Momentum Mushed

#101: Stocks swoon, volatility rises. What's next for the market?

For the past six months, the best advice has been to follow the pack.

With relatively little friction, equities have levitated higher. In the upswing, stock picking has been a momentarily easy game — most have appreciated. My advice to readers over the period has largely been to swim with the current, following momentum until a material change in sentiment or conditions arises. For those invested, it has been a rewarding period.

As asset prices have pushed higher, I’ve tried my best to document the evolving sentiment of the rally as I perceive it. Enthusiasm metastasized from true thematic winners, to possible tag-alongs, and increasingly into speculative if not intentionally silly assets.

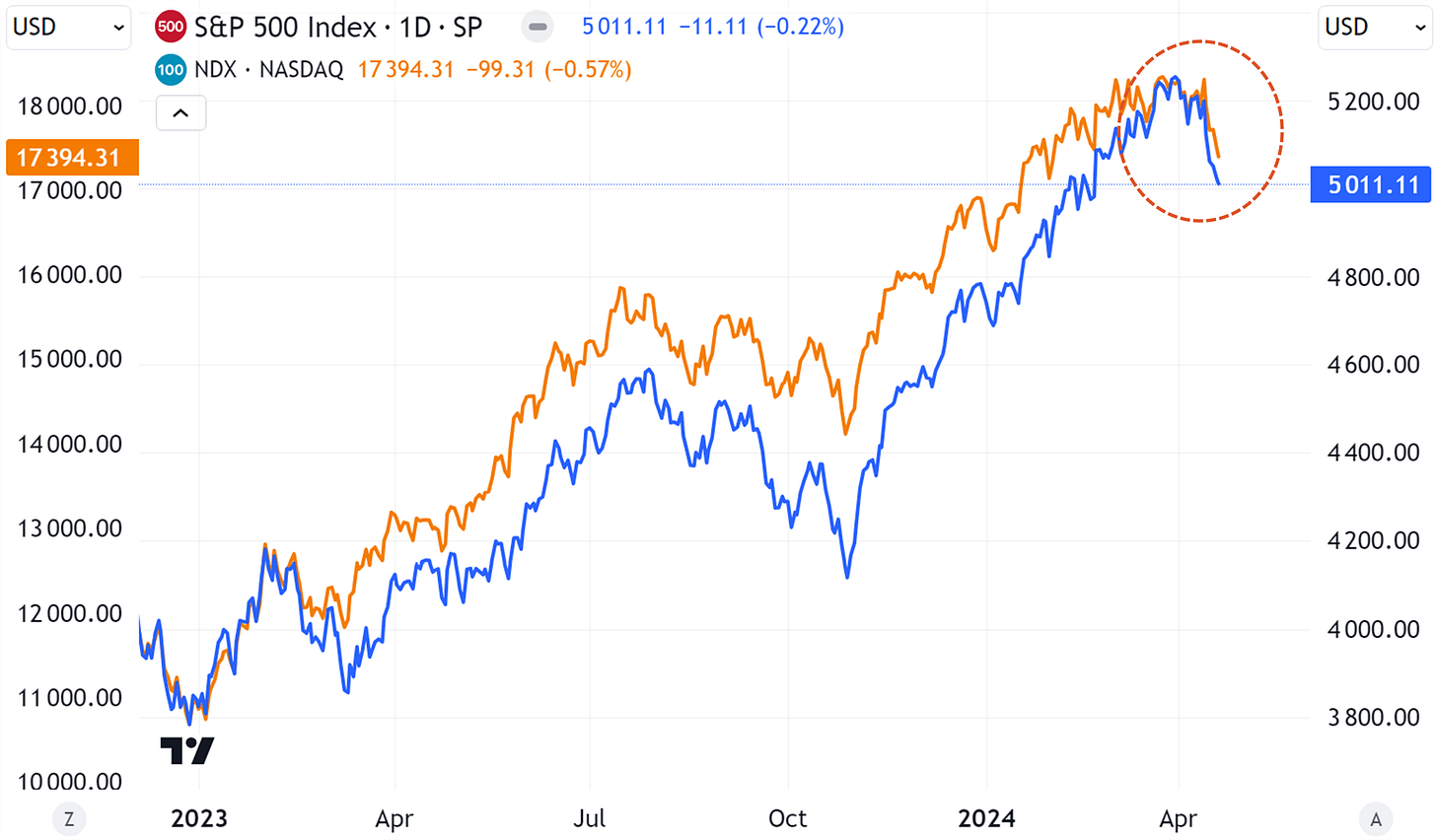

But a sense of sobriety has settled into the tipsy landscape. U.S. indices, including the S&P 500 and Nasdaq 100 hit a glass ceiling around the end of March, treading water and prompting the risk of consolidation and heightened volatility. And sure enough, stocks traded off in the past two weeks in some of the most bearish action we have seen since the rally began last October.

This reversal of fortune extends internationally, in Japan’s Topix and Nikkei indices, the Eurostoxx 50, the U.K.’s FTSE 100, and Germany’s DAX.

