Five Themes of 2023

#60: As we enter the second half of the year, we discuss the key themes in macro and markets.

This week, we dive into five key themes of 2023 so far, and where they go from here.

Recession Postponed

Perhaps the biggest question among macroeconomic observers this year has been evaluating the odds of a U.S. recession - one that has long been expected but remains elusive.

The most widely anticipated recession’s arrival has gone beyond fashionably late. Its tardiness is now just rude.

One could be forgiven for getting it wrong. After the sugar high expansion during 2021, 2022 was a year of headwinds. The Federal Reserve began hiking rates, money printing turned to shredding, and inflation crushed real earnings. Stocks, bonds, and housing prices all stumbled from great heights.

The only thing left was for the official recession - the hard landing. An overall contraction in economic activity, falling employment, and of course the easing of monetary policy.

Yet, none of those things has happened. Aggregate measures of economic activity - incomes, employment, consumption - have shown little signs of wavering. The unusual nature of this economic cycle continues to cause false-positive recession flags. Relative weakness in manufacturing has been offset by continued strength in services, travel, and hospitality. Meanwhile price pressures have eased meaningfully, providing relief to consumers in real terms.

Sure, there are plenty of concerns. The primary examples cited today are the dwindling of savings or the pressures in commercial real estate. I’m familiar with these arguments, because I made them back during COVID.

“Just wait… after this last stimulus check… after enhanced employment runs out… after the Child Care Tax Credit expires… after these empty offices go up for sale…”

Being wrong forces a more nuanced and humble understanding of this strange economic period. Pandemic policy dramatically increased household wealth and corporate earnings. The surge in asset prices combined with a remarkable window to refinance debt at historically low rates has created sturdy balance sheets that can withstand higher rates.

When deficit spending is funded by monetary expansion - i.e. when newly printed money is directly injected into the economy via federal spending - the effects are not one-time. “Excess savings” don’t dwindle, they simply move from entity to entity as money circulates. Excess savings become excess profits. Even as Quantitative Tightening (QT) shrinks the overall money supply, checking account balances (demand deposits) remain three times higher than 2019.

Of course a recession will happen, eventually. But when it comes to calling this recession, we borrow advice from the Battle of Bunker Hill:

“Don’t fire until you see the whites of their eyes.”

In other words - wait until we see it. There is risk in being late to the punch. But there is also risk in holding on to a stubborn outlook in the face of consistently contradictory data. So long as the economy continues to grow, the economy is growing.

Disinflation and Monetary Policy

The second key theme is the reduction in inflation (or disinflation) and the implications for Federal Reserve’s monetary policy.

Two weeks ago, during the June FOMC meeting, the Fed acknowledged the durability of economic growth in spite of its tightening cycle, forcing the bank to pencil in two more rate hikes this year. And last week, we showed how inflationary regimes disturb the yield curve indicators we have become accustomed to watching.

Yet, on balance, the pace of inflation has slowed significantly across almost all measures. Every key category - producer prices, consumer prices, energy costs, or wages - shows significant disinflation. It is hard to find a category in which inflationary pressures are increasing rather than decreasing. The Consumer Price Index for June (to be published in July) will almost certainly fall below 4% for the first time in over two years.

From a monetarist perspective, this should be expected. If the monetary expansion of the prior years provided fuel for inflation’s surge, monetary contraction should help tame inflation. Today, the broad money supply is shrinking, and the most liquid demand deposits have stopped growing. Rate hikes have stalled price increases in the housing market, at least for the moment. Two years of heady inflation has reduced excess demand by increasing nominal prices.

On the supply side - energy production has returned to pre-COVID levels, as oil prices continue to slide and U.S. natural gas remains under $3.00 - with major flow-through benefits to the cost of food, manufacturing, and transportation.

But if the Fed has put inflation back in the bottle, its goal is now to keep it there.

Inflation still remains above the Federal Reserves’ target, particularly given the ongoing strength in the labor market. Financial conditions have eased and the economy remains resilient. Despite the promising disinflation that has occurred to date, the Fed has little leeway or rationale to cut rates until its second mandate of maximum employment is directly challenged.

Consider what might happen if the Fed slashed interest rates today? Rate-sensitive buyers would rush back into the market for houses and cars and reinvigorate key sources of inflation that the Fed has been desperate to tame.

Today, disinflation is a boon to consumers - reflected in consumer sentiment and real earnings. Ironically, disinflation and sanguine financial markets merely demonstrate that rates can remain higher for longer.

The Tech Revival

In equity markets, the story of 2023 so far has been the tech revival.

