Golden Age of Graft

Did Musk burst the Trump bubble?

Money is power. Proximity is currency.

There is nothing new under the sun. Throughout time, the state has shaken hands with commerce for self-interested gains. Yet, we still expect a certain level of decorum — closed door deals, public denial, the projection of propriety. That’s what makes this current moment so unique.

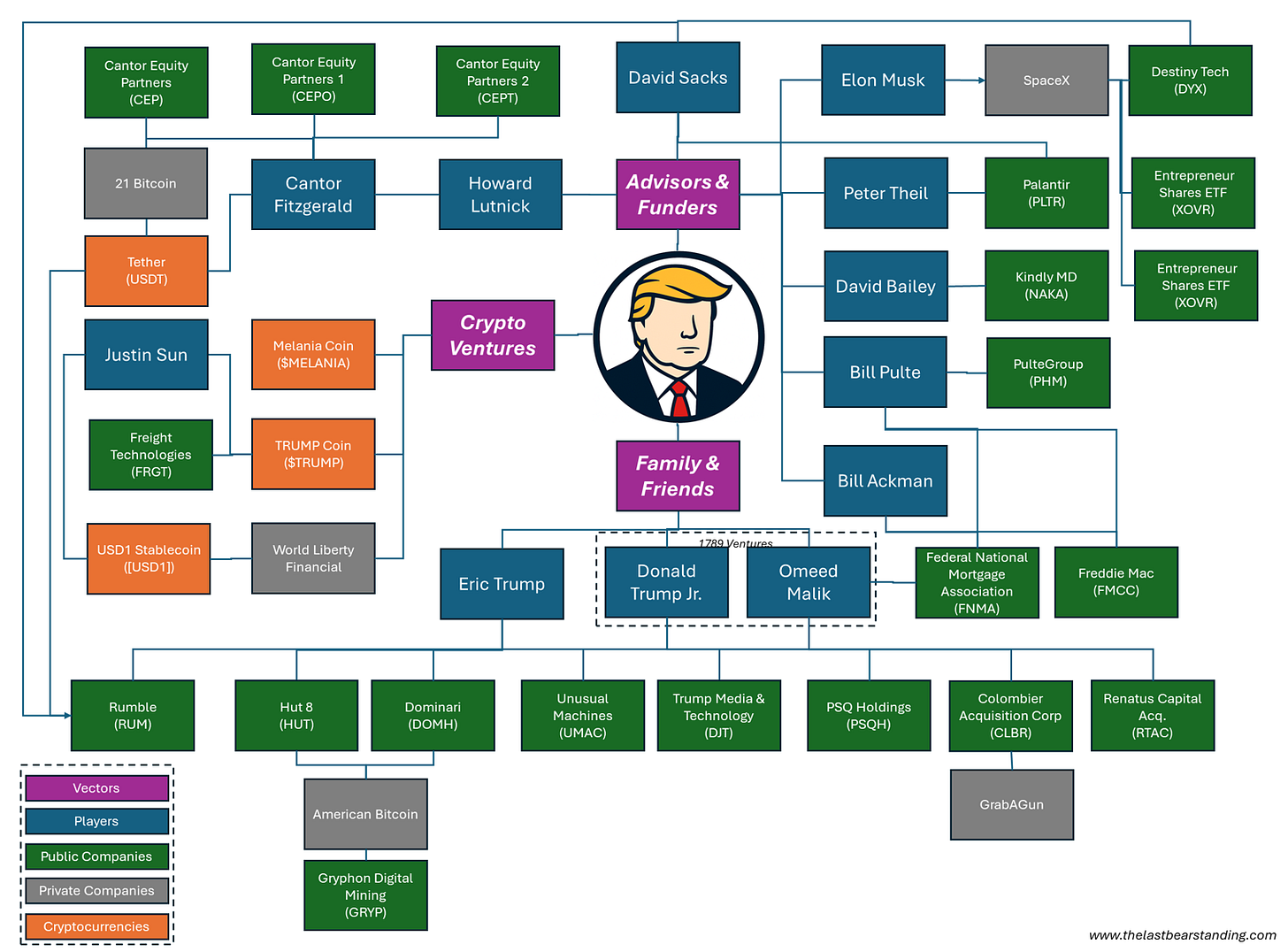

In this Golden Age of Graft, pretense is checked at the door. We’ve moved from “10% for the big guy” hidden in private emails to the in-your-face, pay-for-play paradigm of the new Trump era. From self-serving backers, to the Trump kids’ expanding public interests, to eponymous cryptocurrency — a new paradigm of money, access and patronage has taken form.

