Imitation Game

#117: Chipotle blazed the trail. Can Cava and Sweetgreen follow?

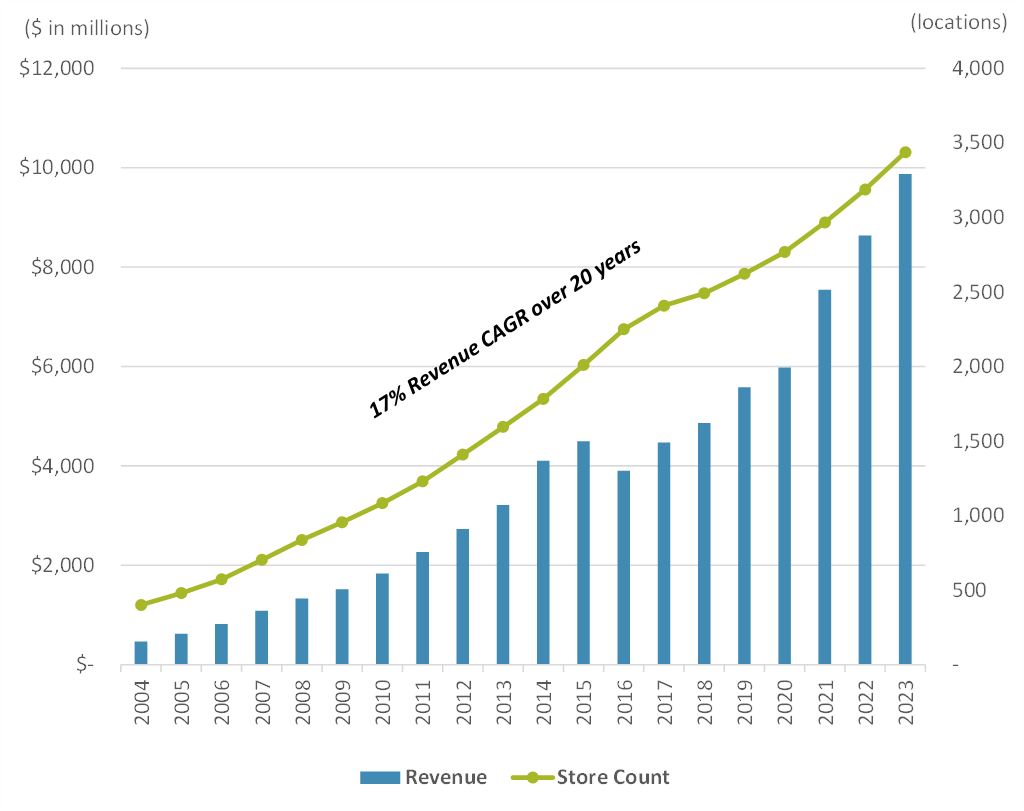

Sometimes you just have to appreciate a good business. One that looks like this:

Over the past twenty years, Chipotle Mexican Grill Inc. (NYSE: CMG) has multiplied. Since 2004, Chipotle’s store count has grown nearly nine-fold from 401 to 3,530 today. With revenue per store doubling, the burrito chain’s top line has grown 21x, even despite food safety concerns that plagued the company in the last decade. Last year, the burrito king notched a record $1.2 billion in net income with near record operating margins.

Impressive growth and margin expansion in the past several years has re-affirmed the company’s value proposition, brand loyalty and has rewarded investors handsomely. Even despite its recent pullback, the CMG shares have tripled in value since the onset of the COVID pandemic. Of course, this week CEO Brian Niccol was poached by Starbucks to attempt to replicate this success in a turnaround for the struggling coffee chain.

Broadly, Chipotle has epitomized the shift to fast-casual, eating the lunch of traditional fast-food by appealing to higher incomes with a fresher menu and format and pushing pricing along the way. The ladled assembly line is now a staple and the continued adoption of delivery services has proven a powerful tailwind.

With twenty five years of years of impressive growth and durable earnings, Chipotle has blazed a trail for a new quick-service model as many other restaurant chains have struggled. If you build the right box (or bowl) and can replicate it (over and over again), your company might just be a $70 billion behemoth in the making.

So it is no surprise that new bowl-hawkers have entered public markets, appealing to a similar customer base and pitching their businesses implicitly as young Chipotles. In particular, Sweetgreen Inc. (NYSE:SG) and the Mediterranean kitchen CAVA Group, Inc. (NYSE:CAVA) both debuted in the past several years, and both stocks have caught fire. Each has seen their share price triple in less than a year, in part aided by growth and improving profitability, but also the halo effect of the forefather.

But while imitation may be flattering, there’s a difference between a knock-off and the real McCoy. In light of the market action and recent Chipotle headlines, this week I examine the three companies to see how the newcomers stack up.

At a Glance

First let’s start with some basics: growth rates, restaurant economics, cost structure, and valuations.