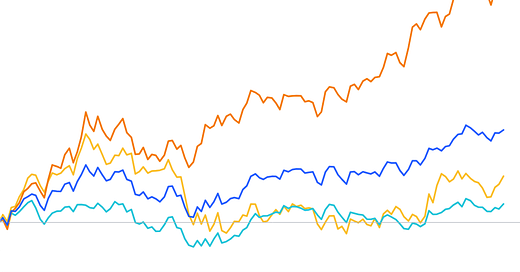

While the S&P 500 (blue) is off to a good start, up 14.4% YTD, nearly all the gains have been driven by the growth of mega-cap tech. After seeing large drawdowns in 2022, the Nasdaq 100 (orange) is up 38%, one of the best first halves on record. By comparison, small caps measured by the Russell 2000 (yellow) are up just 7%, while the Dow Jones Industrial Average (teal) is barely changed, up 3%.

The pandemic brought a massive growth of revenue and profits to the largest tech oligopolies. But stagnating revenue growth and shrinking margins led to an earnings recession that brought the tech stocks down considerably throughout 2022. Indeed, trailing twelve month (TTM) reported earnings for Apple, Alphabet, Microsoft, Amazon, Netflix, Meta, and NVIDIA are all down from this time last year. But of course, the market is forward looking.

The rebound in stock prices this year has been driven by substantial multiple expansion, suggesting that investors believe the earnings recession is over and these companies have turned the corner back to growth. There is already evidence this is underway.

A renewed focus on efficiency has reduced headcounts and tightened cost structures that likely had plenty of fat to trim. Recent earnings have already shown sequential quarterly upticks at most of the giants, and guidance has significantly exceeded Wall Street expectations in some cases.

But, these green shoots must continue to outpace expectations in order to justify the rapid rebound in share prices and valuation multiples. The pandemic earnings bonanza was generated by a perfect storm of monetary expansion and stimulus combined with a dramatic shift towards technology-based platforms for work and school - aiding software, hardware, and ad sales.

These favorable conditions are unlikely to coalesce in such a favorable way again, even if cost cutting and revenue growth lead earnings upwards again.

Meanwhile the Artificial Intelligence (AI) revolution is still in its early days. NVIDIA’s monster forward guidance shows the massive growth potential for companies benefitting from AI capital expenditures, which will only increase in the near term.

I believe in AI as a technology, primarily because of my own experience using the products, but the exact path of commercialization remains an open question. For example, if expensive AI processing becomes ubiquitous in internet search or other software functions, then it could erode gross margins while simultaneously requiring significant capex.

So far, the AI tide seems to have lifted all boats, but only in select cases can we see the immediate translation to an earnings growth.

Going forward, tech needs to prove that its 2022 earnings recession is firmly in the rearview and that its growth multiples are justified. Similarly, “AI names” will need to prove that they have been invited to the party and aren’t just drafting off the hype.

The first six months have been almost universally positive for big tech, but we should expect more differentiation going forward - separating winners from losers both in their core business growth and their true positioning in the AI arms race.

Return to Normal (Volatility)