It may seem like ages ago (two months), but there was a time when Wall Street feared Trump. But ever since the Tariff trade turned into a TACO (Trump Always Chickens Out), the vibes have swung in the opposite direction. With the administration’s pivot from stock puncher to stock pusher, a new investment theme has taken shape. A certain niche asset has been among the biggest winners in this rally — publicly traded entities with proximity to the President.

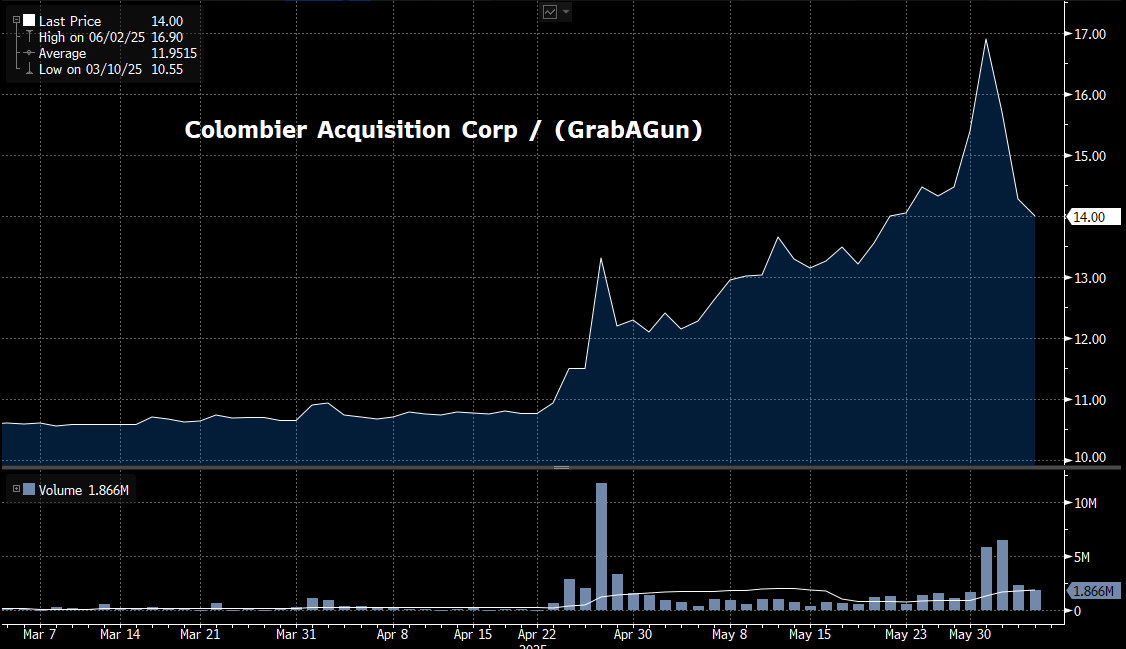

Take, for example, Colombier Acquisition Corp (CLBR) — a SPAC backed by Trump affiliate Omeed Malik that announced a merger with GrabAGun, an online firearm retailer which elected Donald Trump Jr to the Board of Directors on April 29.

