prices continuing to rise in most regions, now up over 50% nationwide since the beginning of 2020. Meanwhile, new housing starts are in decline while mortgage rates have fallen below 6.5% for the first time in over a year, likely spurring buyer activity.

Further, the aggregate data hides a growing gap in regional dynamics.

2 - Continental Divide

While the initial reduction in inventory was nationwide, the rebound has been highly regional.

In the Southern and Western states, inventory levels are rapidly approaching pre-pandemic levels while median listing prices have remained flat over the past two years. In the South, which holds over 50% of the total U.S. inventory, the number of listings with price reductions has increased sixfold since early 2022, and now exceeds 2019 levels. If these trends continue, we may even see prices begin to fall in certain oversupplied markets.

By contrast, in the Northeast and Midwest, inventory continues to edge lower and asking prices have risen 15% since 2022, showing no signs of reprieve. With limited homebuilding activity, it’s unclear how or when these dynamics ease in these densely populated regions.

The evolution of the housing market is now defined by the continental divide.

3 - Mind The Gap

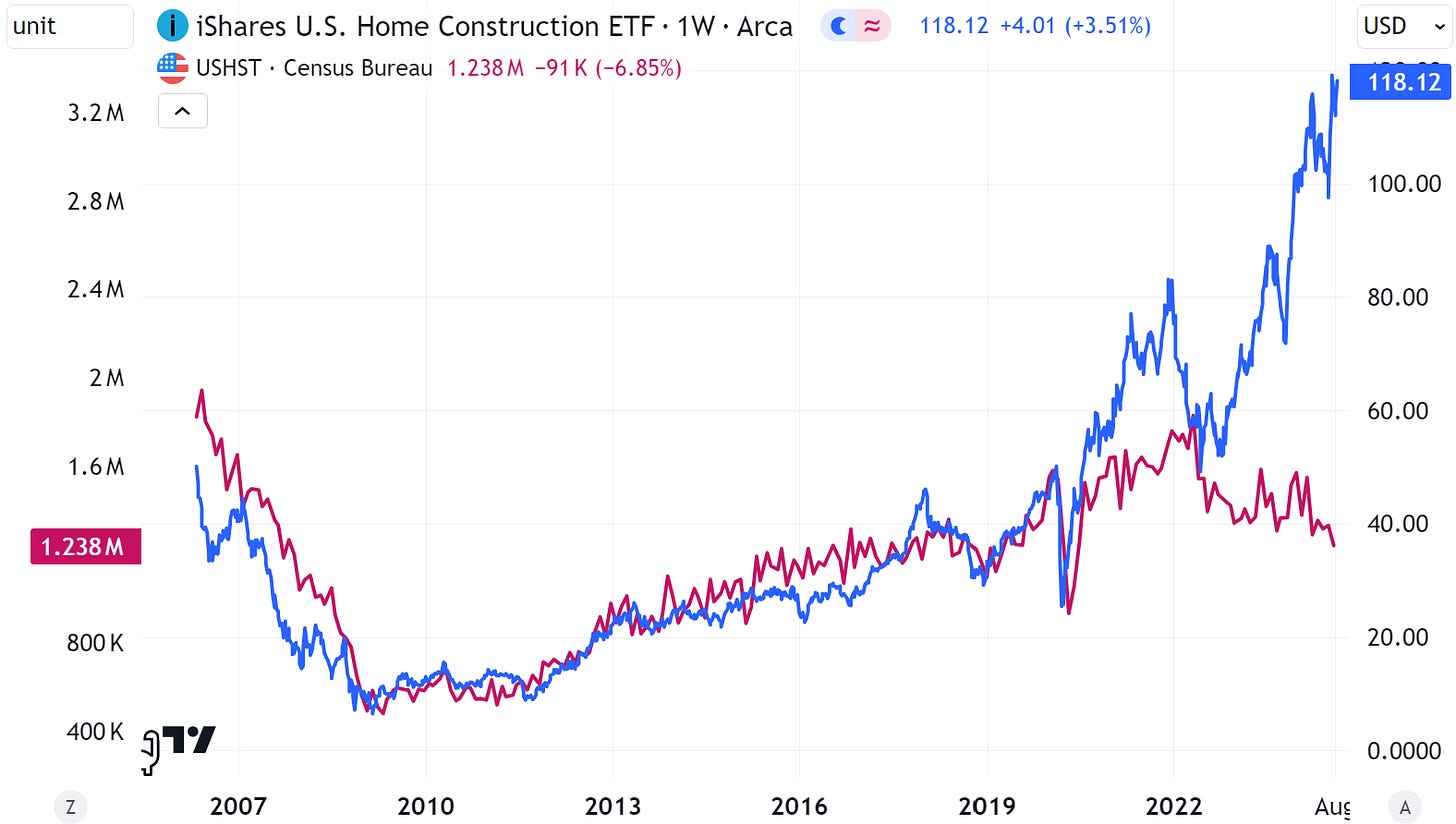

Meanwhile, another gap is growing between homebuilding stocks and homebuilding.

Homebuilders clearly benefited from the unique dynamics of this decade — rapid price appreciation since 2020 and strong newbuild demand given the frozen resale market. Accordingly, builders have proven more durable than many expected when rate hikes began. Now, the prospect of falling mortgage rates have pushed these shares even higher.

Nevertheless, new housing starts declined in June to the lowest level since lockdowns while homebuilding stocks have soared to new records. How long can this disconnect last?

For example, D.R. Horton (NYSE:DHI), the nation’s largest homebuilder, has seen declining revenue over the past year and declining profits over the past two years. In the most recent quarter, DHI’s order backlog continued to shrink, down 12% year-over-year and 50% from the highs in 2021. Yet the stock is up nearly 75% in the time frame.

The number of “completed” new homes on the market is accelerating higher as the months of new housing supply is growing to historically elevated levels. Given the inventory trends in the South, homebuilders will face increasing competition on price with existing home sellers. With valuations rising against falling earnings, will homebuilders eventually return to earth?

The demand slowdown isn’t limited to new houses.

4 - Spending Slowdown

Consumers have suddenly stopped swiping.