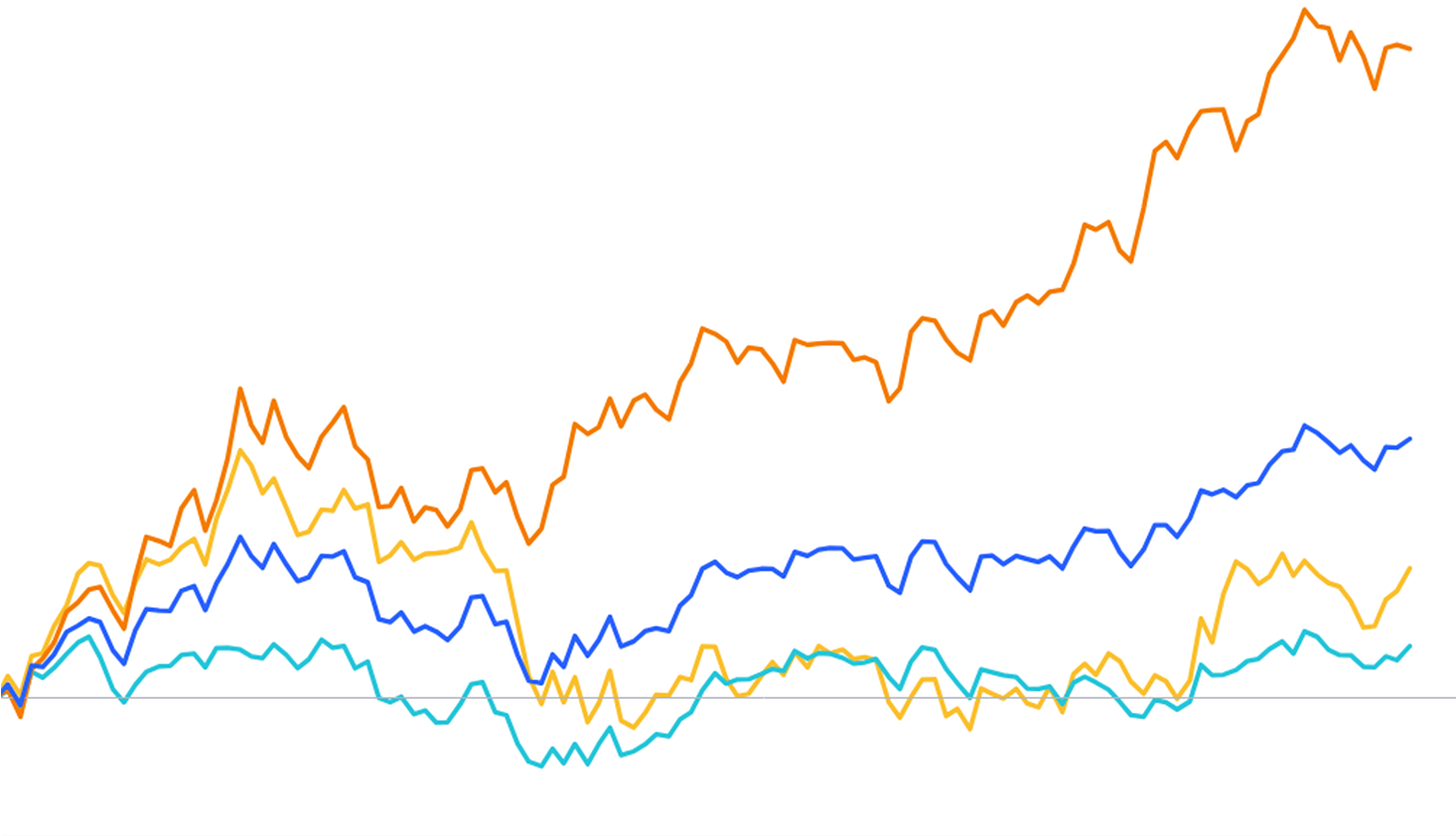

In options land, the theme of 2023 has been the ongoing slide in market volatility. While we have chronicled the death of volatility here well over a year ago, the trend has only become more pronounced. Realized 30-day volatility (RVOL - blue), implied volatility (VIX - orange), and volatility futures (VIX futures - teal) have fallen substantially after a tumultuous 2022.

Now for the first time in over three years, both the VIX index and prompt month VIX futures are trading lower than they were on at the start of the February/March 2020 COVID crash. After years of highly elevated volatility, this feels like an important round trip.

Unsurprisingly, lower volatility has coincided with the rise in equity prices. Options activity has picked up substantially this year as well. As we outlined in The Return of the Calls, there has been a renewed enthusiasm for call-buying that began early this year and has continued through today. In other words, we are experiencing a powerful volatility-down / price-up cycle. But has the juice run out?

Not necessarily. Positive feedback loops are self-perpetuating in nature. During the 2020-2021 bull run, we saw nearly two years of aggressive and persistent call-buying. Today we are only six months into the trend, and while put-to-call ratios have become increasingly call-heavy, they are only beginning to reach levels of the last options frenzy.

Similarly, while implied volatility has fallen to the lowest levels since the onset of the pandemic, it is only now within the “normal range” of the 2012-2020 period.

Of course a tail risk is ever present. The cost of insurance (VIX futures) is relatively low when compared to historical volatility (RVOL), leaving a smaller margin of safety for those selling volatility. Meanwhile, outstanding open interest on VIX futures is at the highest level since 2020. In some ways, the setup for a volatility squeeze is present, but may only materialize if there is a sudden, dramatic change in sentiment.

For now, the call-buyers reign supreme.

Banking Stress

The final theme of the year has been the stress in the banking sector. It has been two months since a bank failure or quarterly financial disclosures shed light on the health of specific institutions. Yet sentiment - as measured by stock price - has not improved for the publicly traded regional banks. If the fallout from Silicon Valley Bank’s implosion has indeed been contained, as many suggest, there could be upside opportunity.

Next week, we will publish a deep dive on the regional banks in advance of second quarter earnings…. Stay tuned.

If you enjoy The Last Bear Standing, please consider subscribing, hit “like”, and tell a friend! Let me know your thoughts in the comments - I respond to all of them.

As always, thank you for reading.

-TLBS

Supreme article by Mr. Bear as always. You always leave me scratching my head… and I love it!

Enjoy the holiday weekend …always appreciate your thoughtful articles… have you started adding exposure to the market yet? What are your favorite sticks?