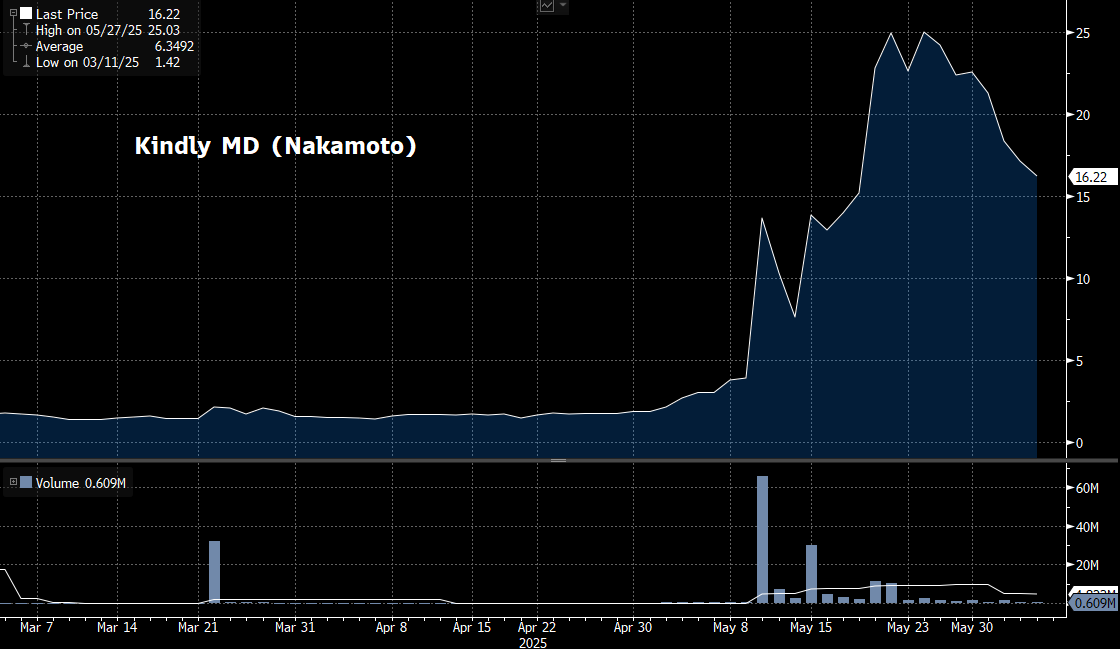

Or, Kindly MD (NAKA) — now known as Nakamoto holdings after announcing a merger with Trump crypto advisor David Bailey’s firm on May 12 — transforming a medical marijuana prescription business into a crypto holding company.

Even Bailey can’t believe his fortunes. In his words from March:

“If a year ago you put me into hypnosis and said, ‘Describe to me your deepest dreams of what could happen,’ this would be straight-up fantasy,”