Today, it’s tough to find charts that give the warm and fuzzies.

Semiconductors, one of the hottest (and hotly debated) thematic plays of the past year, have broken down, now in correction territory after falling over 10% from a peak in early March.

Biotech — which tends to imbibe the speculative spirits — shot up over 60% from late October 2023 through early March 2024, but has already given back half of its gains and now sits in negative territory year-to-date after this week’s action.

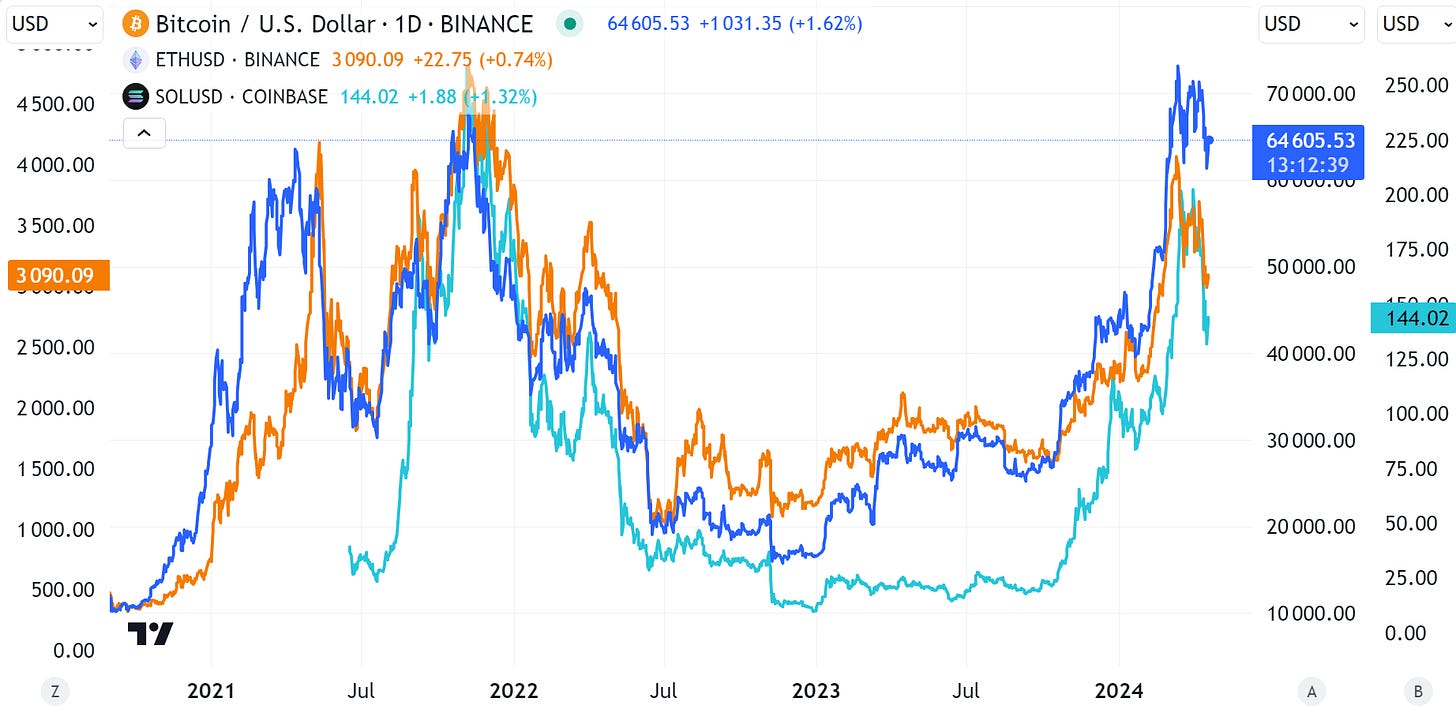

Crypto fever is breaking. Bitcoin has fared the best of the major coins, but still did not not manage to sustainably break out to new highs. For the past several weeks, the coin remains stubbornly range bound between $60,000 - $70,000. Others, like Ethereum and Solana stalled out well below each’s former peak, and have experienced even greater declines. The new minted memecoins are past expiration. Sadly, Dogwifhat is down 40% in April.

In the most meme-like corners of the stock market, speculative tickers like Sam Altman’s SPAC (ALCC) or the recently debuted Destiny Tech100 (DXYZ) went vertical last week before crashing back to earth just as quickly. While I hesitate to ascribe meaning to shenanigans, these movements reek of a last-gasp attempt to find a multi-bagger amid a rally that already produced its most justifiable fruit.

Even energy, a recent outperformer, has struggled as crude oil staggers despite heightened geopolitical concerns in the Middle East. Last night, news of Israel’s counter strike on Iran bumped crude 4%, but the boost did not even survive until sunlight. As of writing, crude is back to flat.

In other words, Momentum has been mushed.

There are three leading explanations.