Last Quarter Mile

#124: 4Q Market Preview.

As we enter the fourth quarter, let's refresh where we came from and where we are headed.

Across the board, 2024 has been a strong year for financial markets. The rally in global equities that began back in late 2022 has continued. Most global stock indexes have posted double-digit returns through nine months, with the U.S. benchmark S&P 500 notching over 20%. Even as the third quarter brought a Japanese flash crash, heightened volatility, and growing macroeconomic concerns, indexes have pushed to new highs.

At the same time, the global easing cycle in developed markets is well underway, with Western central banks charting the path. The Federal Reserve, European Central Bank, Bank of England, Swiss National Bank, Bank of Canada, and Sveriges Riksbank have all begun to cut rates as inflation approaches central bank targets.

Easing short-term rates, tight credit spreads, and strong opening yields have kept U.S. fixed income above water, surviving the “higher-for-longer” yield curve surge in the second quarter. Today, long-term U.S. Treasury rates trade nearly unchanged from the beginning of the year. "T-Bill and Chill" has provided a yield of over 5% to date, even as Powell put the kibosh on the 5-handle risk-free rate in September.

Meanwhile, the commodity landscape is best described by the Black/Gold spread. Inflationary commodity pressure — oil and other consumable raw materials — has remained in check, allowing precious metals — gold, silver — to rally on the expectation of monetary easing. Dating back to October 2022, the trough in equities and peak of “financial tightness,” the price of gold has risen 56% while oil has dropped 12%.

Finally, despite attention on the Japanese yen, the world's most important reserve currency has remained range-bound for nearly two years after significant volatility in prior periods. This relative stability has provided an accommodative backdrop and funding conditions for the global financial system.

Together, the picture has been roundly positive. But what comes next?

Equities

U.S. Large Caps:

The tension in the stock market today is between the here-and-now and the fear of what might lie ahead.

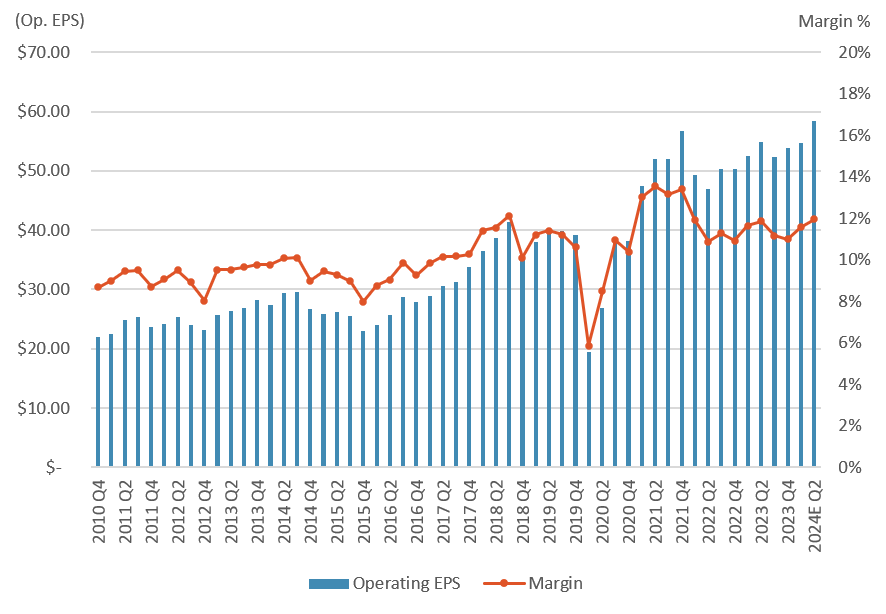

The first point to emphasize is that there is a fundamental basis for appreciating stock prices. Earnings at large-cap companies have been consistently rising since late 2022. Operating earnings per share across the S&P 500 reached a new record in the most recent quarter, eclipsing the prior record from 4Q 2021. Moreover, margins are much closer to historical norms, suggesting greater durability than the 2021 profit boom.

This aligns with hard economic data, which suggest that the U.S. economy continues to grow at a normal pace, particularly in nominal terms. Personal consumption expenditures (PCE), personal income, and GDP are all growing at around 5% nominally and show few signs of wavering to date. If these conditions hold, earnings growth is likely to continue trending upward in the mid-single digits range.

It is true that valuations are high, and earnings expectations for the years ahead assume double-digit growth, which seems untenable. But forward expectations are always inflated (and revised down), and valuation alone is not a catalyst. These factors may provide a drag on forward returns, but if the fundamental trajectory remains upwards, we should not expect a sustained downturn in the market, just a move to achieve a more comfortable multiple.