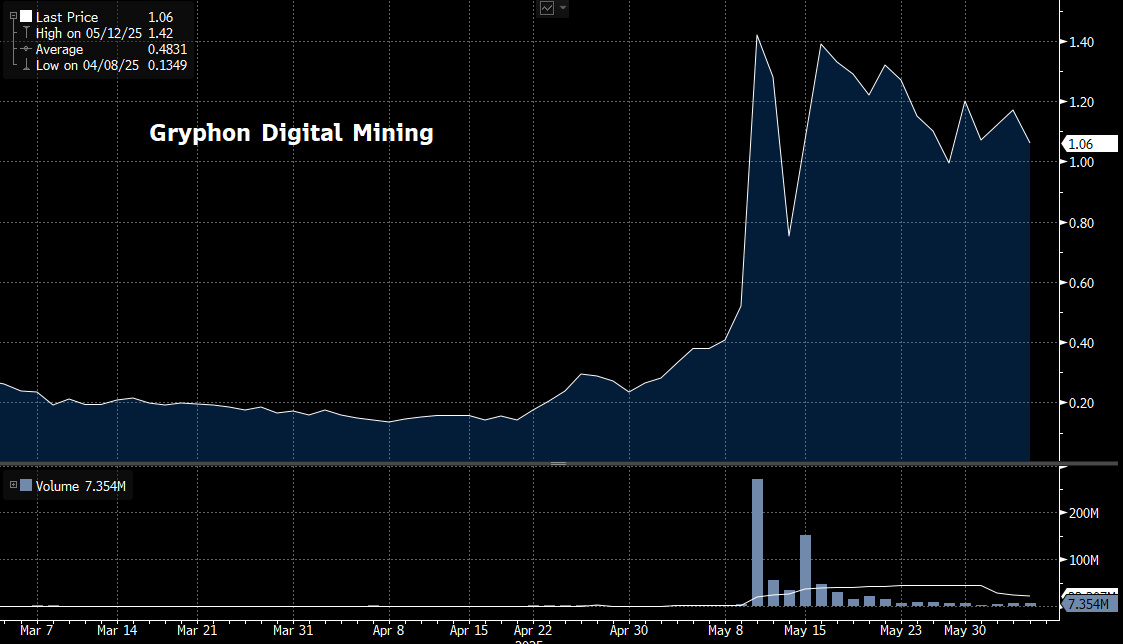

Or take bitcoin miner Gryphon Digital Mining (GRYP), which announced a deal on May 12 with HUT 8 (HUT) and Dominari Holdings (DOMH) to acquire and develop the American Bitcoin, a mining company supported by both Eric Trump and Donald Trump Jr.

This just scrapes the surface.

Commerce Secretary Howard Lutnick’s Cantor Fitzgerald has spawned multiple SPACs in the past several months which are trading significant premiums to NAV even before merger announcements. Prominent Trump supporters like Bill Ackman and Peter Theil seek to reap returns on their political investments as the administration contemplates the privatization of the Fannie Mae (FNMA) and Freddie Mac (FMCC), and Palantir (PLTR) is awarded wide-ranging government contracts. Top TRUMP coin holders gain presidential access in private dinners and companies like Freight Technologies (FRGT) lever up to buy $20 million of TRUMP with explicit intention of influencing tariff policy.

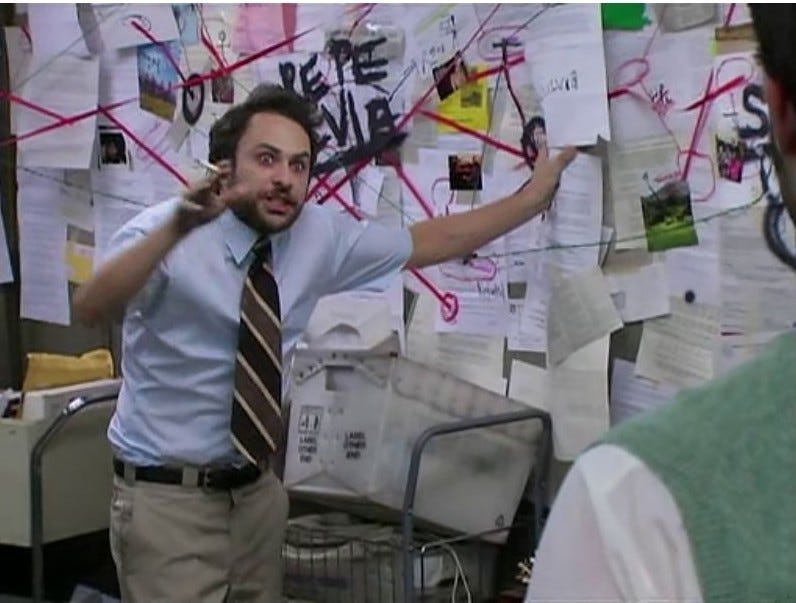

It is impossible to map a complete web of influence — the tendrils are too many, too intertwined. But it might look something like this.

We are verging into manic territory, but hear me out…